The Blackrock stock price will be in the spotlight this week as investors wait for the company’s third-quarter earnings. The stock is trading at $844, which is about 12% below its highest level this year, meaning that the stock is in the correction zone.

Blackrock earnings

Blackrock is the world’s biggest asset manager with more than $9.5 trillion in total assets under management. It is followed by Vanguard, which has more than $7.5 trillion in assets. Most of the company’s assets are for institutional investors while the rest are for retail and ETF investors.

Because of its size, Blackrock is the biggest investor in most companies globally. It owns billions worth of shares in companies like Apple, Microsoft, Tesla, and Google. Most of these investments are passive since they track specific indices. This means that it can’t change or exit its funds.

Blackrock will publish its quarterly results on Wednesday this week. Analysts expect that the company’s revenue rose from $4.82 billion in the second quarter to more than $4.89 billion in Q3. They also expect that the firm’s profitability improved in the quarter to about $9.61 per share.

Still, there is a possibility that the firm’s revenue and profitability will be better than expected since it has done so in the past seven straight quarters.

In addition to the headline results, investors will be watching other key numbers in the company’s release. For example, analysts will be watching the company’s inflows in the third quarter. In the second quarter, the firm generated inflows of about $81 billion, which was an increase of 4%. Therefore, there is a likelihood that the company’s total assets crossed the important level of $10 trillion in the third quarter.

Analysts will also watch for the company’s growth in China, where it hopes to replicate its success in the United States. Most importantly, they will be looking at the performance of its key segments like base fees, securities lending, performance fees, technology, distribution, and advisory fees.

Is Blackrock a good investment?

Blackrock has transformed itself from a relatively small bond trading company into the most powerful company in the world. With its assets, the company is able to champion for key changes in companies and in governments. Indeed, the Federal Reserve depends on the company in implementing its quantitative easing program.

Most analysts believe that the company’s share price will keep rising. For example, most analysts expect that the Blackrock stock price will move above $1,000 in the coming months. For example, analysts at Jefferies, Credit Suisse, and Deutsche Bank expect that the shares will rise to $1,000 and above. Those at Argus, BMO, and Barclays expect that it will rise to $900.

The company has a pole position in the asset management industry. Indeed, there is talk that Invesco and State Street are considering merging their asset management businesses in a bid to compete with Vanguard and Blackrock.

Blackrock stock price forecast

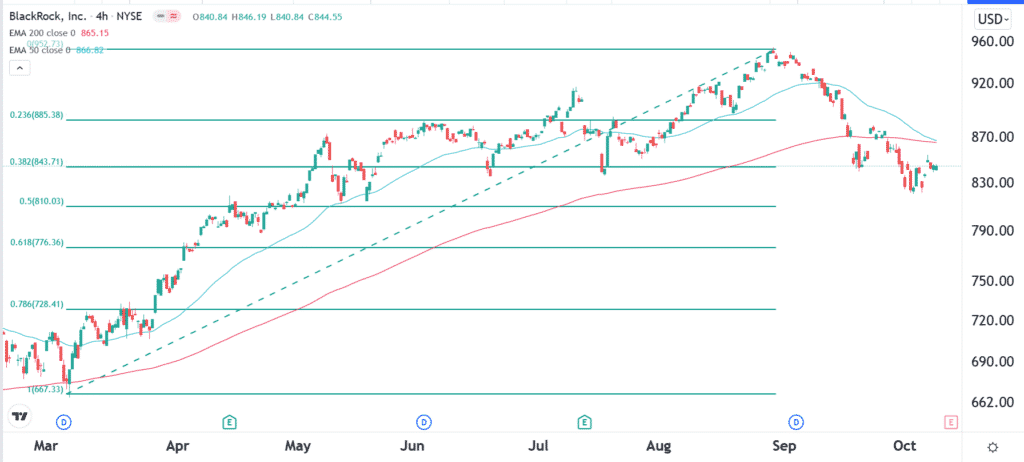

The daily chart shows that the Blackrock stock price has been under intense pressure in the past few weeks. Along the way, the shares have moved below the 50-day and 200-day moving average. Indeed, the two are about to make a crossover, which is known as a death cross.

In technical analysis, a death cross is usually a bearish signal. It is also along with the 38.2% Fibonacci retracement level. Therefore, the stock will likely push lower ahead and after earnings. If this happens, the key level to watch will be at the 50% retracement level at $810.