- Consensus estimates for JPM’s EPS have lowered 32.68% from $4.59 to $3.09.

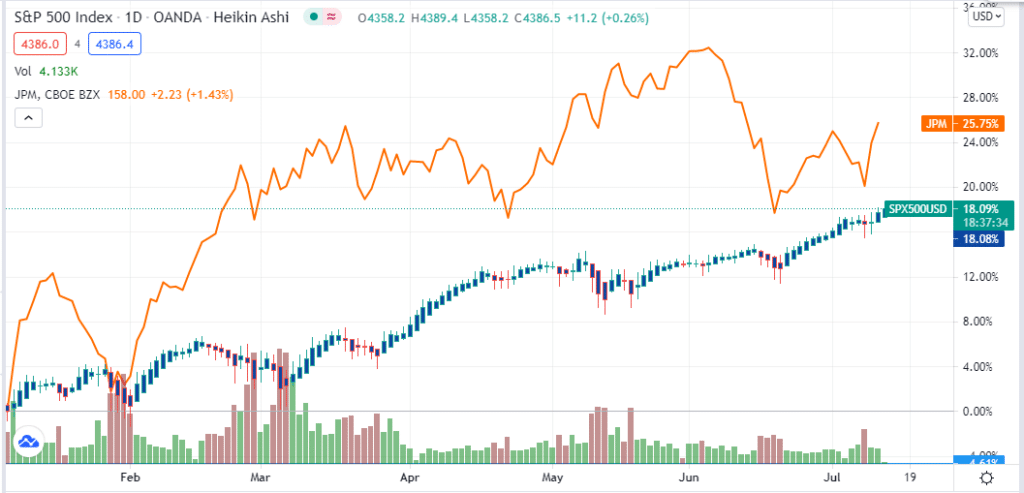

- Shares of JPM have moved in tandem with the stock market with a return of 25.75% against the S&P 500 Index at 18.08% after launching two new ETFs.

- JPM has strengthened its Fintech presence with the acquisition of OpenInvest.

JPMorgan Chase & Co (JPM) rose to a high of 1.43% ahead of its Q2 2021 earnings report on July 13, 2021. The stock traded at $158.00 but was down 0.12% at $157.81 in post-market trading at 7:44 pm GMT.

Consensus estimates for the bank’s earnings-per-share (EPS) have lowered 32.68% from $4.59 to $3.09. Revenue estimates have also declined 7.93% from $32.27 billion to $29.71 billion.

Investors are, however, watching to see how the bank outperforms after the EPS pulled a surprise in Q1 2021 at +$1.53, while revenues were up $1.96 billion. JPM stock has risen 70.65% since July 2020 and has gained 22.59% year-to-date (YTD).

The bank’s asset management platform announced the launch of two new investment ETFs: JP Morgan ActiveBuilders US Large Cap Equity (JUSA) and JP Morgan ActiveBuilders International Equity (JIDA) on July 8, 2021. JUSA tracks large-cap US companies traded at +0.58% on July 12, 2021, at $49.38 while JIDA was up 0.47% at $48.54. JUSA intends to outperform the S&P 500 index, and JISA will track the MSCI EAFE Index.

JPM vs. S&P 500 Index

Shares of JPM have moved in tandem with the stock market with a return of 25.75% against the S&P 500 Index at 18.08%.

Dividends and buyback

On Capital distribution, JP Morgan was expected to extend its Q1 2021 limitations into Q2 2021. JPM’s buyback capacity into the second quarter will stand at $7.4 billion. This capital is based on a dividend payout of $0.90. The banking giant has already invested in more than 100 companies.

Investors may be concerned as to why the bank may intend to buy back the stock after payment of the dividend rather than focus on new acquisitions. It is vital to remember that JPM’s capital-to-advance risk-weighted assets (as of Q1 2021) stood at 13.6%.

Customer deposits grew to $240 billion in the quarter representing a 32% increase. Assets invested by clients rose 44% spiraled by originations of home lending services at $39 billion (+40%).

At the moment, the US Fed may not be keen to implement negative repo rates due to the increasing inflation standpoint. Going into Q2 2021, the bank will be supported by nil guidance of up to $55 billion after the financial report indicated a net loss of $580 million. Further revenue inflow fell to $473 million (-$639 million YoY) pulled by a 6% increase in expenses at %2.6 billion.

Notable investments

As a prime bank in the US, JPM has invested in payment solutions, asset management portfolios, data services, and adjacencies. On payment services, JPM has invested in InstaMed, a payment solution specializing in bridging the gap between customers and providers of healthcare. This move is strategic, due to the decrease of in-house payments in the US health facilities.

According to a COVID-19 pandemic survey, 28% of US healthcare service consumers paid their bills online, while 23% used mobile applications. As of July 2020, around 64% of consumers made their payments in the hospitals.

After buying 55ip — a tax-smart company — JPM announced the purchase of OpenInvest — an ESG company to help improve the bank’s fintech’s presence.

Technical analysis

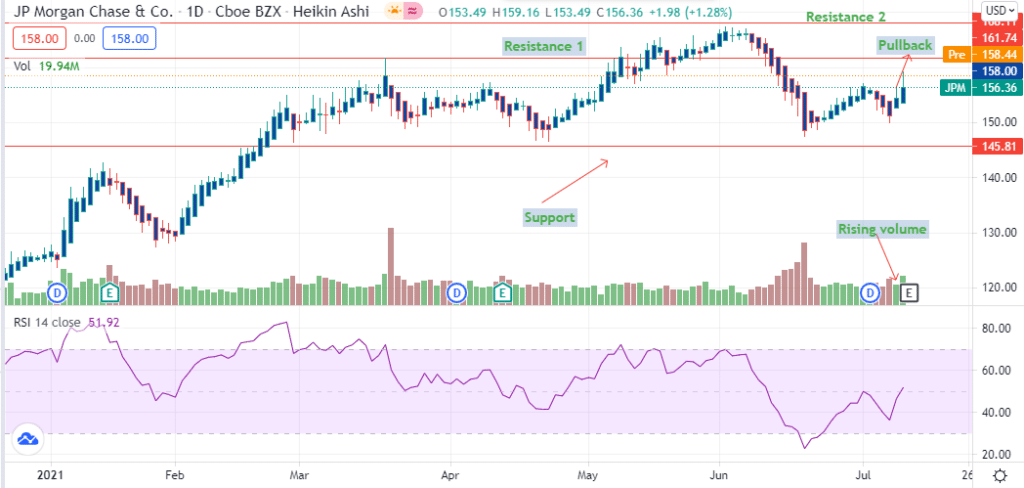

After hitting the first support at $145.81, JPM stock is seen to rise close to the first resistance at $161.74, following the progression of the pullback.

Volume is rising on the buy-side, and the 14-day RSI at 51.92. The stock may increase until it hits resistance at $168.00. Failure to recover from the pullback may push the price towards 145.81 (see Support 1).