- America’s issuance of the travel ban against South Africa due to the new SA Covid-19 variant decreased ZAR’s hold against the dollar into 2021.

- SA’s hope to vaccinate at least 67% of its population by the end of 2021 will improve investor sentiment.

- Increased trade balance on South Africa’s side is a positive step towards improving ZAR’s currency standing.

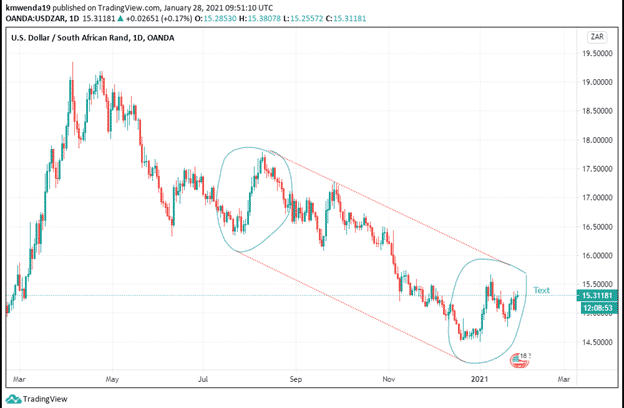

The South African rand has struggled to reduce the margin against the dollar amid claims of slow delivery of Covid-19 vaccines and a new variant. On January 28, 2021, the rand opened trading at 15.3560, which is 20.66% below the 52-week high of 19.3547. The problems plaguing the South African economy aside from Covid-19 include mismanagement of its public entities and slow economic growth. Interestingly, the rand held against the dollar in December 2020 at 14.5255, figures last seen between 2017-2019.

Covid-19 Variant

The discovery of the new Covid-19 variant in South Africa has led the United States to issue a travel ban among its citizens. Other restrictions were announced as revelations indicated that the new variant was more infectious than the original variable. Investors have shied away from the African economic hub as the variant is described as between 20-200% more infectious. However, relatively fewer numbers have been recorded, with up 7,000 new cases and 753 deaths in South Africa. The country’s modern infrastructure in health has helped improve service delivery in the wake of the pandemic.

South Africa’s procurement of coronavirus vaccines is more than 20 million. President Ramaphosa called on the developed countries to release surplus vaccines. The government aims to vaccinate 60 million people that translated to 67% of its total population (by Q4 2021).

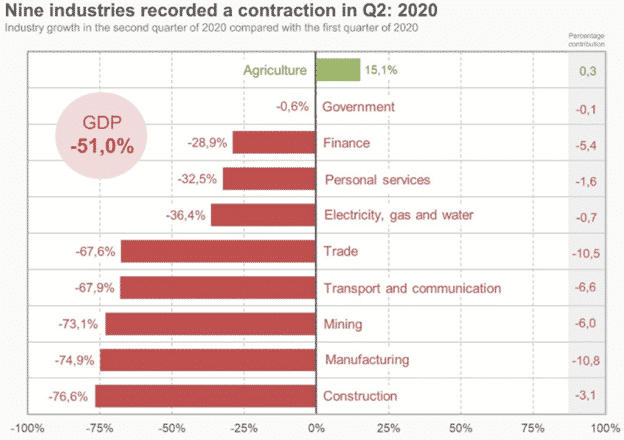

The second quarter of 2020 saw the economic output contract sharply, with the GDP falling 16%. The annualized rate of growth (GDP) decreased by 51%. Out of the primary nine industries, only agriculture had a positive growth rate in the wake of the pandemic.

Heightened maize exports achieved a 15.1% growth in agriculture, high citrus fruits demand, and pecan nuts (on an international scale). The baking craze during the nationwide lockdown accelerated demand for home-cooking products.

The International Monetary Fund (IMF) has raised concerns about the mismanagement of public (state) corporations in South Africa and corruption that has hampered growth. The ballooning debt of entities such as the electricity monopoly – Eskom has increased budget deficits and other pandemic expenses. The country needs inclusive growth strategies that will cover the fiscal challenges exposed by the pandemic.

The IMF proposed the facilitation of private investment and competition in the country to tighten the fiscal policy. South Africa is facing intermittent power cuts by Eskom that have continued to undermine production into 2021.

US-South Africa relations

The US relief aid since 2004 totals more than $6.2 billion. Bilateral goods trade among the two countries added to $14 billion as of 2018. In 2020, the trade balance was $6.2 billion, where exports from the US to SA were $4.08 billion while imports were $10.28 billion. This balance represented an increase of 155.12% from 2019 that settled at $2.4317 billion.

Technical analysis

In the short-term, the USD has an advantage over the ZAR, with the RSI indicating a solid buy at 61.863. The stochastic RSI supports a long sell position at 39.229, indicating that the ZAR may rise against the USD in the long-run. The 100-day SMA gives support at 15.1787 and EMA at 15.1748. Failure to perpetuate the vaccination process may hurt the South African economy further and increase the US dollar’s advantage in the long-run.