The Microsoft (NASDAQ: MSFT) stock price crashed to the lowest level since July 2021 as investors waited for the coming quarterly results. The stock is trading at $296, which is about 15.4% below the highest level this year.

Microsoft earnings preview

Microsoft has achieved a remarkable turnaround in less than a decade. Today, it has a total market capitalization of over $2.3 trillion, making it the second-biggest firm in the world after Apple.

Microsoft has achieved this success by embracing cloud computing and the software-as-a-service (SAAS) model of doing business. Today, it is one of the biggest players in terms of subscriptions.

The company will publish its quarterly results on Tuesday, and analysts believe that its strong momentum continued in the fourth quarter.

According to SeekingAlpha, analysts expect the company’s revenue to grow by about 17% to $51 billion in the quarter. They also expect that its profitability also did well in the fourth quarter as its earnings-per-share rose to $2.32.

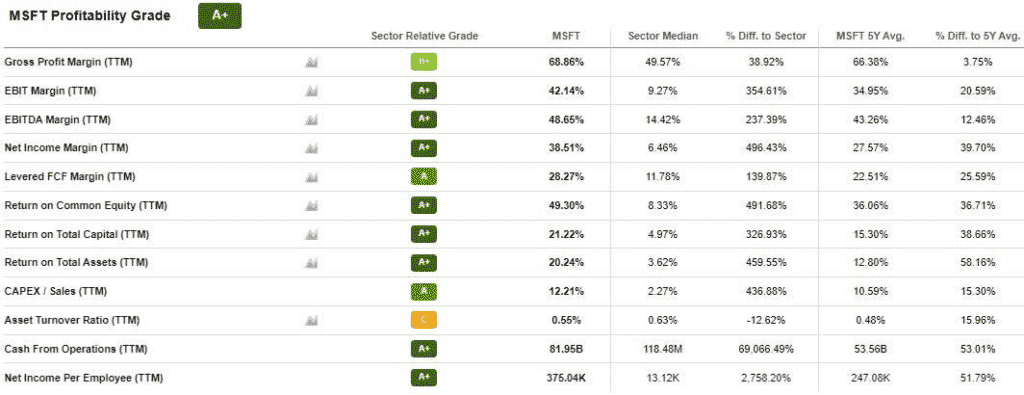

Still, if history is to go by, Microsoft will easily beat the consensus estimates since it has outperformed them in the past few years. For example, in the previous quarter, Microsoft’s revenue rose by about 21% to $45 billion while its net income surged by 47% to $20.50 billion. Microsoft is one of the most profitable companies in the world, as shown in the profitability grade shown below.

Another reason why Microsoft will likely beat is that IBM also managed to outperform the consensus estimates. On Monday, the company said that its revenue came in at over $16 billion while its pre-tax income came in at $3 billion. Therefore, strong results by IBM are a sign that cloud computing demand is rising.

What to watch

The Microsoft stock price will be moved by several catalysts in the report. First, investors will focus on the company’s cloud computing growth. The company expects that the Windows and cloud segment will grow by double-digits, helped by the rising demand for Microsoft 365.

Still, investors will want to see the growth of key parts of the subscription business. Microsoft Teams will be crucial, considering that Zoom shares have dropped by about 60% in the past 12 months. As such, since the two platforms offer the same solutions, it is logical to assume that Teams revenue growth has also slowed.

Gaming is another important catalyst for the Microsoft stock price. Last week, Microsoft announced that it would spend about $68 billion to acquire Activision Blizzard, a leading game studio. Microsoft hopes to use the acquisition to boost its gaming revenue, which includes the Xbox, Bethesda, GamePass, and other gaming products.

Therefore, in the earnings call, analysts will want to know more about the company’s plans for Activision and its expectations.

In general, investors are optimistic about the Microsoft stock price. Data compiled by WeBull shows that the average target among investors is that the stock will rise to $305 from the current $200.

Microsoft stock price forecast

The daily chart shows that the Microsoft stock price has been in a strong bullish trend in the past few months. The stock rose to an all-time high of $350 in December last year. Now, it has moved slightly below the 25-day and 200-day Moving Averages, signaling that bears are prevailing. It has also moved above the ascending trendline, shown in green.

Therefore, there is a likelihood that the Microsoft stock will bounce back if it publishes strong results on Tuesday. If this happens, the next key level to watch will be at $325.