Before you jump into investing and start wading through the numerous index funds that you can invest in, there are a few things that you need to know about index funds. Warren Buffet, the most successful investor in the world, once said: The most prudent investments that one can make are in low-cost index funds. If you’re looking to take this advice, here’s what you should know first.

What are Index funds?

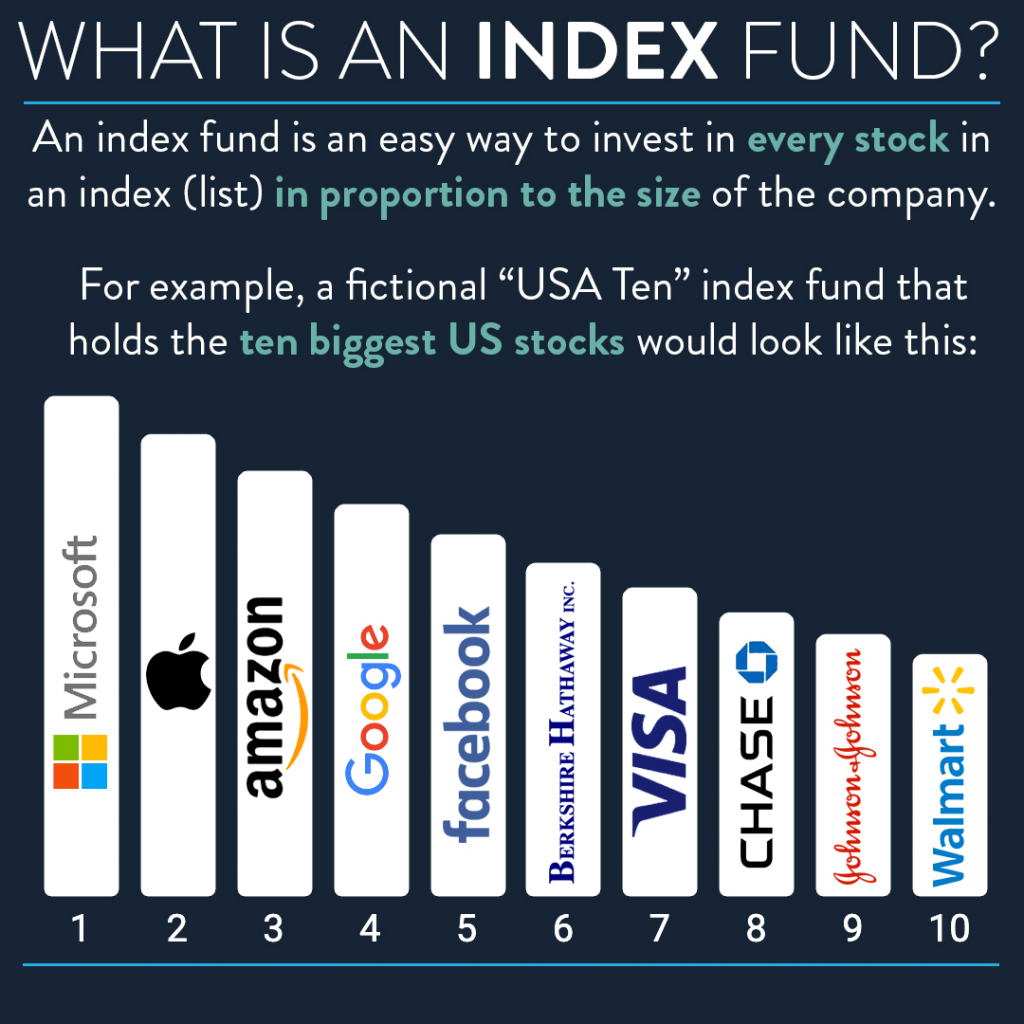

ETFs and mutual funds that hold either all or a demonstrative sample of certain specific index securities are index funds. The goal of these indices is to track the performance of their particular indices as close as possible.

One of the most well-known indices is the S&P 500. But, there are such indices for every market strategy and investment opportunity that one can conceive of. These funds can be bought via a brokerage account or from an index-fund provider directly.

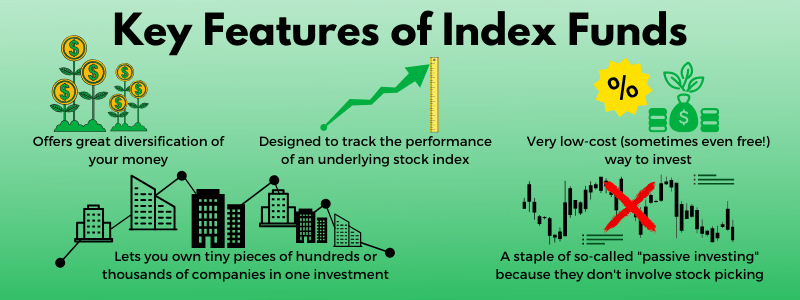

With an index fund, you get a heterogeneous group of securities with just one low-cost investment. Some such funds expose you to thousands of securities that bring down your overall risk level with diversification.

One can also invest in multiple index funds that track disparate indices so that you can build a portfolio that allows you to have the asset allocation that you desire. For instance, you can put 70% of your capital in stock index funds and the rest in bond index funds.

Pros of Index funds

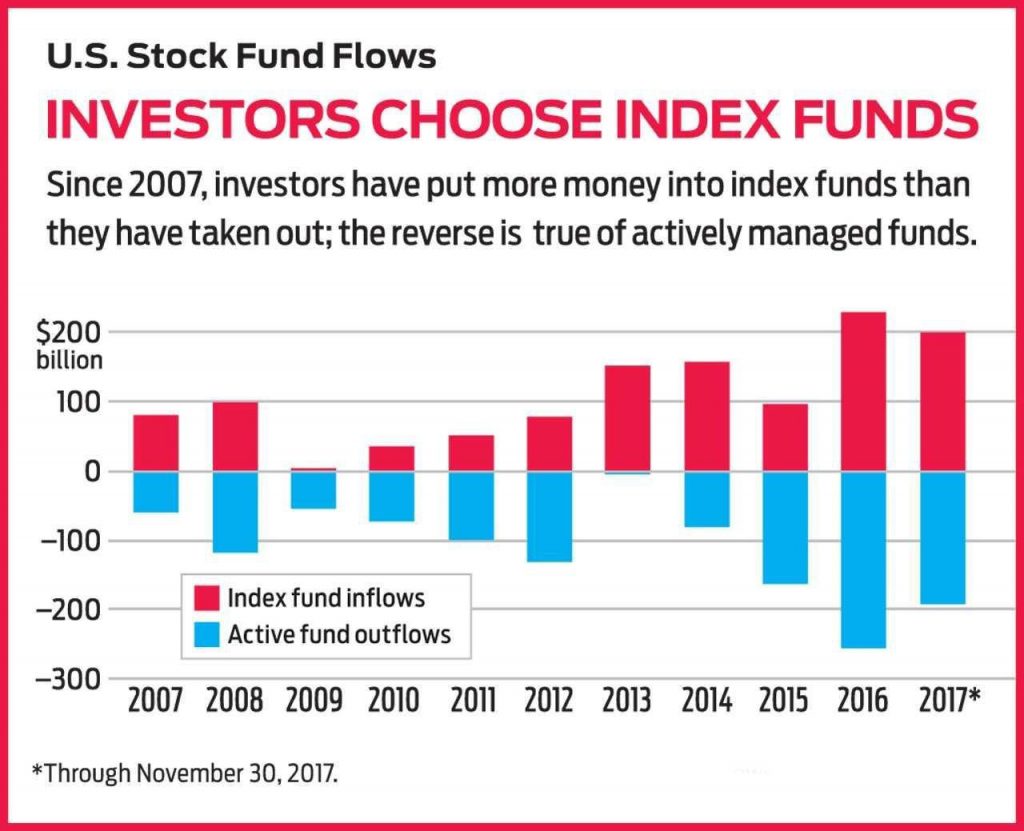

One of the biggest benefits of index funds is that they have regularly trumped over forms of funds when it comes to the total return on investments. This is because they have extremely low management fees than other funds since they are only passively managed. Rather than having someone to manage the trading actively or a team of researchers analyzing securities and giving recommendations, the portfolio of an index fund simply mirrors that of the index that it is following.

They also retain investments unless the index itself changes, which seldom happens, and so have extremely low transactional costs. These lower costs can make a big impact on returns, especially in the long-term. On top of that, since investors don’t trade securities as often as actively managed funds, there is less taxable income that has to be passed down to the shareholders.

Big investors have consistently performed well below the so-called unsophisticated index fund investors that do nothing but sit on their investments for decades. The main reason for this has been the high fees and commissions that big investors pay to get access to consultants and recommendations. This has been called ‘a fool’s game’ by Warren Buffet.

There is another important advantage when it comes to taxes. Since new security lots are purchased whenever investors invest in the fund, there can be thousands of lots that one can pick from when looking to sell a particular security. What this means is that investors can sell the lots at low gains and have to pay fewer taxes.

Cons of Index funds

Unfortunately, there isn’t a single investment deal that is ideal; for even in index funds, there are a few drawbacks that one has to be aware of. One of the most blatant drawbacks is inherent in index funds.

Index funds rise and fall with the index (or indices) that it is tracking. If, for instance, your index fund tracks the popular S&P 500, you will enjoy the benefits when it is doing well but will completely be at the mercy of it when it is not doing so well.

On the other hand, if you have an actively managed fund, you can always adjust your portfolio or liquidate it, depending on what your fund manager advises if you feel that a market correction is about to come in.

Sure, one can always talk a great deal about how the fees in an actively managed fund come in the way. But, the expertise of a qualified manager can guide you and assist you in safeguarding your portfolio and sometimes outperforming the market. But, not every manager has been able to do so on a regular basis.

Diversification, too, can be a tricky business to earn off of. It may smoothen the volatility and reduce the risk but doing so also reduces the upside and limits your returns. The diversified collection of stocks of an index fund may be pulled down by only a few bad performers, while the portfolio that cherry-picks its stocks may be better off in amassing huge returns.

An index fund is also ideal for only those investors who are looking to invest in the long term. Those who have a larger investment horizon will be able to take full advantage of its potential. In the short-run, on the other hand, the fund can experience, and does so often, fluctuations that can make or break your portfolio. Any investor expecting returns between 10-12% should ideally invest in an index fund for 7 years or more.

The bottom line

Index funds are a great investment tool for those who are looking to invest long-term and don’t want to pay the commission linked with funds that are actively managed. The benefits are quite attractive but there are drawbacks to consider as well. Knowing what an index fund is and how it works is essential for an investor or a trader before s/he decides to invest. Before we end, here is a list of all the pros and cons of index funds:

Pros

- Low fees

- Low tax exposure

- Well-diversified

- Passively managed funds outperform active ones over time

Cons

- No protection against a market slump

- Cannot take advantage of lucrative opportunities

- Cannot get rid of stocks that don’t perform

- Lack professional portfolio management

Now that you have briefly understood what an index fund is, you can move forward and look to invest in those that appeal to you and your goals.