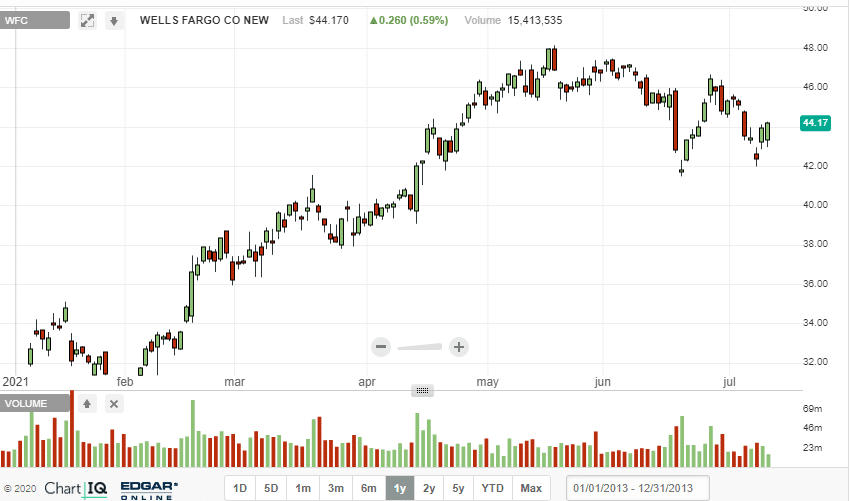

- Wells Fargo is up by about 40% ahead of its Q2 earnings report

- Wall Street expects EPS of $0.97, a 245% year-over-year increase

- Q2 revenue is expected at $17.77 billion representing a 0.3% year-over-year decline

- Wells Fargo expected to affirm dividend and buyback program

Wells Fargo is scheduled to report its second-quarter earnings on July 14, 2021, before the market opens. The fourth-largest lender heads into the Q2 earning session after posting its first loss since the financial crisis of 2008 the same quarter last year.

Additionally, the stock is up by more than 40% year-to-date, outperforming the S&P 500, which is up by about 15%. While the stock is down by about 7% from record highs, a solid earnings report could be the catalyst to fuel a bounce back to all-time highs.

The earnings session in the financial sector comes after the four largest banks booked $33 billion last year to cover expected loan losses owing COVID-19 shocks. The massive program came as it became clear the American people were struggling financially amid the pandemic lockdowns.

However, aggressive stimulus packages and monetary policies meant most of the losses did not materialize. With the reopening of the economy, the banks are only expected to record less than $1 billion of loan loss provision.

Additionally, Wells Fargo, Bank of America, Citigroup, and JPMorgan are expected to report $24 billion in Q2 profits compared to $6 billion recorded last year in the same period. Additionally, analysts expect the banks to report a 28% drop in trading revenue.

Wells Fargo Q2 earnings expectations

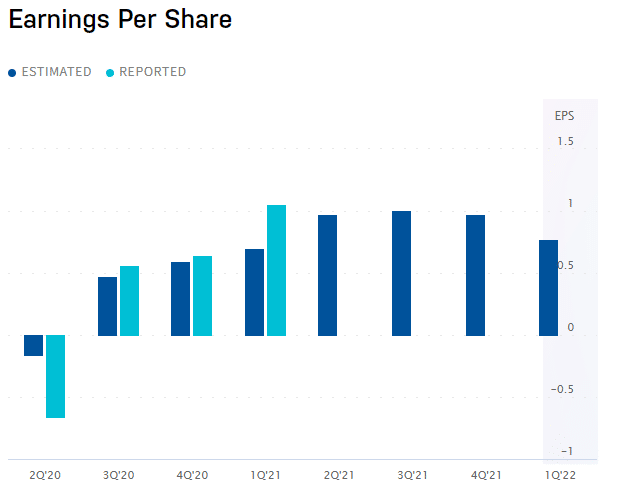

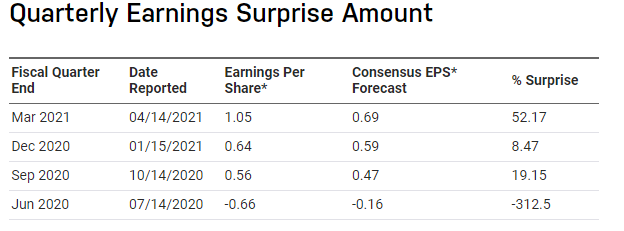

Wall Street expects Wells Fargo to report earnings per share of $0.97 a share, representing a 245% year-over-year increase. Last year, during the same period, the bank suffered the effects of the COVID-19 pandemic and consequently posted a net loss of $0.66 a share.

In addition, analysts expect Wells Fargo to post a 0.3% decline in revenue to $17.77 billion compared to $17.84 billion reported in the same period last year. Over the last four quarters, the company has only reported earnings surprises two times.

Wells Fargo reported a net income of $4.7 billion or $1.05 a share in the first quarter. Total revenue came in at $18.1 billion, up from $17.7 billion reported in the same period last year. The results also included a $1.6 billion pre-tax reduction in the allowance of credit losses.

What to look out for?

During the first-quarter earnings report, CEO Charlie Scharf reiterated that the focus was on building the appropriate risk and control environment. He also affirmed plans to simplify the company and focus resources on core customers. Therefore, it will be interesting to see the progress made on this front.

Loan growth is still the center of attention in the financial service segment ahead of the Q2 earnings season. Over the past year, banks have seen the segment come under immense pressure due to pumping trillions of dollars in stimulus packages. Analysts expect commercial banks to report a 3% year-over-year decline in total loans.

Stimulus packages have meant people have sufficient money in their pockets to pursue loans from banks. Likewise, depressed loan applications have taken a toll on banks’ loan interest income.

In the first quarter, Wells Fargo’s net interest income was down 22%, hurt by the impact of the record low-interest environment. The decline forced the bank to reprise its balance sheet. Consumer and small business banking were also down 6% due to the impact of lower interest rates and lower deposit-related fees.

Loan growth is the only way the likes of Wells Fargo can continue to enjoy revenue growth amid the record low-interest-rate environment. Additionally, it will go a long way in shrugging off the effects of a slowdown in the mortgage market hurt badly by supply constraints.

Dividend and buybacks

Amid the record low-interest-rate environment that continues to affect Wells Fargo’s ability to generate optimum net interest income, the bank has affirmed its commitment to return value to shareholders. Consequently, the financial services company doubled its dividend offering to 20 cents a share from 10 cents a share, starting the third quarter.

The bank was forced to slash its dividend by 80% last year. However, the increase is less than half the 51 cents a share dividend that the bank paid before it slashed last year in the aftermath of the COVID-19 pandemic.

Additionally, Wells Fargo plans to repurchase $18 billion worth of stock over the next 12 months following the lifting of a cap imposed by the Federal Reserve last year. Therefore, the bank could end up returning about 10% of its current market value to shareholders over the next year factoring in the dividend increase and buybacks.

Bottom line

Wells Fargo heads into the second quarter earnings session after an impressive first half of the year. The stock is up by more than 40%, outperforming the overall market. An impressive second-quarter report that tops analyst estimates could excite the markets resulting in investors pushing the stock to a new 52-week high.