- The Chinese yuan is holding firm heading into the weekend, receiving a boost on accelerated economic recovery.

- The pound and Canadian dollar are also holding firm, emerging as a solid bet for fading against dollar strength.

- Japan has opened discussions as it seeks to create a digital currency. The BOJ and the ministry of finance are spearheading the push.

Sentiments in the forex market are increasingly shifting to currencies that fend off the greenback strength. The Chinese yuan is a holding firm that has received a boost on accelerated economic recovery. The Canadian dollar and the pound are other currencies strengthening across the board. The Japanese yen remains under pressure even as the BOJ makes a case for a digital currency.

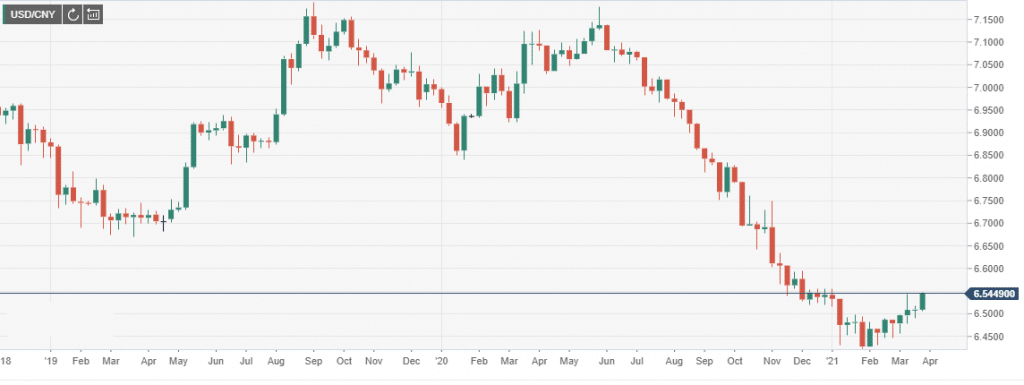

Chinese economy

The Chinese yuan rate has stabilized, fending off dollar strength as a plethora of impressive economic releases affirms economic growth. Chinese Central bank has already reiterated that the economy will grow at a medium to high rate, having shrugged off the COVID-19 slowdown. The government now expects the economy to grow by between 5% and 5.7% through 2025.

The British pound is also holding firm even as other majors remain under pressure. The cable is strengthening across the board as traders react to the UK’s handling of the pandemic amid an aggressive vaccination campaign. Increased optimism about the UK’s economic recovery is fuelling the pound strengthened against the euro.

EUR/GBP has been the biggest beneficiary of pound strength, dropping to one-week lows.

The pair looks set to continue edging lower as the euro remains under pressure amid an escalating COVID-19 situation in Germany. Europe’s biggest economy has reported 21,000 new infection cases with 183 deaths. Europe’s biggest economy plunging deeper into the pandemic crisis should continue to weigh heavily on the euro.

Canadian dollar resiliency

The Canadian dollar is another currency holding firm and ideal for fading in dollar strength. CAD strength stems from accelerated economic recovery following a massive vaccination campaign. Bank of Canada deputy governor Toni Gravelle has hinted at the possibility of winding down the quantitative easing program as the local economy continues to recover at an impressive rate.

Speculations are high in the market that the BOC could taper its bond-buying scheme at the upcoming April meeting. The central bank last cut purchases of government debt in November to $4 billion a week from $5 billion.

Japan digital currency push

The Japanese yen is another currency that has come under immense pressure weakening to eight months low. The weakness stems from growing concerns about the country’s economy as it remains under pressure amid the COVID-19 pandemic.

Amid the yen’s weakness, the Bank of Japan has instituted a committee that will create a central bank digital currency. The committee consists of the BOJ, Ministry of Finance, and the Financial Services Agency. It will also include officials of financial lobbies.

Japan joins several countries that are looking to tap into digital currencies. China is leading the pack, having already unveiled a digital yuan even though it lacks the anonymity that most people had hoped for.

Silver bounce back

In the commodity markets, silver bounce back from two-month lows gained momentum early Friday morning. The precious metal rallied even as it remains below the 200 SMA after coming under pressure on rising yields.

With technical on hourly chart gaining positive traction, Silver could bounce back to the $26 handle as the greenback retreats. However, it needs to breach the 25.35-25.40 resistance level to have any chance of powering high.