Alibaba Group Holding Ltd (NYSE: BABA) stock has been on a rollercoaster, to say the least. As 2020 turned out to be a year of e-commerce stocks, the Chinese tech heavyweight rallied 38% to record highs of $319, its sentiments bolstered by a spike in online sales. The pullback that has followed ever since the stock touched record highs is one for the books fuelling talks of a potential bubble.

The Chinese e-commerce heavyweight started the year on a roll, recouping some of the losses after a pullback from record highs. A 13% rally in the first two months of the year fuelled suggestions that the stock was ready to start climbing the ladder. However, that was not to be, as the stock has imploded in a classic example of a bubble burst.

Alibaba has shed more than 30% in market value since the start of the year. In the recent past, the stock has touched levels not seen in three years, plunging below the $200 a share level to 52-week lows of $138 a share.

Regulatory pressures

Alibaba was one of the biggest culprits as Chinese authorities embarked on a regulatory crackdown targeting companies perceived to be operating a monopoly. The gaming, education, and technology sectors have been the most affected driving volatility in the Chinese stock market.

For the longest time, Alibaba has always traded at a premium in total disregard of the underlying risks the authoritarian communist party poses. With Alibaba a high-profile name in the tech industry, it was always susceptible to feel the effects of a tight grip from authorities.

Alibaba sentiments and valuation also came into question as regulators ordered Ant Group to carve its lending business into a separate entity. The tech giant owns a 33% stake in Ant Group which runs the highly successful Alipay payment system.

The push is part of the government’s drive to reduce the tech giant’s monopoly power given the huge troves of data it has access to with this business.

Alibaba woes were further exacerbated in response to concerns that Chinese real estate giant Evergrande Group was on the brink of going under. The Group owns roughly $300 billion worth of real estate in China, of which its collapse would have had a ripple effect on the Chinese economy.

Fears of the real estate bubble have come at some of the worst times, given the effects of COVID-19 are still being felt and the mounting regulatory pressures. This explains why Alibaba outlook in the market has turned sour in recent months to the point of investors questing its valuation given site exposure to the Chinese market.

Recent happening underscores why Alibaba stock will always be at the mercy of the government, even on underlying fundamentals painting a different picture.

Revenue growth evaluation

When analyzing whether a stock is a bubble, it is important to focus on three key metrics: revenue margin and risk.

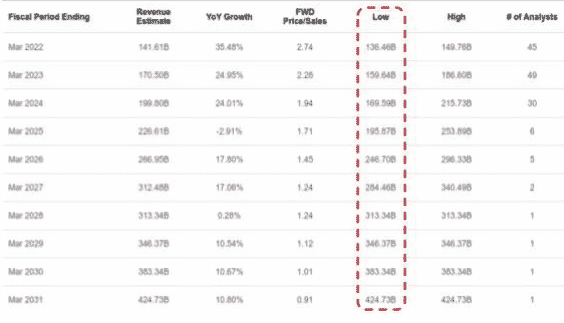

Analyzing the company’s financials using the discounted cash flow model, it becomes increasingly clear that its growth prospects might as well be overstated.

For instance, taking the company’s revenue forecast for the next ten years and reducing it by 10%, it becomes clear that the compound annual growth for Alibaba’s revenue is 14% which is three times less than the result of the last five years.

Alibaba’s risk underestimated

Amid the valuation concerns, it’s also becoming clear that Alibaba’s underlying risk might have been underestimated as the stock raced to record highs. It’s no secret that the Chinese e-commerce heavyweight operates under the mercy of the Chinese Communist Party, which maintains a tight grip of the economy and all activities in it.

When it comes to margin, Alibaba’s capitalization has always been susceptible to political processes in China. The company has sought to strengthen its growth metric through strategic investments that have allowed it to buy out the competition and build a monopoly.

While the investment drive has always eaten into the company’s profits, the regulatory scrutiny that the action is attracting appears to have caught the market’s attention. In the recent past, the communist party flexed its muscle as part of an aggressive crackdown on companies touted as monopolies in the internet sector all but shook Alibaba sentiments and prospects.

The stock did pay a heavy price imploding in the process as its proposed Ant IPO was called off, and the company was forced to change its practices amid the regulatory crackdown. The crackdown all but affirmed that Alibaba might as well have skyrocketed to record highs in total disregard of the underlying risks.

Technical context

A bubble in the capital markets is often characterized by super-exponential growth that is not in any way supported by fundamentals. The exponential growth repeatedly warns how unstable a stock is and can be easily spotted on a technical chart.

From when Alibaba peaked at record highs of $319 a share, it started pulling back. The corrections from record highs were normally characterized by periods of sell-offs and bounce backs. As the stock edged lower between November of last year and August this year, it experienced a normal correction.

However, a bubble collapse was confirmed in late August as a super-exponential decline came calling, resulting in the stock declining at an exponential rate, all but affirming the formation of a bubble inside out.

Given that the stock is currently trending lower, the bubble bursting following the exponential decline could result in the stock bouncing back and starting to move up as shown above. The stock already appears to have reached support at $138, where demand has begun building up, resulting in a bounce back in recent days.

However, one cannot be overly optimistic of the bounce back holding after the exponential sell-off in recent dates. As long as the price fails to find support above the $160 level, the prospects of further downside action is always high.