- Zilliqa explosive rally

- Sharding edge on Zilliqa Blockchain

- Zilliqa metaverse and eSports prospects

Zilliqa has been a bag of mixed fortunes in the cryptocurrency market. For the better part of last year and this year, the metaverse crypto has been under immense pressure shedding more than 60% in market value from its all-time highs.

The sell-off accelerated early in the year as the cryptocurrency fell off amid a broad market sell-off. However, as the first quarter was coming to a close, Zilliqa bounced back, rallying by more than 500% in weeks and, in the process, recouping a good chunk of the losses accrued over the past year.

Zilliqa technical analysis

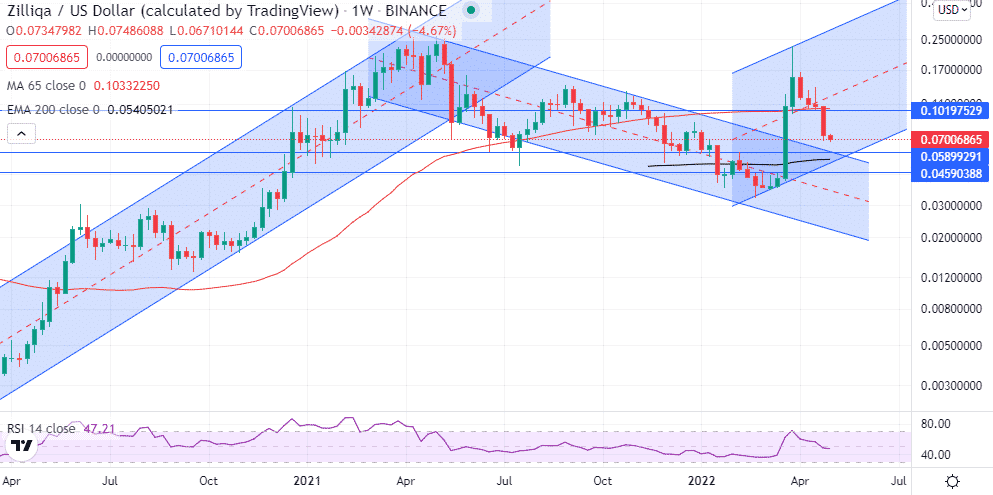

After rallying to near all-time highs of $0.22 level, the coin yet again came under immense short-selling pressure. A deep pullback has since ensued, with Zilliqa giving back more than 50% of the gains registered at the end of March.

Failure to find support above the $0.10 level has left the metaverse coin under immense pressure and susceptible to post significant losses. A sell-off followed by a close below the 200-day moving average affirms bears are in control and likely to fuel another leg lower.

In addition, the Relative Strength Index is pointing lower after plunging below the pivotal 50 level. With the indicator pointing lower, the momentum on ZILUSD is to the downside. Immediate support on the new leg lower is the $0.0594. A bridge of the support level would leave ZIL vulnerable to plunging to 2022 lows near the $0.03 area. On the flipside, ZILUSD finding support above the $0.07 level could pave the way for a potential bounce back to the pivotal $0.1 level.

Behind Zilliqa growth

Sharding benefit

Amid the underperformance in recent weeks, Zilliqa has outperformed other cryptocurrencies, which are down by double-digit percentage points this year. Its edge and outperformance stem from carving a niche in the development of decentralized applications. Currently, more than 200 projects are running on the Zilliqa blockchain.

Sharding edge also stems from sharding, a process that allows for dividing its blockchain into smaller segments dubbed shards. Dividing the blockchain into smaller nodes allows Zilliqa to process transactions in parallel. Consequently, the sharded architecture allows the throughput in Zilliqa to increase as the size of the network increases.

Sharding has allowed Zilliqa to address congestion issues that have clobbered Ethereum blockchain over the years. Conversely, it is becoming a preferred platform for the development of decentralized applications. With sharding, it now boasts of the same capabilities as Ardana, Solana, and Etherium in the development of decentralized applications.

Metropolis metaverse

Zilliqa’s popularity has skyrocketed in recent months as focus shifts to the launch of the much-awaited Metropolis metaverse. Having been in the pipeline for some time, Zilliqa has raised more than $2 million in pre-launch revenue for the project. It has also inked a deal with Agora to make it easy for content creators to engage through the metaverse and other industries such as eSports, health, and wellness.

In addition to expanding its footprint into the metaverse world, Zilliqa is also becoming a firm favorite blockchain for the eSports industry. It has already inked a deal with Ninjas in Pyjamas, RRQ Indonesia, and MAD Lions to develop their Web 3 Solutions in terms of NFT tokenization.

Final thoughts

While the ZIL token has taken a significant beating over the past few weeks, it has outperformed the overall industry. The long-term outlook remains bullish amid growing expectations about Zilliqa’s prospects in enhancing decentralized application development. Expansion into the metaverse world and inking deals with eSports companies affirms Zilliqa’s utility use case, thus long-term prospects.