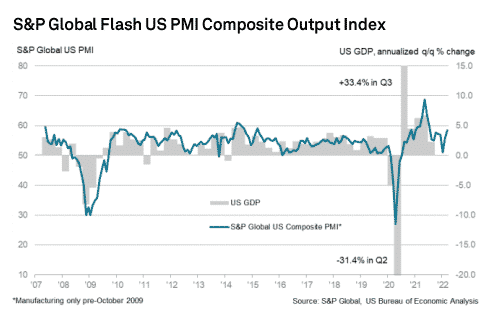

(IHS Markit) The Composite Output Index, gauging activity in the US private sector, hit 58.5 in March, up from 55.9 in February. The rate marked the fastest expansion since July 2021.

Output growth was noted in service and manufacturing, with the former’s activity index rising to an eight-month high of 58.9, from 56.5 in February.

The Manufacturing Output Index was at a seven-month high of 56.5, an increase from 52.5 in February. The Manufacturing PMI was at 58.5, up from 57.3 in February, a six-month high.

The private sector firms pointed to a rise in pent-up demand as the Covid-restrictions eased amid slowing supply chain bottlenecks.

New orders rose to a nine-month high, with new export orders surging at a quicker rate. Backlogs of work expanded steeply in the month.

Job creation expanded at the quickest since April 2021, with both manufacturing and service firms posting steep upturns in activity.

The rate of output charge inflation maintained above the series average. Input costs continued to surge, with the rate at near-record level among the service firms.

The private firms remained largely upbeat about the coming year, although the degree of business confidence was dampened to a five-month low by the rising costs.

SPY is up +1.03%, DXY is up +0.11%