Overview:

- ARK Genomics ETF (ARKG) benefits its investors from the disruptive scientific and technological advancements in genomics.

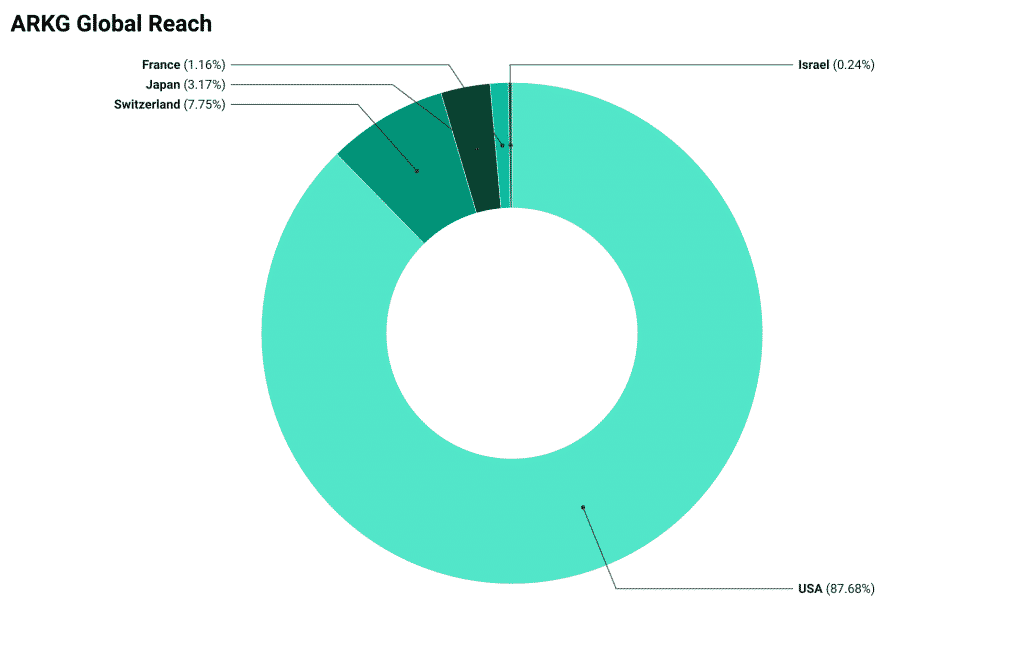

- The fund holds the stocks of the leading bioscience, pharmaceutical and other niche companies across the globe, 87.68% of them being US-based.

- The fund did best in 2020, its performance reaching 184.4%.

About ARK Genomics ETF (ARKG)

Segment: Equity: Global Health Care Pharmaceuticals and Medical Equipment.

ARKG is an actively-managed niche fund. Almost all of its underlying stocks are US biotech and healthcare companies, however, the genomics ETF reaches globally as well.

The stocks are selected based on internal and external research and analysis. The ARK Genomics Fund commits itself to invest the minimum of 80% into the niche stocks, however, a significant part of its revenue comes from fintech equities.

Presently, 92.06% of the fund holdings are in the healthcare sector, while 5.61% are in technology and 0.24% in consumer non-cyclicals.

All the companies tracked by the fund focus on substantially incorporating the improvements and advances in genomics into their business. These include the following sectors:

- Bio-inspired computing

- Bioinformatics

- Agricultural biotechnology

- Molecular medicine

- Bionic devices

For the investors holding their shares in a taxable account, a higher portfolio turnover may incur higher taxes and transaction costs as a result of the fund paying commissions for purchasing and selling securities. The annual fund operating expenses will not reflect these costs, which can affect the portfolio performance. In the last year, the turnover was 55%.

| Issuer | ARK |

| Dividend (Distribution Yield) | 0.95 % |

| Inception Date | 10/31/14 |

| Expense Ratio | 0.75 % |

| Market Cap | $53.68B |

| Number of Holdings | 56 |

| Index Weighting Methodology | Proprietary |

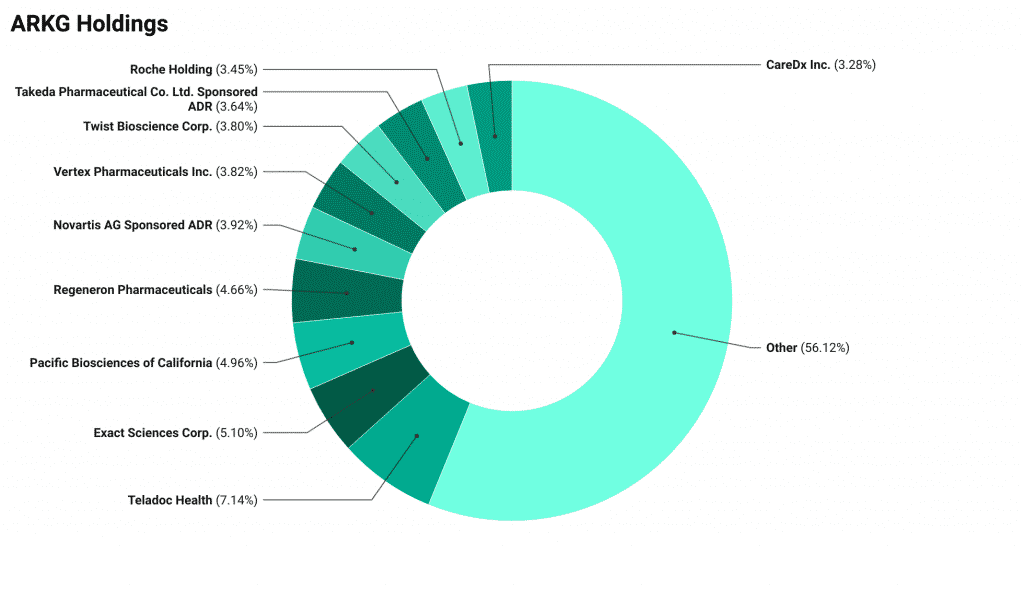

ARKG Top Holdings

Although the fund reaches technological and scientific developments globally, 87.68% of its holdings are concentrated in the US.

ARKG investments include micro-, small-, medium- and large-capitalization companies, their top ten holdings being the shares of the companies listed below.

According to the data presented by the Genomics Revolution ETF, its market capitalization capitalization is distributed between its holdings in the following way:

- Mega (companies whose market capitalization exceeds $100 bln) – 10.6 %

- Large ($10 – $100 bln) – 32.6 %

- Medium ($2 – $1 bln) – 44.6 %

- Small ($300 mln – $2 bln) – 11.6 %

- Micro ($50 mln – $300 mln) – 0.4 %

Recent Performance

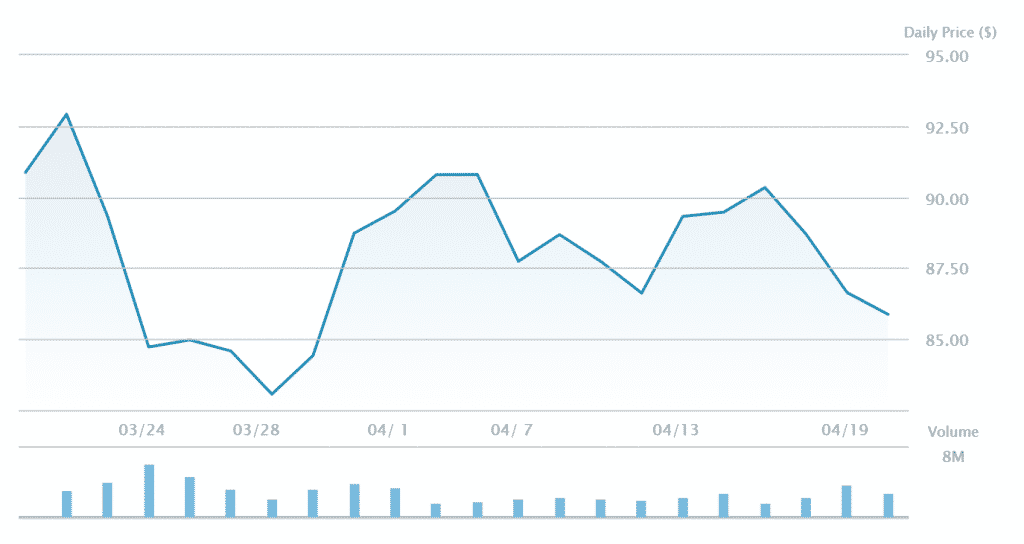

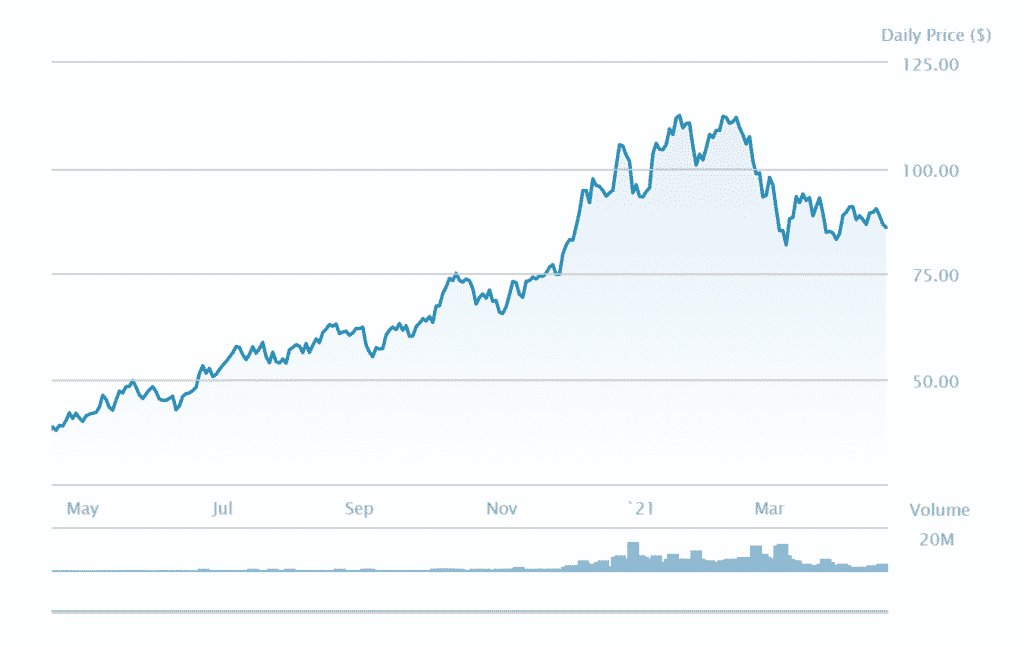

The highest price ARKG shares were trading at within a year and YTD was $112.47 reached on January 20, 2021. That was also the highest historical price of the fund shares reached since its inception in 2014, the highest price in April 2021 being $90.8. Meanwhile, the fund share price faced correction, losing 5.07% in Q1 2021.

However, ARK Genomics Revolution ETF success becomes evident once larger time frames are applied. The fund showed the best performance within the last year growing by 184.4%, while the figures are 53.97% and 40.28% for the last three and five years, respectively. Finally, the fund has shown 27.51% total growth since its inception.

ARKG assets under management (AUM) are $9.60 bln and the weighted average market capitalization is $51.89 bln as of this writing.