The Bitcoin price suffered a major drop on Friday as investors remained concerned about monetary policy and regulations. The BTC price declined to a low of $38,675, which was the lowest level since August 5th last year.

Regulatory concerns

Bitcoin price has been in a strong bearish trend in the past few months. As a result, the coin’s price has declined from an all-time high of almost $70,000 to a low of $38,675. It has fallen by over 40%, meaning that it is double bear territory.

In all fairness, Bitcoin is not the only cryptocurrency that has crashed lately. Other altcoins like Ethereum, Cardano, and VeChain have all collapsed. Therefore, the total market capitalization of all cryptocurrencies has dropped by about $1 trillion to about $1.8 billion.

One reason why the Bitcoin price collapsed in the overnight session was that there are new regulatory concerns from Russia. On Thursday, the Bank of Russia proposed a blanket ban on the use and mining of all cryptocurrencies.

In a statement, the bank cited the dangers posed by cryptocurrencies in the country’s economy. It argued that the industry had the hallmarks of a pyramid scheme. It also pointed to the growing risks of cybercrime, which has led to losses worth billions of dollars.

Most importantly, the central bank said that cryptocurrencies were undermining the sovereignty of monetary policy. Unlike fiat currencies, Bitcoin cannot be printed when there is a crisis. Its supply limit is capped, unlike a central bank that can print currency.

At the same time, the bank argued that Bitcoin mining was compromising the country’s green agenda. Therefore, if these policies go ahead, the impact will be dire because of the role the country plays in the industry.

European Union mining ban

Russia is not the only country proposing tough regulations on the industry. In India, Narendra Modi’s government is working with parliament to come up with strict laws on the industry. There are rumors that the government will propose an outright ban.

Meanwhile, in the European Union, a regulator called for the region to ban the mining of Bitcoin. Ethereum, and other proof-of-work networks. She argued that this technology undermines the region’s resolve to fight climate change.

In the United States, the Securities and Exchange Commission (SEC) is also working on regulations for the sector. In a statement this week, Gary Gensler said that these regulations will likely be unveiled in 2022 or 2023.

Meanwhile, the Bitcoin price has declined because of the hawkish Federal Reserve. The bank has said that it will implement about three rate hikes this year. A hawkish Fed is dangerous for Bitcoin and other cryptocurrencies because they are considered risky assets. It also explains why the Nasdaq 100 index, which is made up of growth stocks, has tumbled sharply recently.

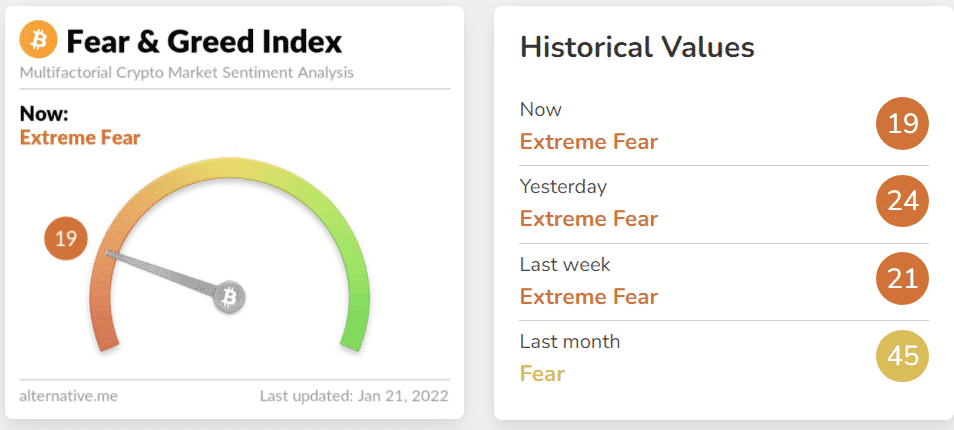

All these factors have led to a sharp decline in the Bitcoin fear and greed index. The index has dropped to 19, the lowest level in a few months.

Bitcoin price prediction

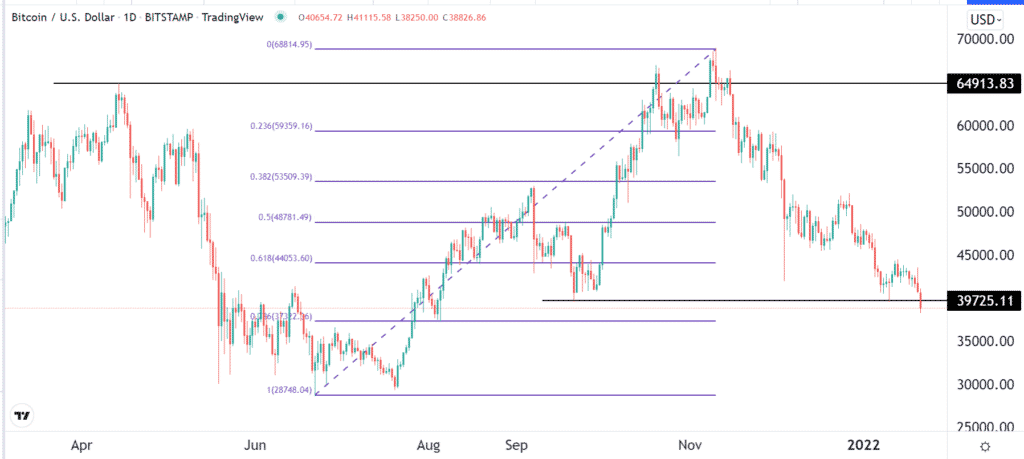

The daily chart shows that the BTC price has been in a strong bearish trend in the past few months. The coin has declined by over 40% from its highest level in November last year. Along the way. It is approaching the 78.6% Fibonacci Retracement level.

It has also moved below the 25-day and 50-day moving averages. Therefore, for now, the path of the least resistance for the coin is lower, with the next key support being at $35,000.