- US dollar strength softens at one-year highs.

- AUDUSD and NZDUSD bounce back stalls.

- Gold prices bounce back, retaking the $1750 handle.

- US equities register the worst month of the year.

- Bitcoin and Ethereumare are trying to rally.

The US dollar is poised to end the month near one-year highs after flourishing in September. The greenback has been on the front foot against the majors strengthening the Federal Reserve’s case for early tapering. Rising US Treasury yields to three-month highs have only gone to fuel dollar strength.

Consequently, the dollar index, which measures the greenback strength against the majors, has rallied to one-year highs of 94.29. Continued dollar strength is expected amid the increasing real rates as rising inflation raises the case for the Federal Reserve hiking interest rates.

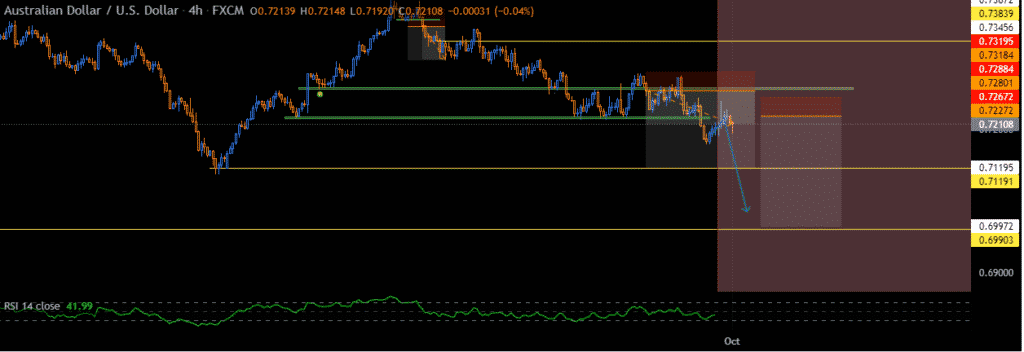

AUDUSD bounce back stalls

The dollar strength is already having a ripple effect in the market, with the majors struggling to bounce back after plunging to one-month lows. AUDUSD is one pair that is under immense pressure despite a recent bounce back above the 0.7200 level.

After grinding to 0.7250, AUDUSD has come down tumbling as bears remain in control. Immediate pull-back faces support at 0.7200.

A breach of the support level could result in the pair tumbling back to one-month lows of 0.7168. In contrast, bulls defending the 0.7200 should pave the way to bounce back to the 0.7250 level.

The Australian dollar is on course to depreciate for the fourth consecutive month against the greenback, which raises the prospects of the pair edging lower. However, the dollar appears to be in consolidation mode at one month high, especially after US initial jobless data disappointed on indicating the third consecutive month of gains. Focus now shifts to next week’s non-farm payroll report.

NZDUSD under pressure

Meanwhile, the New Zealand dollar also remains under pressure and on course for a fourth consecutive month of loss. The NZDUSD is down to one-month lows after sliding below the 0.6900 level. With bears in control, a drop to lows of 0.6800 is on the cards, given the strength of the downward pressure.

The surprise US jobless claims, which showed an increase to 362,000 from an expected 335,000, weighed heavily on the Dollar, curtailing further greenback strength. While NZDUSD did bounce back, it remains under pressure, with bearish biases still in play.

Gold bounce back

In the commodity markets, gold bounced back from near two months lows on Thursday, helped by the greenback giving up some of the gains registered in the week. XAUUSD bottomed out from lows of $1722 to session highs of $1764.

However, XAUUSD has given up some of the gains retreating to lows of $1754. As it stands, the precious metal is trading near the $1750 support level below which additional sell-off should be expected. Acceptance above the $1764 level should result in renewed bullish interest back to the $1780 level.

The spike in gold prices is supported by the dollar coming under pressure on a spike in jobless claims and a retreat in US treasury yields from three-month highs. Chicago Fed Reserve President Charles Evans insists that low interest rates are still needed to bring inflation back to 2% and also weighs on dollar strength.

Equities big pull-back

In the equity markets, US stocks suffered their worst monthly loss since March 2020 as volatility continues to roil the financial markets. Stocks edged lower on Thursday even as the House passed a nine-week spending bill to avert a government shutdown.

The S&P 500 fell 1.19%, taking its monthly loss to 4.8%. The Dow Jones also fell 1.59%, also posting a 4.3% loss for the month. The NASDAQ fell 0.4%, also down by more than 5% for the month. September lived up to expectation as the worst month for stocks.

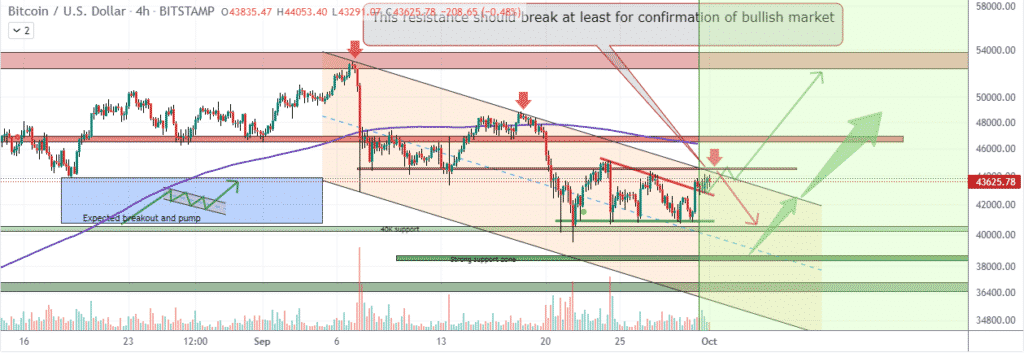

Bitcoin and Ethereum in consolidation

Bitcoin and Ethereum are showing signs of edging higher in the cryptocurrency market as they continue to trade above key support levels. BTCUSD is closing in on the $44,000 handle after the recent bounce-back below the $40,000 level.

Ethereum, on the other hand, has also found support above the $3,000 level but struggling to power through the $3,100 level.