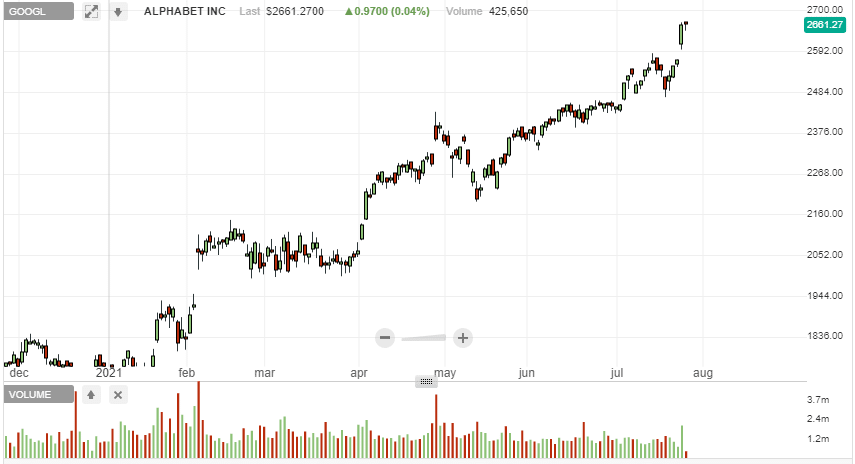

- Alphabet stock outperforms market year to date.

- Earnings and revenues projected to top estimates.

- Advertising and cloud revenues to drive top and bottom line.

- Cloud unit to be in the spotlight amid global digitization drive.

Alphabet is scheduled to report its fiscal second-quarter results, which could reflect steady growth on cloud and service offerings. The company has topped earnings in the last four quarters, an impressive record likely to continue with the Q2 report.

Additionally, it’s been firing on all angles with the stock price following suit, outperforming the overall market and the overall FAANG stocks. The stock is currently trading near all-time highs after a 40% plus rally year to date.

Google has carved a niche for itself to develop products and services tied to the internet, software, and consumer electronics. Thanks to a diversified range of products, the tech giant has grown to become one of the most valuable companies with a diversified revenue base.

In the most recent quarter, revenue growth was mostly driven by advertising on YouTube, with the cloud segment doing well. With the search business continuing to see growth amid the opening of the global economy, the firm is expected to report solid Q2 results.

Q2 expectations

Wall Street expects the search giant to report earnings of $19.24 a share, nearly double earnings of $10.13 a share reported a year ago. Earnings in the first quarter totaled $17.93 billion or $26.29 a share above $6.84 billion or $9.87 a share expected.

On the other hand, revenues are expected to come in at $56.2 billion at the back of $10 billion in traffic acquisition costs. In Q1, revenues were up 34% to $55.3 billion, driven by search revenue which was up to $31.9 billion, as cloud revenue surged 46% to $4 billion. Ad sales on YouTube were also up 49% to $6 billion.

What to look out for?

When Google reports, the focus will be on the cloud unit, which has enjoyed steady growth in recent quarters. The unit has enjoyed growth since the pandemic started as the digitization drive gathered pace. The unit includes Google Cloud Platform and Workspace.

Cloud revenues totaled $4.05 billion in Q1, accounting for 7.3% of total revenues and year-over-year growth of 45.7% waiting to see if the momentum continued in Q1. The segment could post revenues of $4.41 billion for the current quarter, signaling 46.5% year-over-year growth. The growth would mostly be driven by the expansion of the cloud service portfolio and data centers.

Additionally, the company has made strategic investments in data security management and analytics as it looks to diversify its revenue base beyond search and advertising.

The search unit has also been in a bounce-back mode in the recent quarters, with the momentum believed to have continued up to date. The company dominated the online search market with a market share of more than 80%. The search business generates the most revenue with the same expected to be the case with the Q2 report as the company maintained its leadership in the segment. YouTube advertising is also expected to contribute more to the company’s top and bottom lines.

Bottom line

Alphabet is expected to report solid Q2 results as revenue growth is believed to have continued with the opening of the global economy. YouTube advertising and cloud offerings should contribute the most to any revenues and earnings beat. While acquisitions such as FitBit will also have an impact on earnings, new offerings are likely to pressure margins.