President Trump Eyes Powell’s Ouster Amidst Renovation Probe and Rate Standoff

President Trump on Tuesday discussed with a group of House Republicans the possibility of dismissing Federal Reserve Chair Jerome Powell, a move that would challenge the historical independence of the central bank. The President confirmed on Wednesday that he had spoken to lawmakers about the idea, noting that “almost all of them said I should.”

Sources reported to CBS News that President Trump indicated he would proceed with the action. The discussions occurred in the Oval Office on Tuesday night following a procedural vote in the House that blocked cryptocurrency legislation favored by the President.

Federal law stipulates that a Federal Reserve Chair can only be fired “for cause,” a legal standard that has not been tested in the context of removing a Fed Chair. Such an action could have significant implications for financial markets.

READ: “I’m Bored”: Florida Woman Accused Of Chilling Threat To Kill President Trump

When asked on Wednesday if he desired an investigation into Powell for alleged fraud concerning renovations at the Fed headquarters, President Trump stated, “Well, I think he’s already under investigation. He spent far more money than he was supposed to rebuilding.” He added that Powell “has some problems” and that “many people” desire the role of Chair.

Russ Vought, Director of the Office of Budget and Management, previously sent a letter to Powell accusing him of an “ostentatious” years-long office renovation project that might be “violating the law.” Powell, in testimony to the Senate last month, described some characterizations of the renovation project as “misleading and inaccurate.”

Sources within the administration informed CBS News that the President has been discussing the possibility of a “for-cause” firing publicly and privately, but the White House has not yet formally established a legal basis for such a dismissal.

READ: Kentucky Rep. James Comer Says ‘No Evidence’ Yet Suggests Biden Controlled Use Of Autopen

The Trump administration has reportedly intensified pressure on Powell, with some officials publicly criticizing the Fed’s management of the headquarters renovation project, allegations that Powell has denied. For decades, Federal Reserve leaders have largely operated independently from the rest of the government, making decisions on monetary policy with minimal political intervention.

Florida Representative Anna Paulina Luna, who voted against advancing the crypto legislation, stated in an X post on Tuesday night, “Hearing Jerome Powell is getting fired! From a very serious source,” and later added, “I’m 99% sure firing is imminent.”

Several lawmakers present at the Oval Office meeting declined to comment on the private discussion. White House spokespeople did not immediately offer comment. A planned meeting between members of the House Financial Services Committee and Powell for Wednesday night was canceled due to vote timing uncertainty in the House, according to a spokesperson for Committee Chairman Rep. French Hill. The meeting had been scheduled months in advance to introduce freshman members to Powell.

READ: Florida Reps Buchanan, Donalds Lead Charge Against Global Drug Price “Freeloaders”

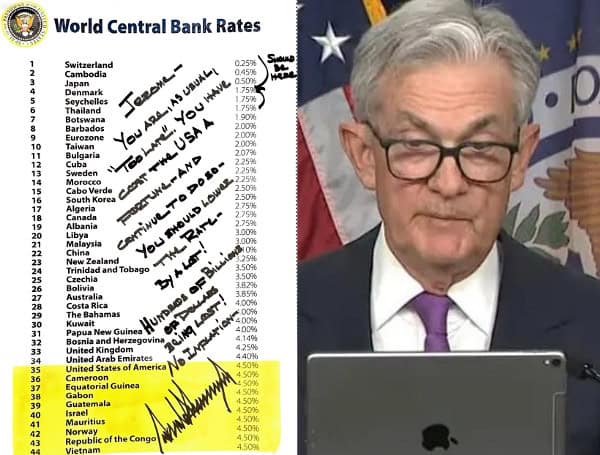

President Trump’s dissatisfaction with Powell, particularly his view that the Federal Reserve is not moving quickly enough to cut interest rates, has been a frequent subject of recent discussions. President Trump has referred to Powell, whom he initially appointed as Fed Chair, as “Mr. Too Late.”

“I think he’s terrible,” President Trump told reporters on Tuesday. He further criticized Powell’s demeanor and the renovation, stating, “I think he’s a total stiff. But the one thing I didn’t see him is a guy that needed a palace to live in.”

Last month, President Trump had stated he would not force Powell out, despite previously calling for his resignation before his term as Chair concludes in May 2026. On June 12, he remarked, “The fake news is saying, ‘Oh, if you fired him, it would be so bad, it would be so bad.’ I don’t know why it would be so bad, but I’m not going to fire him.”

President Trump has criticized the Fed for maintaining interest rates this year after cuts last year. Further rate reductions could stimulate economic growth and ease borrowing, but carry the risk of increased inflation. Interest rates currently remain near a two-decade high following Fed hikes in 2022 and 2023. While inflation has significantly decreased, it remains above the Fed’s 2% annual target, with Powell indicating a cautious approach. Powell has also expressed concerns that President Trump’s tariffs could exacerbate inflation.

READ: DeSantis’s CFO Pick Could Ignite New Trump-DeSantis Showdown In Florida

President Trump has argued that inflation is sufficiently low to warrant rate cuts. He has used increasingly sharp language to describe Powell, including calling him a “Total and Complete Moron” and a “numbskull” in a recent Truth Social post.

Powell was initially selected as Fed Chair by President Trump during his first administration, and President Joe Biden nominated him for a second four-year term in 2022.

A presidential firing of the Fed Chair would likely lead to an immediate legal challenge. The U.S. Supreme Court recently indicated in a May ruling that while President Trump can fire members of independent federal agencies like the National Labor Relations Board, this decision might not apply to the Federal Reserve due to its “uniquely structured, quasi-private entity” status.

Please make a small donation to the Tampa Free Press to help sustain independent journalism. Your contribution enables us to continue delivering high-quality, local, and national news coverage.

Connect with us: Follow the Tampa Free Press on Facebook and Twitter for breaking news and updates.

Sign up: Subscribe to our free newsletter for a curated selection of top stories delivered straight to your inbox.

Login To Facebook To Comment