- Uber stock is down 20% ahead of the Q3 report.

- Q3 revenue and earnings to show year-over-year improvement.

- Focus on being on the path to profitability and regulatory concerns.

Uber Technologies Inc. (NYSE: UBER) is scheduled to deliver its third-quarter results on November 4, 2021, after market close. The earnings report will provide insights into the strides made towards achieving profitability. The company has seen its sentiments in the market take a significant hit even on affirming it is on course to register its first adjusted profit before year-end.

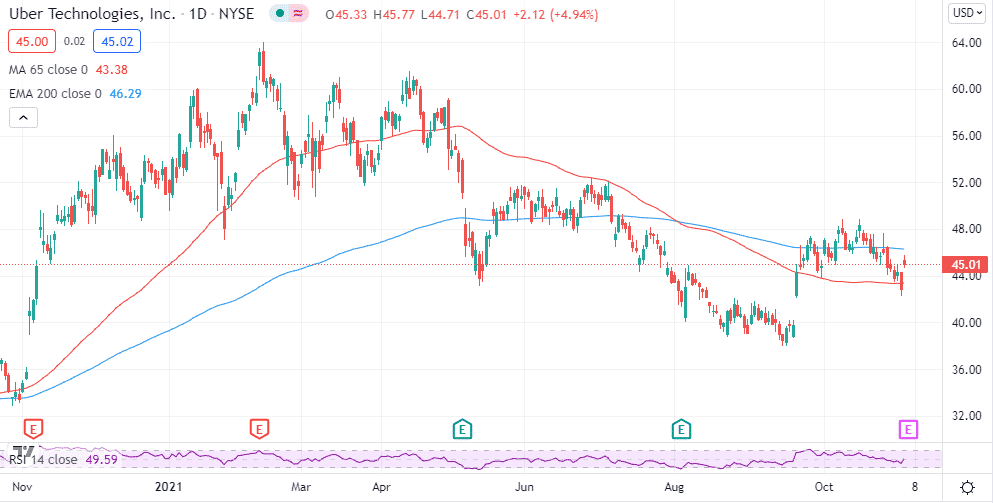

The stock is down by about 20% ahead of the Q3 report underperforming the overall market, with the S&P 500 up by more than 20% year to date. While underlying fundamentals in the ride-hailing business have improved with the easing of COVID-19 restrictions, the same is yet to reflect on the stock performance.

Adjustments taking place in the ride-hailing business have everything to do with Uber’s underperformance in the market. For starters, the company has had to contend with a shortage of drivers even with the opening of the global economy.

Additionally, runaway inflation has hurt margins, making it extremely difficult for drivers to stick to the business. Uber has already been forced to spend $250 million on bonuses and other recruitment incentives as it seeks to get as many drivers back into the business.

Amid the underperformance in the stock market, Uber is expected to deliver solid third-quarter results.

Q3 earning expectations

Wall Street expects Uber to deliver revenue of $4.42 billion, representing a 42% year-over-year increase. The increase will mostly be driven by the easing of lockdown restrictions, which has seen many people get back on the roads going to work, school, and other activities.

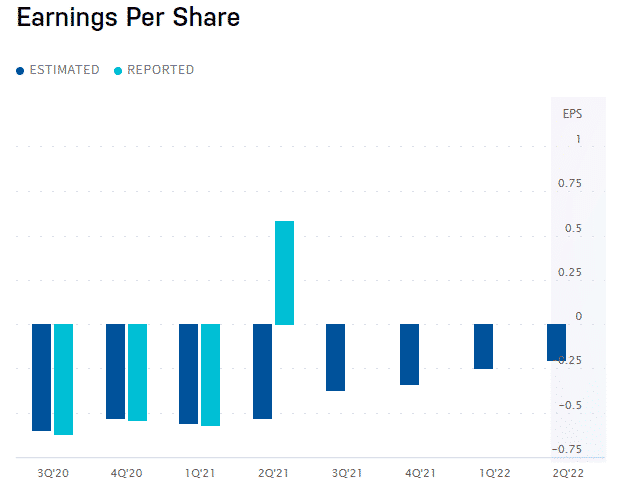

Amid the robust revenue growth, Uber is expected to deliver an EBITDA loss of $47.86 million, a 90% improvement compared to an EBITDA loss of $625 million delivered the same quarter last year. The company on its own has projected an EBITDA loss of less than $100 million.

In the first quarter, Uber posted an EBITDA loss of $359 million, followed by a much bigger loss of $509 million in the second quarter.

What to look out for when Uber reports

When Uber reports, the focus will be on how far the company is on turning in its first profit. While the net loss is expected to narrow significantly in Q3, it will be essential for the company to show it is on track to turn its first profit in the fourth quarter.

Standing in the way of Uber turning a profit before the end of the year is how the government reacts to the coronavirus during the winter months heading into year-end. A new wave of lockdowns would only make the path tricky, given the reduced traveling that comes with such actions.

Additionally, difficulties in finding drivers will be a point of concern when Uber reports. The company has struggled to attract sufficient drivers to its platform in the aftermath of the pandemic. Rising inflation and a surge in fuel prices are other headwinds that the company needs to address to turn its first profit this year.

In addition, the focus will be on Uber’s food delivery business which was a hit during the pandemic when people were forced to operate from home. While that segment has been thriving, it has skewed Uber into the lower-margin segment. It is highly unlikely that the segment will have a significant impact on the bottom line soon.

Mounting regulatory pressure will also be a hot subject when Uber reports. The company has come under intense scrutiny and pressure from regulators around the world over the status of its drivers. While there has been a push for it to list the drivers as employees, Uber has so far been reluctant. It will be interesting to see how it intends to address this matter.

Bottom line

The ride-hailing business improved significantly in the third quarter, which increases the prospects of Uber delivering better-than-expected results. The company posting a surprise EBITDA profit should strengthen the stock’s sentiments in the market, likely to trigger a bounce back after a recent slump.

Similarly, a disappointing Q3 report could rattle the market, sending the shares lower. Additionally, regulatory pressures are other headwinds that could curtail significant price gains on Q3 results.