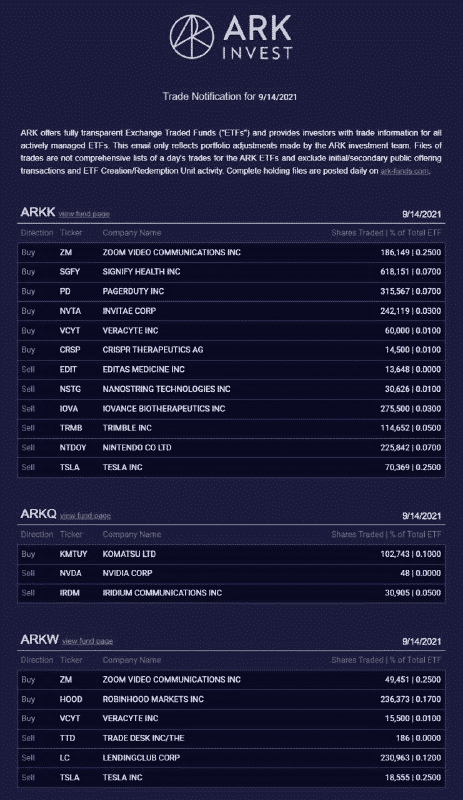

(Bloomberg) Cathie Wood’s Ark Invest added at least 236,000 shares of Robinhood on Tuesday, with an estimated value of $10 million. The fund unloaded 89,000 shares of Tesla valued at about $66 million.

Ark has now added 390,000 shares of Robinhood so far this month, with the stock trading 43% below its peak in early August. The fund is Robinhood’s fifth-largest stockholder with just below 1% of holdings.

Wood’s fund has sold at least one million Tesla shares in the last five months, with about $200 million sold this month. Tesla still ranks as Wood’s largest holding, with more than $4 billion value as of Tuesday’s closing price.

Tesla is up 32% from its March lows. Ark predicted in March that Tesla stock will reach $3,000 by 2025 to take the company’s valuation to about $3 trillion, from the current $746 billion.

Ark’s strategy involves selling its winners and putting the money in other targets. Other additions of the company on Tuesday include Zoom Video Communications Inc., Signify Health Inc. Pagerduty Inc., and Invitae. Other sales included Nintendo, Trimble Inc., and Editas Medicine Inc.

TSLA: NASDAQ is down -0.066%, HOOD: NASDAQ is up +3.12%