Definition of Treasury Yield

Treasury yield is the interest rate that the US government pays its lenders. In other words, it is the return on investment for the debt securities issued by the US government. The figure is usually presented in the form of a percentage.

Just like the treasury bond, treasury yields have different maturity periods. For instance, the US 10-year treasury yield is linked to the 10-year government bond. This means that the bondholder will get the interest payments twice a year until the 10-years are over. Upon maturity, the investor will get the bond’s face value.

Treasury Bond

It is impossible to talk about treasury yields without mentioning treasury bonds. The US government cannot sustain its spending by relying solely on taxes. As such, it borrows money from individual investors, financial institutions, and other countries. The government loans are availed in the form of debt securities that include treasury bonds, treasury notes, TIPS (treasury inflation-protected securities), and treasury bills.

The issuance of treasury bonds takes place through online auctions that are conducted monthly by the US Treasury. It is at these auctions that the bond price and yield is determined. Subsequently, the treasury bonds are available for active trading in the secondary market. Investors can then purchase them via a broker or financial institution.

Treasury bonds have different maturity periods, with the 10-year period being one of the benchmarks. Upon maturity, the bearer of the government bond gets back the initial amount plus interest. The interest rate that the investor gets from lending money to the government is what is referred to as treasury yield.

Relationship between bond price and yield

Bond price has an inverse relationship with the yields. This means that when the bond price is on a decline, its yields will be on the rise. Consider the following scenario:

An investor buys a government bond whose maturity is 2 years for $950. Upon its maturity, the bondholder is set to get $1,000. In that case, the yields will be $1,000/$9500 = 1.05. More investors then get attracted to the investment option and seek to purchase a similar bond. In that case, the bond price may surge to $980. Subsequently, the bond yield will be $1,000/$980 = 1.02.

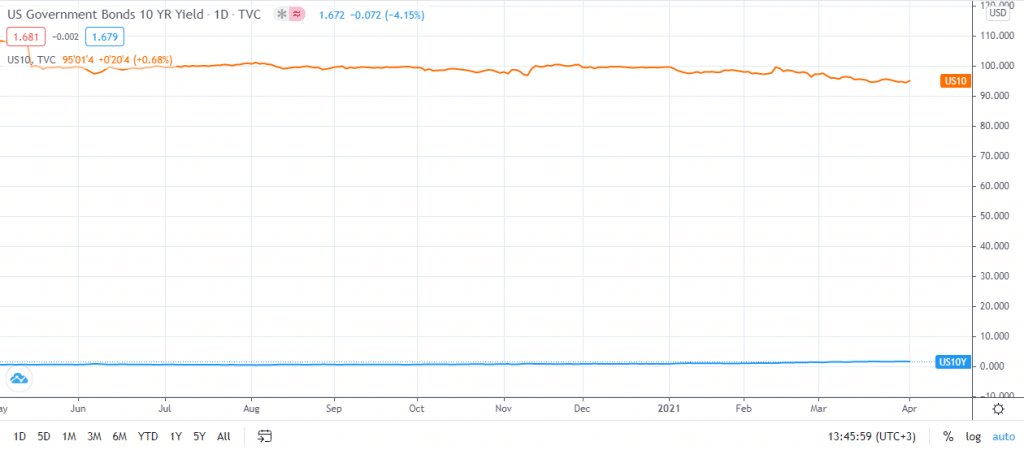

A look at the ongoing trend for US 10-year treasury yields gives a better understanding of this concept. Inflation concerns have resulted in the fall of the 10-year bond price. Subsequently, its yields hit 1.77 on 30th March, which is its highest level since January 2020.

Figure 1:Inverse relationship between Treasury bond price and yields

Importance of treasury yields

Treasury yields mean more than the interest that the bondholder gets from lending to the government. They tend to affect various elements of the economy. To begin with, the yields signal inflation concerns in the market. When the treasury yields are rising, as they have been in the first quarter of 2021, that’s a signal of probable inflation. Besides, treasury yields have a connection to interest rates. High yields result in an increase in interest rates. This increases the cost of borrowing money from financial institutions.