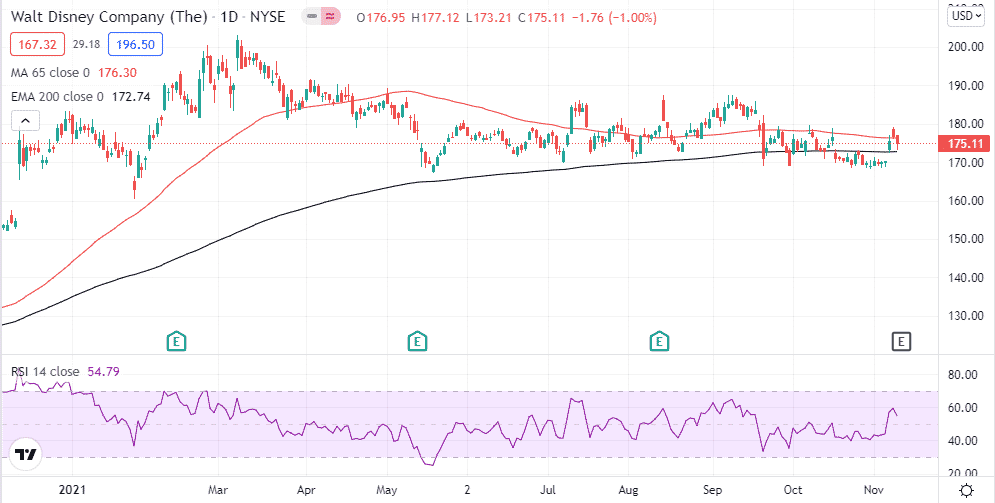

- Stock down 1% year to date ahead of Q4 results

- Q4 earnings and revenue expected to top estimates

- The focus will be on the subscription services, theme park, and theater business

Walt Disney Co (NYSE: DIS) is scheduled to report its fiscal fourth-quarter results on November 10, 2021, after the market closes. The company heads into the earning season in a recovery mode after suffering immensely at the height of the pandemic.

Last March, the stock hit a five-year low as the company’s theme park business and resorts were brought to a halt amid COVID-19 restrictions. Fast forward, the company’s outlook has improved with the easing of COVID-19 restrictions and the opening of the global economy. The stock has risen by more than 100% from last year’s lows.

However, in 2021, the stock has underperformed the overall market. It is down by about 1% year to date heading into the Q4 report and down by about 11% from all-time highs recorded in March. While the stock has been in consolidation in recent months, the earnings report could be the catalyst to fuel a leg higher or trigger a further pullback.

The company is poised to report at a time of significant improvement in some of its core businesses. Its streaming portfolio has been on a roll, boasting over 116 million as Disney continues to reshape the entertainment industry.

The opening of the global economy has also positively impacted the company’s theme park and resort businesses. Disney theaters have fully reopened, with the company enjoying almost full capacity in its theme parks. Additionally, streaming unit Disney + remains a key driver of the company’s growth engine.

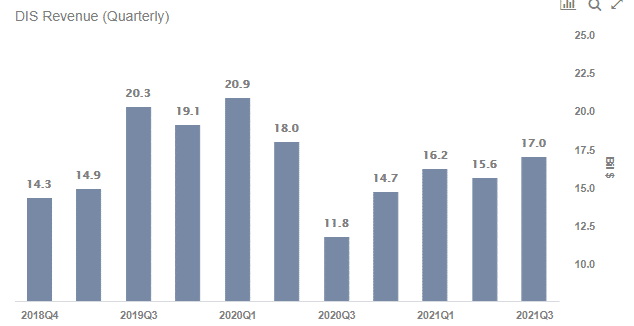

The improvements are already pointing to the company delivering better than expected fourth-quarter results. In the third quarter, the company delivered earnings and revenue that topped consensus estimates.

Q4 earnings expectation

Wall Street expects Disney to deliver revenue of $18.77 billion for its fourth quarter representing a 27.6% year-over-year growth. It will also be an improvement from revenue of $17.02 billion delivered in the third quarter.

Adjusted earnings, on the other hand, are expected to land at $0.51 a share, a significant improvement from a loss per share of $0.20 delivered the same quarter last year. However, it will be down by 37% from an EPS of $0.80 delivered in the third quarter.

In the third quarter, Disney delivered results that topped estimates, with adjusted EPS rising more than tenfold year-over-year marking the second straight quarter of rising EPS. However, as it stands, it appears the growth might have slowed in the fourth quarter.

While revenue did grow by 44.5% in the third quarter, a growth of 27.6% in the fourth quarter would affirm the tough comparison.

What to look out for when Disney reports

When Disney reports, the focus will be on the subscription services, which are a key driver of the bottom line. The company has achieved significant growth in recent quarters, waiting to see if the momentum continued in Q4.

In the third quarter, the company had 116 million paid subscribers on the Disney + platform, an increase of 12.4 million year-over-year. Growth should have continued in the fourth quarter, but there is a likelihood it will not be as strong as Q3’s. ESPN+, which had 14.9 subscribers in Q3, and Hulu, which had 42.8 million subscribers, will also be at the center of attention.

Pricing on Disney + is another factor that should elicit interest. An increase on this front backed by a subscription base of over 100 million people should allow the company to generate significant revenues.

Theme parks and theater businesses will also be at the center of attention when Disney reports. The units took a significant hit last year. Fast forward, they have been in recovery mode this year and are expected to be a key driver of top-line growth in Q4. Strength on the two units should allow Disney to deliver better than expected results.

Bottom line

There is no doubt that Disney has been firing on all angles heading into the Q4 earnings report. Improving underlying fundamentals on the streaming business as well as theme parks and theater business support the prospects of the company delivering better than expected Q4 results. Consequently, after a period of consolidation, the stock could re-rate higher on earnings and revenue coming above estimates.