Leading MT4 Forex Brokers: Dive into the World’s Most Renowned Trading Platform

Publish:

Modified:

Navigating the best MT4 forex brokers is like a maze because of the seemingly endless options available. There are so many questions to consider:

- How safe is the broker?

- How long have they been in the market?

- What markets do they offer to clients?

- What are their trading costs?

What is important to note is the standard of brokers, despite them being plentiful, is relatively the same across the board. There are only some slight variances here and there that separate them.

For example, certain MT4 brokers are good for US-based citizens, while others are more beginner-friendly, and some excel with low spreads.

Although MT4 presents numerous drawbacks where there are more technically superior platforms, it’s still an accessible and simple-to-use platform with an overwhelming majority of brokerages providing it to clients.

The software is only part of the whole puzzle since traders also need to research a broker’s regulation further. This article will cover some of the best MT4 brokers chosen and rated according to predefined criteria.

Top 7 Best MT4 Forex Brokers

1. TechBerry

Best Social Trading Platform for MT4

Founded: 2015

Location: US, DE, AU, UAE

Currency Pairs: 100+

Min. Spread: 0

TechBerry is a top-rated, neural network powered, social trading platform that works with more than 50 reputable Forex brokerage houses to execute trades. Since its inception in 2015, it has averaged 11.2 percent monthly gains among its subscribers. The platform gathers data from over 100,000 accounts to create the most successful trading approach. It provides up to 100% loss reimbursements, so you don’t have to be concerned about losing money. The service is available in a range of subscription plans and a free trial with a $5000 minimum deposit.

TechBerry provides services all over the globe freely without any restrictions and has multiple brokers that come under the regulations of top authorities such as FCA United Kingdom, CySEC Cyprus, FMA New Zealand, FSCA South Africa, and CFTC (Commodity Futures Trading Commission), the USA, etc.

The platform allows traders to earn money by offering personal execution details to the social trading platform. By contacting the developers, big financial institutions can receive a personalized Techbery quotes with exclusive incentives.

A personal manager is ready to assist you in solving any of your questions. The funds are insured by FIDC, adding an additional layer of safety.

Pros

- Average monthly gains of 11.2 percent.

- A personal manager is available to assist you.

- It offers a free trial.

- Up to 100% reimbursement policy.

Cons

- No mobile application for monitoring.

Read more about TechBerry in this review

2. FXTM

All-round Excellent MT4 Forex Broker

Founded: 2011

Location: Cyprus

Currency Pairs: 21

EURUSD Spread: 0 pips

Leverage: Up to 1:2000

There are many brokers at a trader’s disposal, but some may have a few notable push factors or may not tick a particular box. Anyone is only interested in the best brand overall in Metatrader 4 brokers; FXTM is the answer.

Like any broker, security is usually the first consideration. CySEC (Cyprus Securities & Exchange Commission), the FSC (Financial Services Commission – Mauritius), and the FCA (Financial Conduct Authority – UK) are FXTM’s regulators.

With a broad client base of over 2 million clients in over 150 countries worldwide, they have been successful in catering to different needs and personalities through the offering of various accounts like the standard, ECN, zero spread, cent, copy trading, and so on. Also, because of their exceedingly far global reach, there are seemingly countless ways to fund and get paid with FXTM.

Pros

- Multi-regulatory status.

- Wide range of currencies.

- Wide range of funding and payment options.

- Wide range of accounts like zero spread, cent, copy trading, etc.

- Competitive spreads and overall low fees.

Cons

- Some of their withdrawal methods incur fees.

- The unusually high minimum deposit for the zero spread account.

- An inactivity fee is applicable.

Read more about FXTM in this review

3. IC Markets

MT4 Broker with Low Spreads

Founded: 2007

Location: Australia

Currency Pairs: 65

EURUSD Spread: 0.1 pips

Leverage: Up to 1:500

IC (International Capital) Markets is one of the most well-known and revered Australian-based MT4 brokers, started back in 2007. It’s a financial institution that’s truly all about capital markets since they offer several CFD instruments, including 65 forex products.

One of the things IC Markets prides itself on is their low, or ‘raw’ spreads available on the zero or raw spread account with a reasonable deposit of $200. Aside from any trader that is a little more conscious of their trading costs, this account is particularly beneficial for scalpers, high-volume traders, and those trading with robots.

Traders can experience millisecond-fast execution with reduced slippage, no re-quotes, and a decent commission of $3.50 per lot. This solution is perfect for those looking for trading with predictable low charges and institutional-grade pricing.

Pros

- Wide range of deposit options, with 0% commission.

- Zero spread account.

- Several base currencies in an account, namely USD, AUD, EUR, GBP, SGD, NZD, JPY, CHF, HKD, and CAD.

- Extensive selection of forex pairs.

Cons

- No negative balance protection.

Read more about IC Markets in this review

4. AvaTrade

MT4 Broker for Beginners

Founded: 2006

Location: Ireland

Currency Pairs: 55

EURUSD Spread: 0.9 pips

Leverage: Up to 1:400

AvaTrade is an old name in the game. It was established in 2006 and has lived up to its slogan of ‘trading with confidence,’ boasting a wide array of instruments, namely forex, commodities, options, ETFs, stocks, bonds, and crypto.

For beginners, they will rest assured trading with supreme confidence because of Ava’s multi-regulatory status and global footprint with offices spanning five continents. The broker currently has a 4.8 Trustpilot rating at the time of writing.

In line with being among the best MT4 brokers for beginners, AvaTrader offers an immersive educational platform called Sharp Trader, covering basic to advanced technical and analysis concepts.

For additional help, they can readily assure themselves of relying on the multi-lingual online and offline support available.

Pros

- Offices in 10 different countries and multi-regulatory status.

- An extensive selection of markets available.

- Multiple funding options.

Cons

- Inactivity fee.

- Minimum deposit of $100.

Read more about AvaTrade in this review

5. Pepperstone

MT4 Broker for Pro Traders

Founded: 2010

Location: Australia

Currency Pairs: 60+

EURUSD Spread: 0 pips

Leverage: Up to 1:30

Pepperstone is a well-known, multi-instrument, multi-regulated brokerage from Australia USwith more than ten years in the business. Within this period, they’ve expanded their global footprint to have offices in London, Dubai, Nairobi, Germany, and Cyprus.

Traders have a few accounts to speculate with, all starting from a reasonable $200 minimum deposit. Professional traders can benefit from an extensive choice of instruments, competitive pricing, and industry-leading analysis to keep in touch with the global markets.

Like IC Markets, this brand also offers a zero spread offering similar benefits of lower trading costs and fast order placing.

The payment options available with Pepperstone include VISA, Mastercard, PayPal, Neteller, Skrill, etc, all of which incur no fee from the broker.

Pros

- Regulated by many top-tier forex regulators such as ASIC (Australian Securities and Investment Commission), the FCA, etc.

- Supports a wide range of fee-free funding methods.

- Offers an extensive selection of accounts like demo, standard, zero spread, etc.

- Competitive fees overall.

Cons

- A minimum deposit of A$200 may be too high for many.

- Bank withdrawal fees for users outside of the EU and Australia may be higher than normal.

Read more about Pepperstone in this review

6. IG

MT4 Broker for US Traders

Founded: 1974

Location: UK

Currency Pairs: 104

EURUSD Spread: 0.8 pips

Leverage: Up to 1:50

It’s a well-known fact only a handful of MT4 forex brokers accept US clients as it’s one of the most problematic nations for brokerages to receive regulation. Fortunately, one of the few exceptions here is IG (an abbreviation deriving their old name from Investors Gold Index).

IG is one of the oldest existing brokers in the financial markets, being established in 1974. It is a part of the FTSE 250 and a publicly-traded company on the London Stock Exchange with multi-regulatory status, including the States via the CFTC (Commodity Futures Trading Commission).

IG has an unquestionable and esteemed reputation in the forex industry, where they cover all the needs of the modern forex trader. Overall, they tick boxes in many areas leaving very little to chance due to their impressive range of services they offer.

Pros

- US-friendly broker with licenses from multiple regulators.

- Simplified and transparent fee structure overall with competitive spreads.

- Simplified account structure and a good selection of trading platforms catering to all trading levels.

- Large selection of forex instruments.

Cons

- Somewhat limited are the options for depositing funds, though enough to be compatible for clients in any region.

- The broker is not offering services in many countries.

- The account opening process is a little longer than it should be.

Read more about IG in this review

7. FP Markets

Best MT4 ECN Broker

Founded: 2005

Location: Australia

Currency Pairs: 60+

EURUSD Spread: 0.1 pips

Leverage: Up to 1:30

FP Markets (First Prudential) is yet another of the popular Australian-based Metatrader 4 brokers with many years of experience in the industry. When considering any forex brand, longevity often prevails for several reasons.

Aside from its top-tier regulation from ASIC, arguably the second consideration is the execution employed by a broker. It’s a known belief that we have ECN and dealing desk brokers.

Although the latter isn’t necessarily bad, ECN is still more preferred in the general trading community. There is usually no conflict of interest; clients receive consistently lightning-quick execution and tight spreads with barely any re-quotes because of the deep liquidity the broker connects itself to.

Traders can enjoy this experience in their standard or zero spread accounts with a reasonable minimum deposit of $A100. Even with such a small balance, profit opportunities aren’t so limited because of the 1:500 maximum leverage and the extensive selection of tradable forex pairs.

Pros

- ASIC regulations compliance.

- ECN brokerage.

- Zero spread being offered.

- Flexible leverage.

- Plentiful depositing and withdrawal options.

Cons

- $25 withdrawal fee for bank wire transfers outside of Australia.

- No negative balance protection available for the customers.

Read more about FP Markets in this review

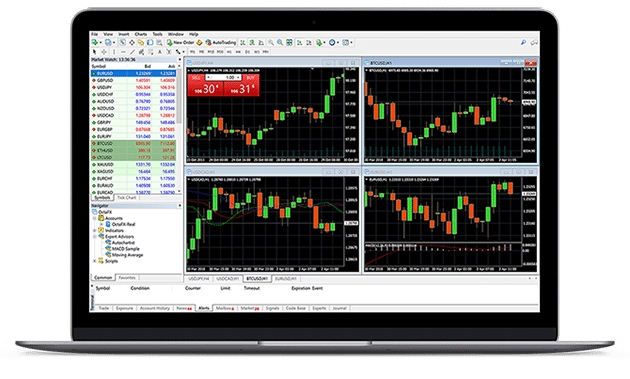

What is the MetaTrader 4 (MT4) platform?

It usually doesn’t take long for any beginning trader to hear the mention of the term MT4. MetaTrader4 is a trading software developed by Cyprus-based software corporation MetaQuotes.

It saw the light of day back in July 2005. The developers already had several MetaTrader platforms under their belt since the millennium turn but struck gold with the fourth version. Most analysts attribute this because of its user-friendliness, third-party scripts, and fluid programming language.

By 2010 when the corporation released MetaTrader 5, MT4 was already one of the popular trading software packages globally. This status has grown somewhat exponentially, far beyond even its successor, with nine in ten brokers providing the platform to their clients.

Despite there being other trading software tools, MT4 is widely used by forex brokers primarily.

Why you should trade with MT4: Features

The first reason that comes to mind when considering MT4 is that it’s the most popular trading platform. Over 90% of forex brokers offer it, with some only providing it without any alternatives.

Though MT4, like any product, is not without its flaws, accessibility is the primary motivation for anyone to use it. MT4 is like a car that’s not too old but not too high-tech either. It strikes the right balance between simplicity and sophistication; it’s not too simple, but not too sophisticated either.

The first thing to observe about any trading platform is its user-friendliness. MT4 is well-renowned in this aspect as it doesn’t take very long to be good with navigating the software in areas like setting orders, adding indicators, using drawing tools, and other bells and whistles.

These features are highly customizable from color design, background, charts, indicators, profiles, etc., where each trader’s set-up can look uniquely aesthetic. Good trading software should have compatibility with a wide range of operating systems for traders to experience these attributes.

Again, MT4 is one of the highly compatible trading programs in the industry. It’s usable on several operating systems for Windows, Mac, and Linux desktop users, and then Android and iOS for the mobile versions.

Not only is MT4 compatible with these operating systems, but even the computer specs do not need to be high-tech because of being a 32-bit single flow platform. MT4 only requires a computer with at least 512MB RAM.

Lastly, another big reason for MT4 popularity is its programming functions for creating trading robots through the MQL4 language.

What is the difference between MT4 and MT5?

The most recent version of this program is called MetaTrader 5. However, MetaTrader 4 is built on an earlier generation (version). With the addition to CFDs and FX trading, MT5 can also provide stock and futures trading, making it a more multi-asset platform.

Advanced features like using cloud storage for strategy execution or backtesting are also included in MT5. Backtesting with MT4 can only be done locally or over a virtual private server (VPS).Although it has a similar look, MT5 is a quicker, more advanced trading platform. The number of MT5 servers recently outnumbered the number of MT4 servers globally (it only took a decade), although the best US brokers for Metatrader 4 are still more popular.

How do you deposit and withdraw money from MT4?

You’ll utilize the ways provided to you by your best US mt4 forex broker to deposit and withdraw money from MetaTrader; these can change based on brokers and your place of residency. You must fill out a withdrawal form provided by your broker and send it to them for processing if you want to make an electronic withdrawal request through your website or client portal.PayPal has gained popularity as a way to fund and withdraw funds from live forex trading accounts; some well-regarded, reputable best brokers for metatrader 4 accept PayPal payments.

Is automated trading with MetaTrader risky?

Automatic trading platforms known as experts in MT4 and MT5 are created by traders based on backtesting to demonstrate profitability. Automated techniques have the drawback of relying on the advantages of hindsight bias. The truth is that only a very small percentage of trading strategies are profitable over an entire year.

Here are some suggestions to assist you in choosing a reliable automatic trading system. Metatrader 4 brokers reviews.

1. Find out the trading technique (system) that expert advisers use for its automated trading approach by researching the best forex brokers with MT4 platform.

2. If possible, backtest the strategy using several instruments and timeframes, and review its prior results.

How to choose the best MT4 broker

As we’ve established a vast majority use this platform, we then need to consider logical and thorough selection criteria for the best Metatrader 4 brokers. Everyone will have their order of importance, but the majority will agree regulation is arguably the first point of reference.

Regulation

One must verify a broker’s license status, that it’s active and is from the top-ranked regulators in the industry like CySEC, ASIC, FCA, CFTC, and other trusted regulatory bodies from recognized forex hubs in Europe, North America, and Australia.

These regulators are more trustworthy than those from offshore regions like the Bahamas, Mauritius, Bermuda, Belize, Mauritius, and the Cayman Islands.

The importance of regulation is ensuring safeguarding practices in handling clients’ money (insurance, segregated accounts, processing withdrawals, etc.), that a broker consistently acts in good faith, and performs according to periodically-reviewed auditory standards as a financial institution.

Negative balance protection

This feature is critical, especially because of leverage. Although ‘black swan’ events are rare in forex, if one isn’t cautious, there is always a chance, albeit unlikely, of blowing an account.

Negative balance protection prevents any scenario where a trader would owe a broker due to a negative balance. In choosing any MT4 broker, traders should only risk disposable income.

Execution model

As mentioned previously, we class brokers as ECN or dealing desk. Although no model is intrinsically better than another because many brokers alternate between both, it’s something to consider as it sets the tone for any of the services they would provide.

For example, ECN Metatrader 4 brokers generally use variable spreads, unlike dealing desk parties that typically offer fixed spreads. Depending on a trader’s preferences, some may prefer the former while others may lean towards the latter.

Spreads and fees overall

This results from the previous point. Spreads are the main consistent fee for any trader. Fortunately, very little difference exists nowadays between brokers where most offer competitively low spreads.

However, it’s still worth comparing a few if there is a brand offering slightly higher than usual. Other costs worth noting are commissions, funding and withdrawal fees, swaps, and inactivity fees.

The best MetaTrader 4 brokers, in most cases, may charge a commission (depending on the account), have no funding and withdrawal costs, reasonable swaps, and no inactivity fees. To make the best decision, it’s always imperative to compare against a few options.

Wide range of markets

It’s beneficial for a broker to have at least 50 different forex pairs, majors and minors, and a balanced mixture of the most popular exotics.

Wide range of deposit options

When funding, one naturally desires Metatrader 4 brokers allowing different methods aside from VISA/Mastercard and bank wire transfers.

Various support channels

A live chat function is a must nowadays. Other helpful support mechanisms include highly responsive phone lines, emails, and even social media platforms.

Our Methodology

Our methodology in selecting the best Metatrader brokers is simple. The first point of reference is always regulation, a crucial attribute when dealing with any financial institution. Regulation brings security, professionalism, and global recognition to traders.

After confirming this, we will rigorously appraise each broker through a few months of using their services, noting how consistent their spreads are, what markets are available, how adequate the customer support is, the quickness of opening an account, and the ease of depositing & withdrawing.

During this time, we will note what we may believe to be striking drawbacks for the ordinary trader. Finally, everything is condensed into a comprehensive and detailed guide.

The guide above has included highly recognizable brands in the forex brokerage industry. Another part of the methodology is assessing some of the needs most traders have regarding spreads, trade execution, location, options most suited to beginners & professionals.