- Alphabet stock is 50% up ahead of earnings.

- Q3 earnings are expected above estimates.

- Focus on advertising revenue.

- Impact of Apple iOS update.

Alphabet Inc. (NASDAQ: GOOGL), the owner of YouTube, Google, and other digital tools, is scheduled to report its third-quarter results after the market closes on October 26, 2021. The search giant heads into the earnings call, having outperformed the overall market its worth, having doubled over the past year.

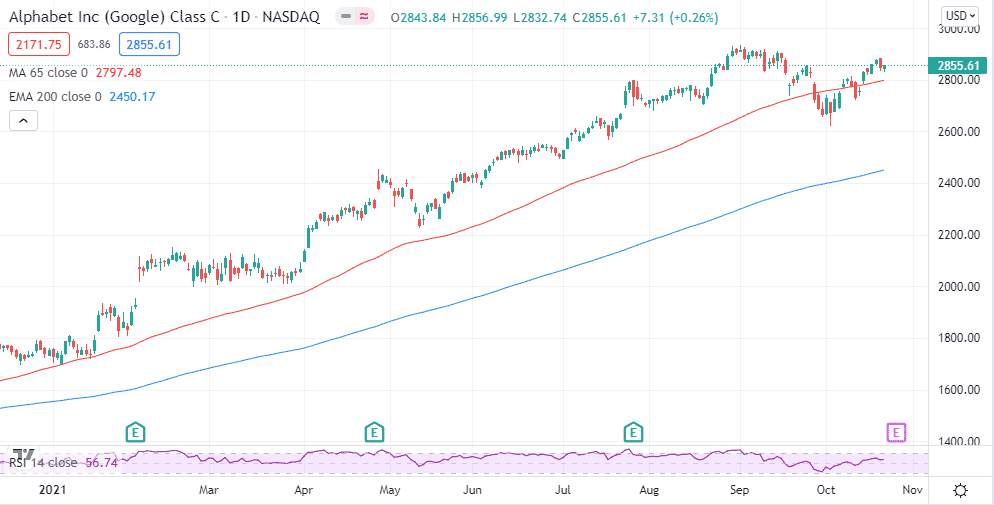

The stock is already up by more than 50% for the year, having outperformed the S&P 500, which is up by about 20%. Since the implosion recorded in March of last year, Alphabet stock has rallied by more than 150%.

The impressive run in the market stems from Alphabet affirming its edge in the search and advertising businesses. Better than expected results in recent quarters have all but affirmed the company’s growth metrics and long-term prospects.

In the second quarter, the tech giant delivered record revenue and profits as it benefited from consumers living most of their lives online. Strong growth in advertising expenditure amid the reopening of the global economy has all but continued to strengthen the company’s revenue base.

The third quarter is expected to be no different, with Alphabet expected to deliver better than expected results driven by growth in online advertising.

Q3 earning expectations

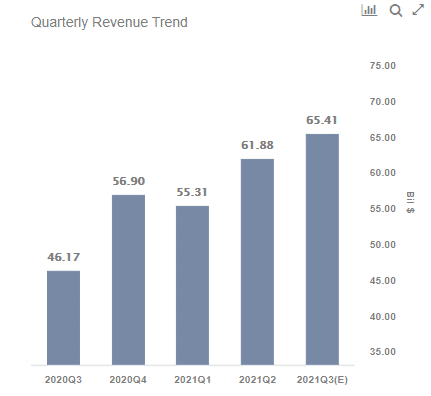

Wall Street expects Alphabet to deliver record revenue of $65.41 billion, representing a 41% year-over-year increase from $46.17 billion delivered in the same quarter last year. However, it will be a slowdown from a growth of 62% recorded in the second quarter and slightly above the growth of 34% in the first quarter.

The slowdown in revenue growth would mostly be due to the tough comparison as opposed to a downturn in business. In the second quarter, the tech giant warned that results in its Google Services division would decelerate in the second half of the year as it comes up with stellar growth levels in the second half of last year.

Net income, on the other hand, is expected to jump to $16.21 billion compared to $11.25 billion delivered in the same quarter last year. Diluted earnings per share should land at $23.93 compared to $16.40 delivered the same quarter the previous year.

What to look out for when Alphabet reports

In the second quarter, Alphabet warned of slow growth in the second half of the year owing to changes made on Apple’s iOS software. The changes have affected the way the advertising giant targets customers on Apple devices.

While Google is not immune to these changes, it remains well protected as changes are only limited to its Network Members unit. Consequently, it will be interesting to see the impact these changes have on the tech giant’s revenue base.

YouTube, a key avenue for advertising revenue, will also be in the spotlight when Google reports. In the recent past, there has been evidence that advertisers are increasingly reaching audiences by advertising on the video platform.

The fact that the platform appears to be gaining an edge over other channels such as TV advertising should be good news. If YouTube is indeed gaining traction with advertisers, ad sales could rise by over 40% year over year.

Google Cloud is another segment that should be in the spotlight when Q3 results come out. The transition to the cloud is believed to be fuelling demand for the company’s cloud computing solution. Consequently, the expectation is high that Google could deliver sales growth of between 45% and 50% on the segment. The momentum is expected to be maintained from the second quarter.

Bottom line

Google is well-positioned to deliver better-than-expected Q3 results given the solid fundamentals in the quarter. While the stock is up by more than 50% year to date, a solid earnings report could be the catalyst to strengthen investor confidence and trigger another leg higher.