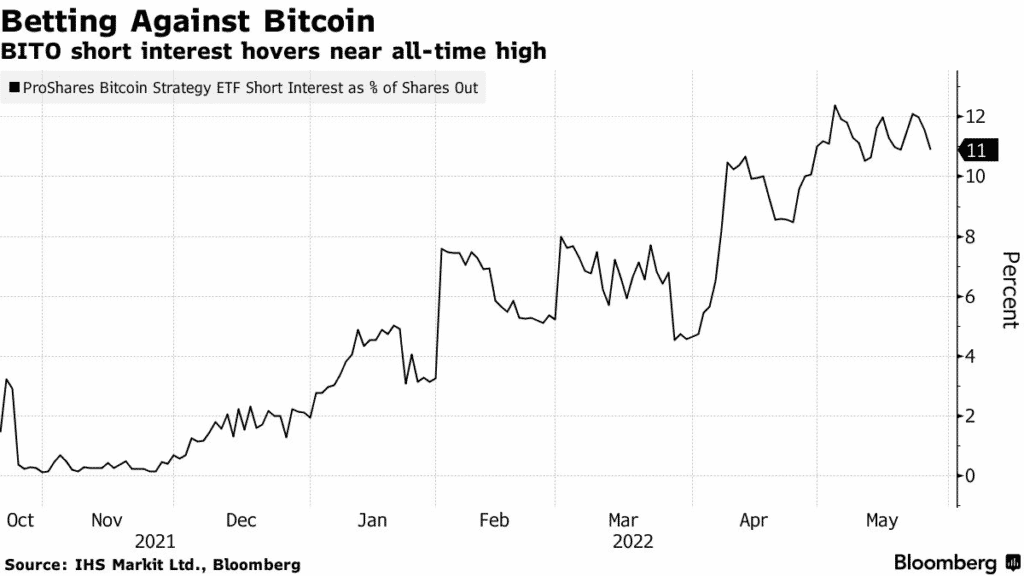

(Bloomberg) Crypto bears are circling on the $748 million ProShares Bitcoin Strategy ETF, with short interest almost 11%. The short interest is nearly the highest since the fund was launched in October 2021.

The fund’s ratio of open interest in bearish put contracts to call open interest is also reported to be on the rise since mid-April and is now at all-time highs.

The rising short interest has been interpreted to suggest that crypto bears are circling on BITO to short sell the product and then wait for the rollout of inverse Bitcoin ETFs.

Reports indicate that BITO is serving as a proxy as markets wait for potential funds from issuers such as Direxion. The funds are expected to provide short exposure to Bitcoin futures contracts.

Bloomberg Intelligence ETF analyst, Athanasios Psarofagis, says there is more volume on BITO since it is the first and largest derivatives ETF in the US.

The short interest and decline in Bitcoin have seen BITO crash almost 37% this year. The decline has made BITO the third-worst performing ETF among non-leveraged funds in the US.

BITO is down -1.87%.