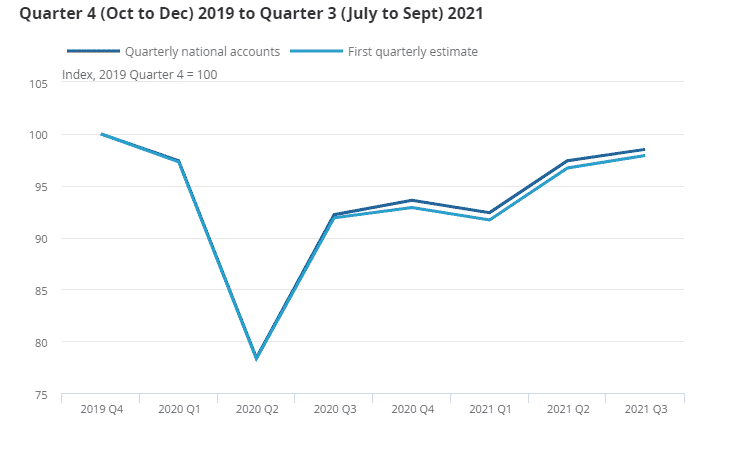

(ONS) The United Kingdom posted a 1.1% expansion in the national output in the third quarter, slower than the 5.4% growth recorded in the previous quarter.

The weaker growth in the third quarter is linked to growing supply chain bottlenecks that hit the building and manufacturing firms.

The savings ratio also went lower to 8.6% of the disposable income, compared to 10.7% in the second quarter.

Business investment was down 2.5% in the third quarter from the second, remaining 12% below the levels before the pandemic.

The declining growth and investments were reflected on the balance of payments, with the deficit increasing to 24.4 billion pounds or $32.35 billion, higher than forecasted $15.6 billion. The current account deficit reached 4.3% of GDP, higher than 2.3% of GDP in the second quarter.

UK economic growth is now projected to weaken further in the fourth quarter on the rising cases of Omicron, with the hospitality and leisure sectors expected to be the biggest culprits.

FTSE 100 is down -0.27%, GBPUSD is up +0.06%