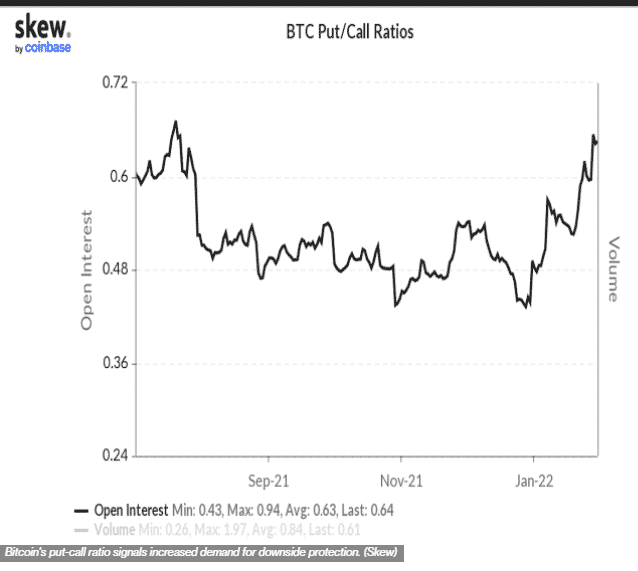

(CoinDesk) Crypto markets are signaling extreme bearish sentiment, with the put-call option interest ratio hitting a six-month high of 0.62.

Patrick Chu of tech platform Paradigm says put-call ratio means that there is a high demand for puts as investors sell calls.

Chu says that investors purchase puts when they expect a price drop, as it allows them to buy at a lower strike price while selling higher-strike calls.

Whereas a put buyer is bearish on the market, investors have traditionally used them as a contrary indicator. A sudden rise in the metric is often seen towards the end of bear runs.

Another more reliable key metric, call-put skew, which gives the price differential between puts and calls, is showing a put bias, with one week and up to six-month skews negative.

Call-put skew is also seen as a contrary indicator, and a put bias shows when prices are near bottoms. Put-call skew is seen as a more reliable metric as it uses real-time data and is not vulnerable to open contracts.

BTCUSD is down -1.32%.