I hope you’ve been patiently waiting up until the last week and didn’t waste away your capital in the choppy market previously. The forex market is finally waking up, while most of the world stock indices closed positive on Friday, with the US staying near all-time highs.

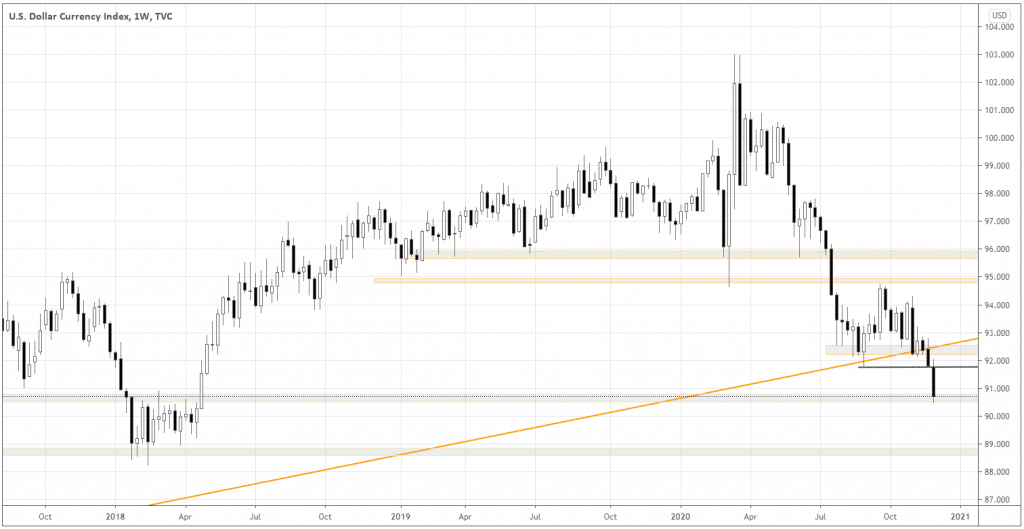

DXY: off we go!

I don’t think there is any doubt now that the long-term trend in the Dollar continues. DXY successfully broke down the critical 91.75 price level and is unquestionably heading down now, showing the awaited moment in the first week of December. The index closed the week around 90.75 –potential support that was formed at the beginning of 2018.

Swing traders and day traders should get ready to jump in the trend next week, as the market is stalling and may form a quality trend continuation setups in FX majors and JPY crosses.

China doesn’t like the strong Yuan

While it’s still an open question to what degree the countries around the world would benefit from the weaker Dollar, throughout the history of monetary policy, China has always attempted to maintain the Yuan weak to boost the exports.

However, the Chinese Yuan has appreciated for six consecutive months since the middle of 2020. PBOC or Chinese central bank continuously injects tens of billions of Yuan in the Chinese economy, with the last one conducted on September 3rd.

Appreciating Yuan may also be pricing in the recent block deal and the attractive prospects of the Chinese economy based on the economic growth during the pandemic.

While these are good news for domestically oriented companies in China, the main drivers of the country’s GDP are still export-oriented enterprises. The regulator is aware of that and might attempt to take measures to weaken the Yuan.

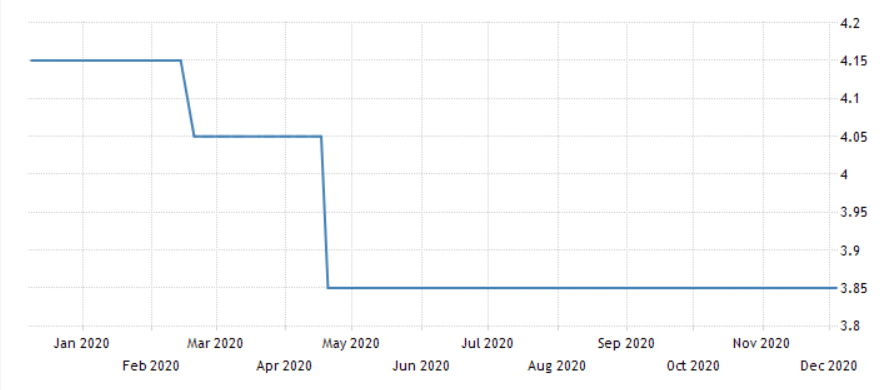

Another factor of the strong Yuan is the unchanged interest rate of PBOC (see the illustration below), while other developed countries expect more rate cuts and monetary easing.

Among traders, the expectations of the hawkish policy of the PBOC is still prevalent. A global multi-asset strategist Sylvia Sheng from J.P. Morgan Asset Management in Hong Kong, also sees upside room for the Yuan as exports and capital inflows take off.

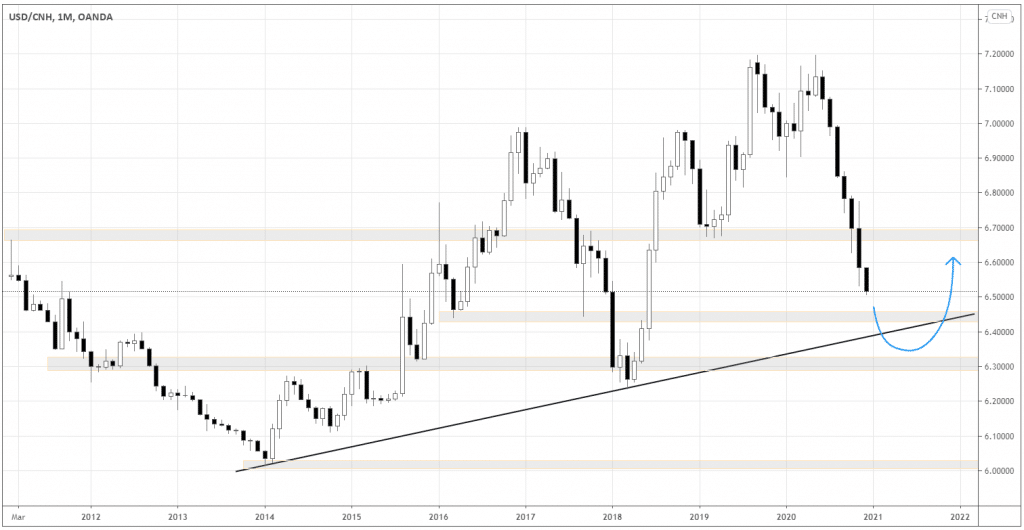

The technical picture of the Yuan

Let’s look at the big technical picture of the offshore Yuan (CNH) in the monthly chart below.

The USD/CNH has been in a strong downtrend since the middle of 2020 without any meaningful correction. The pair is approaching the important intersection zone of the long-term supports(horizontal grey areas) and the trendline (inclined black line). The area of 6.3-6.45 would be a good place to start at least a correction, if not a reversal.

How to trade the rebound in USD/CNY?

As the interest rate of PBOC is still relatively high compared to the rest of the developed countries, just like there is room for upside, the rate cut is still possible. If PBOC suddenly cuts the interest rate despite the hawkish expectations, it can turn into the catalyst of the pair reversal. The central bank will make an interest rate decision on December 21st.

Another possible fundamental signal to anticipate is further yuan injections by PBOC.

It would be great to see any of those two fundamental signals, along with the reversal price action. The monthly candlestick patterns such as Engulfing, Hammer, Morning star, etc., will give us an entry trigger to buy the pair. It may take another quarter to complete the price action setup.

Summing up

The major trading opportunities currently lay in buying risk assets against safe havens such as USD and JPY. The overextended decline of the USD against CNY and the overlap of technical support levels nearby offers a possible reversal setup in the pair in the upcoming months. The fundamental factors, such as the rate cut or capital injections in the economy, would add to the win rate of the setup.