The Amazon (AMZN) stock price has bounced back in the past two days as investors wait for the company’s quarterly results. The stock is trading at $3,023, which is about 11.60% above the lowest level last week.

Amazon earnings ahead

The earnings season is going on this week with some of the biggest companies publishing their results. Amazon will be the next FAANG stock to publish its results when the market closes on Thursday this week.

All indications are that Amazon will deliver strong fourth-quarter results. For one, recent results from companies in their industries have shown that their businesses were relatively strong in the final quarter of last year.

For example, last week, results by Microsoft and International Business Machines (IBM) showed that demand for cloud computing has jumped sharply.

Further, retail sales numbers published by the American government and Mastercard revealed that the holiday season was strong. Amazon is one of the biggest players in American retail.

Analysts polled by Reuters expect that Amazon’s revenue for the fourth quarter rose to $137 billion from $110 billion in the third quarter. If analysts are correct, Q4 will be the best quarter in the company’s history.

The main challenge for Amazon is expected to be profitability. Analysts expect that its earnings-per-share declined to about $3.4 in Q4 from $6.12 in the previous quarter.

Amazon’s profitability will likely remain under pressure because of the ongoing supply chain challenges in its key markets. The rising inflation will also have a negative impact on its retail business.

Key metrics to watch

The Amazon stock price will react to a number of things in this week’s report. First, it will react to the performance of its cloud computing division that is known as AWS. The division is the most profitable for Amazon. Most of its peers have reported strong cloud revenue lately. For example, Microsoft’s cloud revenue rose by 26% to $18 billion in the fourth quarter.

The same trend happened at IBM, where the cloud division helped the firm to have the best growth in over a decade.

The next key catalyst for the Amazon stock price will be its fast-growing advertising business. The segment has grown from a small component of its business to being a pivotal one.

Like the cloud division, results by other players in the industry have been strong. For example, on Tuesday, Alphabet published strong results as its advertising business grew by 32% to $75.33 billion. Meta Platforms is expected to report strong ad business as well on Wednesday.

Is Amazon a good investment?

Amazon stock has lagged behind its peers in the past few months. The shares have lagged all FAANG stocks apart from Netflix. It has dropped by almost 20% from its all-time high.

Still, Amazon is a good investment because of its strong presence in key industries like e-commerce, advertising, and cloud computing.

However, unlike Alphabet and Microsoft, the company has exposure to external factors in its retail segment, which could affect its profitability.

Amazon stock price forecast

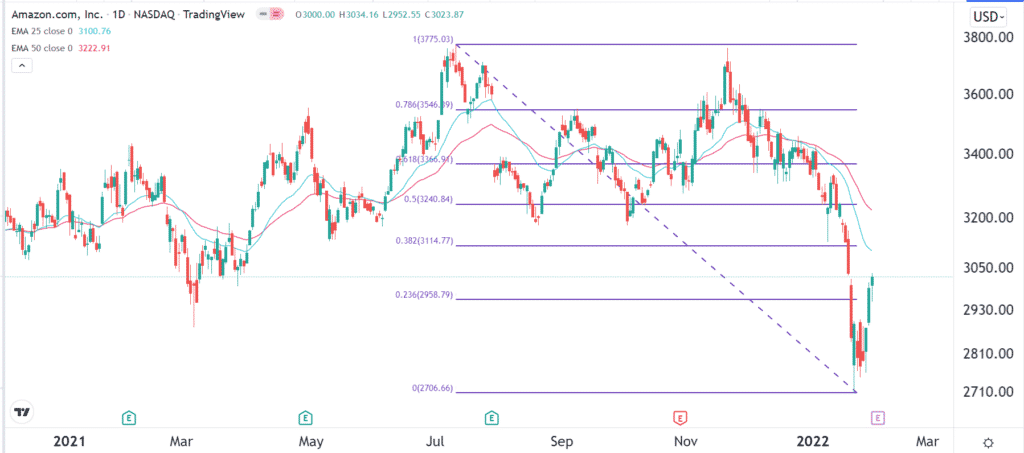

The daily chart shows that the Amazon stock price has bounced back in the past three straight days. The shares have already moved above the 23.6% Fibonacci retracement level. Also, oscillators like the MACD are pointing higher.

However, the stock is still below the 25-day and 50-day moving averages. This means that a significant drop cannot be ruled out when the company publishes its results this week.