Union Square closed at a valuation of $4.6 billion on the day Coinbase was Nasdaq listed, according to Bloomberg. Co-founder Fred Wilson, who once termed bitcoin as “fantasy,” had put $2.5 million in Coinbase years before it listed.

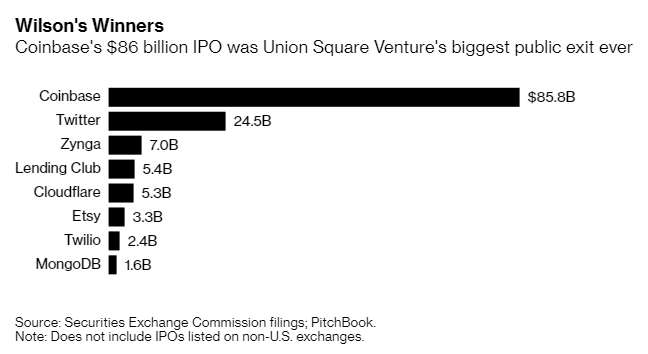

Coinbase’s stock rose to $328.28 a share on debut, pushing the valuation to $86 billion.

Coinbase’s soared valuation on listing helped Union Square to jump ten times since 2018.

Union Square has also invested in at least 100 entities and had 10 public exits since 2003, earning huge returns on listings.

Latest entries of Union Square include entities with strong roots in broadening capital access, knowledge, and wellbeing.

Union Square sold 4.7 million shares, generating $1.8 billion on the day Coinbase was publicly listed.