Pros

- Large user base

- Reliable transaction speed

- Adherence to strict regulation rules

- Wide recognition and awards

Cons

- Withdrawal fee

- No bonus offer

- Inactivity fee

FXTM made its foray into the financial industry in 2011. The company primarily provides consultancy services and guidance to clients looking to go into leveraged trading. The company has a global outlook, with offices in several countries in Europe, Asia, Latin America, and Africa.

FXTM has built a reputation as a trusted brand. Between 2011 and 2020, more than two million people use its services the world over. As an attestation of its efficacy, it has garnered more than 25 awards. Moreover, FXTM subscribes to regulations in multiple jurisdictions. This assures clients of the safety of their funds.

Regulation

Three reputable bodies regulate FXTM. They are CYSEC, FCA, and the FSC. CYSEC is the primary regulatory agency for Cyprus, while the FCA and FSC are the regulatory agencies for the UK and Mauritius, respectively.

These bodies are thorough and provide stringent requirements. Clients should be assured of FXTM’s reliability by the singular fact that they are affiliated with these regulatory agencies.

Account Types

FXTM operates different account types to cater to the various clients they have. This offers users the luxury of choosing which is most convenient for them. Some of the users are discussed below:

- Demo trading accounts

This account is perfect for those who are new to trading and can get familiar with making successful trades. The funding here is with virtual currency, so the risk is reduced. The process of opening an account is equally straightforward. Clients need to fill out a few forms to get started.

- Standard accounts

The standard account has the lowest opening capital. With ten cents, a client can open an account and enjoy all the perks with one. Furthermore, there are no hidden charges or commissions.

- Stock CFD account

It is the account that allows access to the trading stock of companies such as Facebook. Account owners here can only utilize the MetaTrader 4 platform. Here, the required minimum deposit is $100.

- ECN accounts

This is the highest level of account and is available for users who have garnered some experience in the field. There is the ECN Zero account where the minimum deposit is $200. The next is the ECN account. Here, the minimum deposit is $500. The final account is the FXTM Pro account. It is ideal for those who have a wealth of experience in trading. The minimum deposit amount here is $25000.

Fees and Commissions

FXTM makes deposits and withdrawals on the platform seamless. It also does not take up any time at all. There are different options for deposits. These include local transfers from banks. Furthermore, users can make payments using Visa, Mastercard, or Maestro. The same ample opportunities are available for the withdrawal of funds.

Beyond the minimum amount required for each account, FXTM does not require users to make any additional payments. However, withdrawal generally takes about $3 for a credit card and $20 if it is a bank transfer. It is important to note that bank delays could affect the speed and nature of transactions.

If an account has been dormant for more than six months, FXTM charges an inactivity fee of 5 EUR. If no trading activity for six months or more, FXTM may also charge fees for the withdrawal of funds.

FXTM’s commission on trades is also relatively low, especially considered what other platforms charge.

Payment Options

The specific deposit and withdrawal methods that FXTM supports include:

- Mastercard

- Neteller

- Skrill

- Maestro

- Visa

For withdrawals, Visa, Maestro, and Mastercard work best. Transactions using these platforms are typically processed the same day, with a flat withdrawal commission of 3-5 EUR. Even though this process is straightforward, a user must provide additional verification to confirm authorization to make transactions on the account. If a user decides to withdraw using a bank wire option, they would need to upload a bank statement that clearly shows the account holder’s name and account number. The name on the account should match the one used for registration.

Available Markets

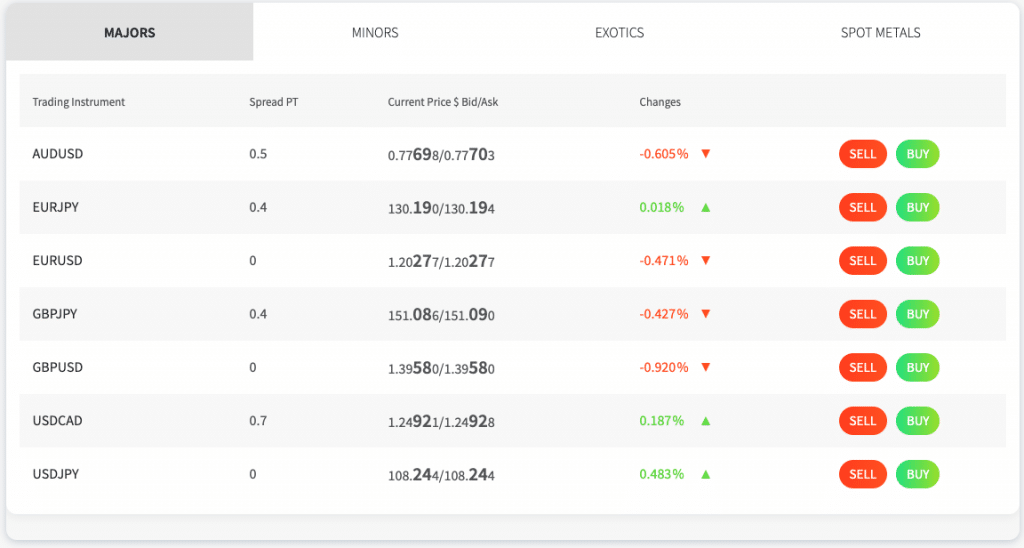

FXTM offers a wide range of instruments. However, the one available for each trader could depend on the country the person is located in. Generally, FXTM permits trading shares of CFDs, silverspot metals, forex, and CFDs for indices and commodities.

Furthermore, there are margin requirements and leverages each trader has to maintain for every account. A margin is the minimum amount of funds that should be in an account at all times. Leverage rates differ from one trade to the other. For most lesser-known trading pairs, such as AUDCAD and EURNOK, the leverage is at 1:20. For most of the others — at 1:30.

Some other factors could influence leverage, such as the trader’s experience and expertise, loyalty to the company, etc.

Trading Platforms

A trading platform is a primary route through which clients interface with the foreign exchange market. Ideally, these platforms are available across a wide range of devices and contain tools that enable clients to carry out trades seamlessly.

For FXTM, trading platforms come in two forms: MetaTrader 4 and MetaTrader 5. The MetaQuotes software engineered both. They are designed to help the user carry out seamless trades with little or no help or supervision. They also have primarily unavailable tools on similar platforms, but there are specific vital differences.

- MetaTrader 4 is a creation of MetaQuotes Software. It is free to download and set up and provides users with all the tools they need to trade successfully. Some of the platform features include intuitive and helpful charts, 30+ technical indicators, multi-device functionality, and access to 9 time-frames for trading ease. It also has a reliable security system that ensures that users have nothing to worry about while trading on the platform.

- The MetaTrader 5 is a successor to the MT4. It builds on the previous version’s success and comes with new and improved features that enhance overall trading. Users can access it in any of the 30 languages. As an improvement of the MT4, it has more enhanced features that make for a more seamless trading experience. The MT5 allows the transfer of funds across various accounts and alerts users. It also comes with an edit button and provides an economic calendar.

Both platforms have apps that are compatible with iOS and Android devices. You can also use them on a PC or Mac. Besides, MT4 has its Multi account manager (MAM) feature, ideal for users with multiple accounts.

Features

Ordinarily, FXTM provides standard stellar features that would be the delight of any client. However, in addition to those, the company also makes other excellent features available to users. Some of these include charting tools, alerts, news, and analysis. FXTM is an industry leader; thus, its statistics and data are regarded as verified when published. This provides users with an authentic source of information regarding data and news about the industry.

Loyalty program

FXTM uses a loyalty program to reward clients and incentivize them to stick with the platform. When clients trade on the platform, they get rewarded with withdrawable cash. The great thing is that this reward process is available, regardless of the account type that the individual chooses. Furthermore, the process is relatively easy and straightforward. You need to keep trading to be eligible for the reward.

Reward system

There are five stages in the reward system. As the client advances through the stages, they become eligible to receive the cash rewards to either choose to plow back into trading or withdraw for other purposes.

Trading program

That is not all. FXTM also has a copy trading program that allows users to imitate some strategy managers’ trading patterns. This is especially useful for those not well versed in the process of trading.

Education

FXTM makes arrangements to provide the necessary learning materials for users. Thus, on its website, it has a section dedicated solely to education. Education is essential for anyone looking to make sure they do not lose all their money when they start trading. Hence, FXTM’s efforts are commendable. The guides and tutorials are divided into several segments. Some of them include ebooks, webinars, and videos. It also offers a list of articles and seminars with helpful information to any trader.

Customer Support

Getting customer support is one of the first things clients check out before settling for a forex/CFD brokerage company. FXTM is reliable on that front. The support system is available 24 hours every day on weekdays. There is the option of either emailing the units with a complaint or having a telephone conversation to handle any lingering issues. For quick results, a live chat is also available to users. Clients can speak to specific customer care agents for different locations. For instance, there are representatives for Nigeria, South Korea, Thailand, India, Indonesia, and China. However, there are some regional restrictions at FXTM. The company does not provide its services to users from the following countries: USA, Mauritius, Japan, Canada, Haiti, Suriname, North Korea, Puerto Rico, Brazil, New Zealand, Occupied Area of Cyprus, and Hong Kong.

Review Summary

FXTM provides a stable learning environment for anyone looking to begin trading. Similarly, it caters to those who are experts already and seek a suitable playing field. The platform takes the education of its customers quite seriously. It also provides reliable customer support systems for the easy resolution of any complaints that may arise. FXTM is deserving of all the accolades it has garnered.