Midcap stocks are defined as companies valued at between $2 billion and $10 billion. In most cases, these are usually small firms that not many people know about. As a result, the midcap companies tend to underperform their large cap counterparts.

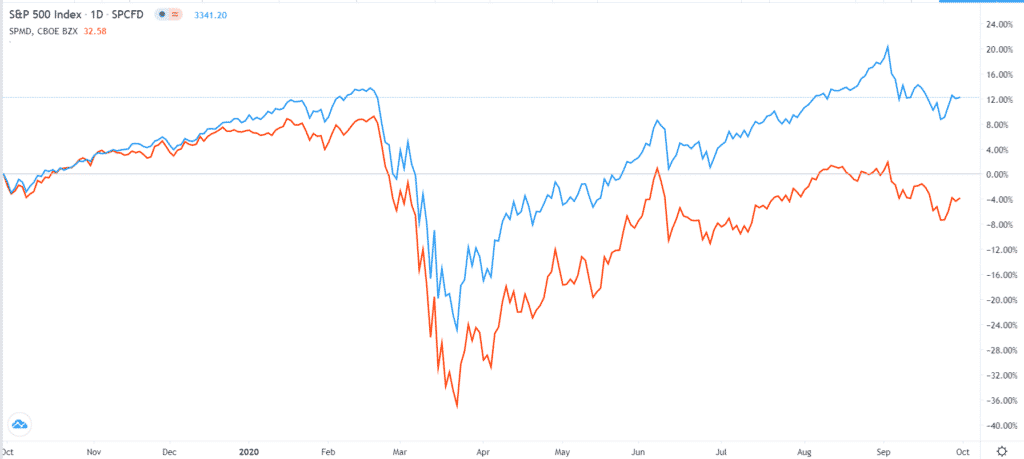

For example, in the past five years, the S&P 500 has returned ~70% while the SPDR midcap 400 ETF (SPMD) has risen by ~20%. This year, too, the S&P 500 has gained by 4% while the SPMD has fallen by ~10%. Still, individually, some mid-cap firms have managed to experience faster growth.

S&P 500 vs SPMD one-year performance

In this report, we will look at the best midcap Covid stocks you can invest in today and own them for the next decade. Ideally, we will look at companies that are likely to benefit from the new normal that the disease has presented.

Fastly (FSLY)

- Industry: Technology (SAAS)

- Market cap: $9 billion

- 2019 revenue: $200 million

- 2020 revenue estimate: $300 million

Fastly is a relatively small SAAS company valued at about more than $9 billion. It is a company that most people have never heard about but one that most of them use their services every day. Fastly provides services like Content Delivery Network (CDN), Image Optimization, Edge cloud platform, and video and streaming services.

The company serves about 300 customers, who include some of the biggest companies in the world like Shopify, New York Times (NYT), and Stripe. Its most important service is the CDN, which helps these companies serve their customers well. For example, it helps to ensure that the NYT is accessible at a faster speed around the world. Most importantly, the company helps to prevent malware.

Fastly revenue is growing fast. It had just $107 million of revenue in 2017 and more than $200 million in 2019. Analysts expect the firm’s revenue will reach more than $300 million this year.

While Fastly is not a cheap company, it has a substantial market share in its industry and low churn. At the same time, it is a Covid stock because it will benefit from the new work-from home trend and the fact that more people have started engaging with digital platforms.

Some of Fastly’s customers

Chegg (CHGG)

- Industry: Education technology

- Market cap: $8.85 billion

- 2019 revenue: $301 million

- 2020 revenue estimate: $601 million

The Covid-19 pandemic has led to large scale lockdowns in the United States. It has also led to several states to shut-down schools. Most schools are also taking advantage of digital platforms to offer education services to their students. Indeed, according to a report by Research and Markets found that demand for online private tutoring is expected to reach more than $7 billion in 2023.

Chegg, a leading provider of digital learning services, will be a beneficiary of these trends. The company offers services like book rentals, textbook solutions, online writing coaching, and even tutoring. In the tutoring service, the firm provides tutors in some of the most popular subjects like engineering, math, science, and humanities, among others.

In 2019, the company had more than $410 million in revenue. For this year, it expects this revenue to grow by ~50%. It also has more than 3.9 million paid subscribers, a figure it expects will continue rising. Therefore, Chegg is a fast-growing company, with low churn, a strong moat, and a relatively conservative balance sheet that will support its growth.

Houlihan Lokey (HLI)

- Industry: Investment banking

- Market cap: $4 billion

- 2019 revenue: $1.15 billion

- 2020 revenue estimate: $990 million

Banks have been horrible investments during the pandemic. That is because of the billions of dollars they have set aside to cover for bad debt and the lower interest rates. Indeed, the SPDR Trust Bank ETF has declined by more than 33% this year.

However, banks are not created equal and a section of the industry is doing well. For example, as of this writing, Houlihan Lokey (HLI) stock has risen by more than 18%.

For starters, HLI is a relatively small mid-cap bank with a market cap of more than $4 billion. It had more than $1.15 billion of revenue in 2019 and a net income of more than $183 million. Unlike other large banks like JP Morgan, HLI specialises in investment banking services like mergers and acquisition, capital raising, and financial restructuring, among others. For example, it has been the biggest firm in M&A, according to Refinitiv. It is also the leading firm in restructuring and bankruptcy advisory. For example, it was the lead banker in some of the biggest bankruptcies such as Lehman Brothers, General Motors, and PG&E.

Therefore, HLI is a great midcap Covid stock to invest in for several reasons. First, in the next decade, we suspect that there will be more bankruptcies because of the virus. Indeed, most companies are only staying afloat because of the financial support they are receiving from the government. Second, mergers and acquisitions will continue to grow as companies seek to lower costs. Finally, more firms will seek HLI’s advise on their internal restructuring processes.

Novavax (NVAX)

- Industry: Pharmaceutical

- Market cap: $6 billion

- 2019 revenue: $18 million

- 2020 revenue forecast: $1.1 billion

With the Covid pandemic continuing, some of the biggest beneficiaries of the illness are those that are actively developing a vaccine. This includes some of the biggest firms in the world like Pfizer, Gilead, and AstraZeneca. Still, there are several small and midcap firms that are also racing to develop the vaccine.

Novavax, a small company that generated just $18 million in revenue last year, is among the leading contenders. That alone has helped the stock rise by more than 2,000% this year, giving it a market cap of more than $6 billion. This is in part because the government has helped finance the vaccine development through its Operation Warp Speed. It received ~1.6 billion from this program.

According to the New York Times, the firm has started the final phase of conducting its trials. Indeed, the vaccine has already started showing strong results. And some experts believe that the antibodies it produces are better than those by other firms.

The vaccine, if it succeeds, could help turn Novavax from an unknown pharmaceutical company, to a global giant.

However, unlike the other Covid midcap stocks, this one is riskier because it is contingent on its vaccine being effective.

Box (BOX)

- Industry: Technology

- Market cap: $2.7 billion

- 2019 revenue: $699 million

- 2020 revenue forecast: $770 million

Started in 2005, Box has become one of the best-known unicorns in the United States. The firm offers cloud storage services to individuals and most large firms in the United States. It also offers security services, collaboration, and workflow services. The firm had more than $699 million in revenue last year and is expected to grow to $770 million this year.

In the next decade, more companies will embrace the role of working from home. As a result, we expect that more of these firms will continue to embrace the products offered by Box. Better still, Box has developed strong long-term relationships with some of the best-know brands in the US like Coca-Cola, Allstate, Broadcom, and FICO. Most of these firms rarely cancel their subscriptions because of the cost involved and time wasted. Also, Box is a relatively undervalued and is also a strong acquisition target.

Some Box customers

Final thoughts

Covid-19 has had a major impact in the world. More than a million people have died and millions more have lost their income. Still, there are some companies that have benefited incredibly from the disease’ impact. Some of these firms are Amazon, Shopify, Wayfair, and Etsy. Still, there are other small and midcap stocks that will benefit from the disease. The five we have mentioned, together with others like RH, Informa, and Five Below will be key beneficiaries.