The week has closed not in favor of risk assets, as the stock indices declined across the board. On the contrary, safe-haven assets experienced some surge. It’s time to consider upward momentum opportunities for the classic safe-haven – the US Dollar and further volatility associated with safe-haven currencies.

What hints at the reversal in DXY?

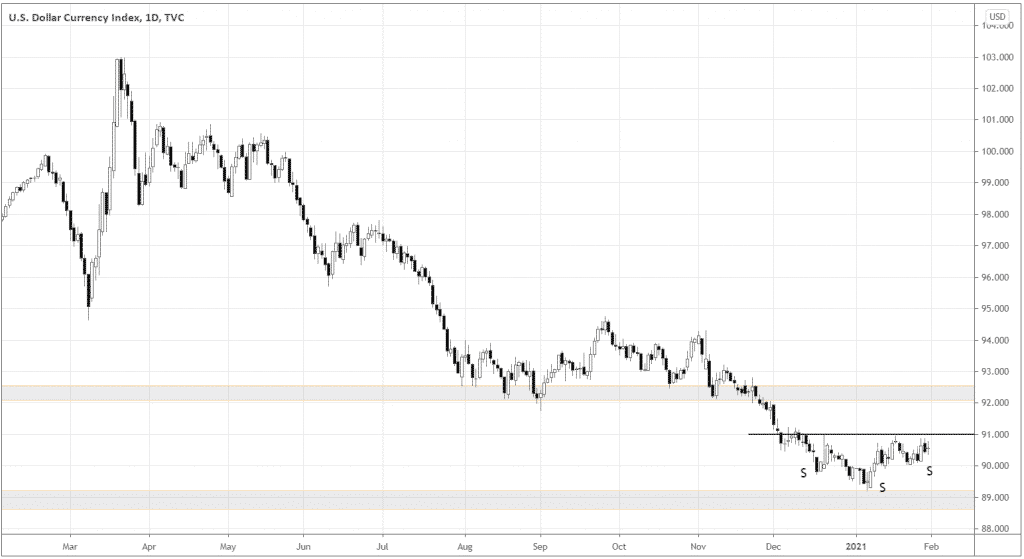

To assess what setups the USD can offer us, we will look at DXY as a broad benchmark of the world reserve currency. Let’s look at the Daily chart of DXY below.

On a daily chart, the US Dollar index formed a classic chart pattern – Head and Shoulders. If the daily candle closes above 91.00, it will be a trigger for the bullish momentum.

92.50 would be a good price target as that’s the closest resistance area. You can enter at the close of the daily candle above 91.00. Your protective stop can be under the entry candle’s low. In this way, you can expect a reasonable risk-to-reward ratio from the trade.

The Head and Shoulders pattern within the longer timeframes starting from Daily has a high win-rate. According to Chartered Market Technician (CMT) and Ex Portfolio manager Aksel Kibar, Head & Shoulders (bottom) pattern has a 73.3% success rate over the period of 2017-2020.

The battle of forex safe-havens is about to be resolved!

What can be more dramatic than one major safe-haven overpowering another? When risk sentiment changes, in Forex, we can use either USD or JPY pairs to express our sentiment shift view. I rarely consider trades in USDJPY because both currencies that the pair consists of are safe-havens, and their behavior usually is rather erratic.

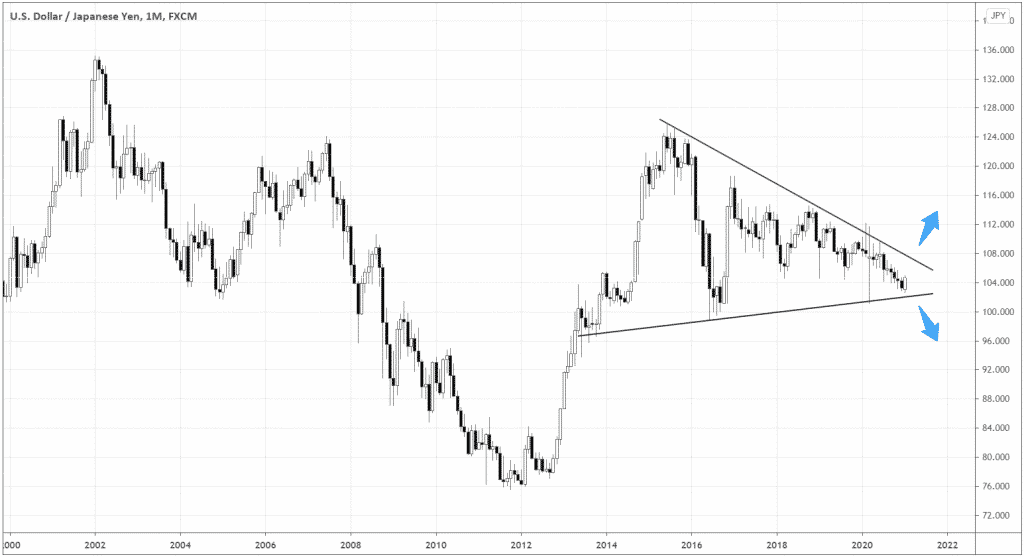

Previously we looked at USDJPY and saw a descending triangle on the weekly scale. With the recent strength in USD, the monthly candle has closed above 104.00 – the key down the boundary of the pattern. To me, it’s a suggestion to look at the pair from another angle.

On the monthly time frame, the price action confirms the symmetrical triangle that’s been forming since 2014. Look at the monthly USDJPY chart below.

According to the nature of the symmetrical triangle pattern, the market can make a breakout in either direction. The signal of the breakout would be the monthly candle closing beyond the boundaries of the triangle. If it breaks down, the candle should close below the down border, and if it breaks out, the market should close above the upper boundary of the pattern.

You can trade the actual USDJPY pair, although, to catch even more volatility, it would be a good idea to trade USD or JPY against the risk currencies, such as AUD or NZD.

For example, if USDJPY breaks out, it would signify USD’s relative strength as a safe-haven. Therefore, if the sentiment shifts towards seeking risk, it would be better to buy risk currencies against JPY. The latter would be relatively weak, taking into account the USDJPY breakout.

Being the second most traded Forex pair in terms of volume, USDJPY can cause a lot of volatility across the board in case of the breakout.

Summing up

As risk assets are entering the negative territory, the risk-off sentiment fuels the upward momentum in safe-havens. DXY has formed a classic Head and Shoulders pattern that historically has a high win-rate on long-term timeframes starting from the daily ones. The breakout of the pattern’s upper boundary can spur further bullish momentum in DXY, thus in USD pairs. USDJPY is about to break out from the long-term symmetrical triangle, which can cause a massive volatility surge across all Forex pairs and create relative strength/weakness divergence opportunities.