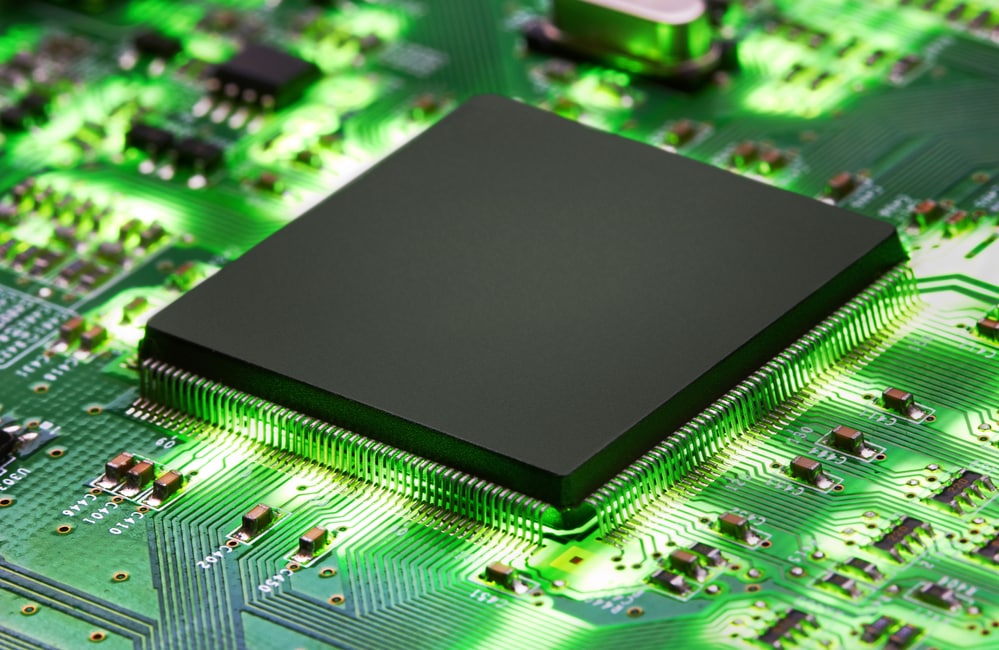

Semiconductors are used in many products and technology processes, including mobile phones, automobiles, military weapons, smart technology, and much more. They are typically thought of as a single technology play in a single industry, but they are used in many applications.

The sector can serve as an indicator of the health of the broader economy because of its wide application. ETFs can give investors a wide view of the semiconductor industry, which has outpaced the entire market in the past year, according to the benchmark S&P 500 Semiconductors Sub-Industry Index.

Which criteria are used to rank the best semiconductor ETFs?

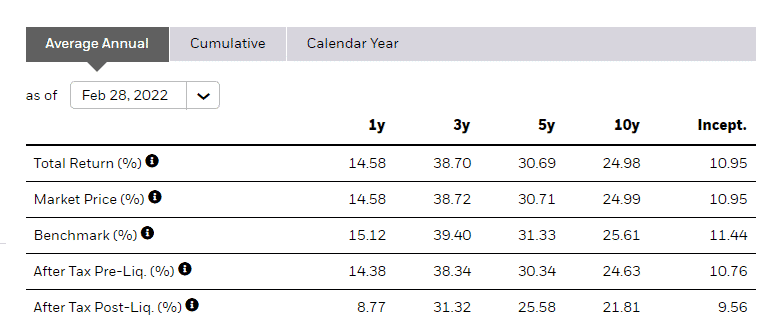

Performance: The major selection criteria for analyzing the performance of semiconductor ETFs is their one-year return. Before choosing an ETF for their portfolio, investors should look at returns over longer periods of time, such as three, five, and ten years.

Expense: This is measured by the expense ratio of the fund. When two ETFs track the same or similar index, the one with the lowest expense ratio outperforms the one with the highest.

Structure: Unlike closed-end funds (CEFs), most ETFs are open-end funds. ETF structures are a grantor trust, a limited partnership, or an exchange-traded note (ETN).

Holdings in the portfolio: Semiconductor ETFs invest in firms that design, manufacture, and distribute semiconductors, commonly known as semis or chips. Companies involved in semiconductor equipment may be included in chip stock ETF holdings.

Factor Grade: Factor Grades provide letter grades for five factors – Momentum, Expenses, Dividends, Risk, and Asset Flows. Investors compare the essential indicators for the factor to the same metrics for the other ETFs in the asset class. The factor grades range from A+ to F.

iShares Semiconductor ETF (SOXX)

SOXX is a passively managed stock that provides concentrated exposure to the top 30 publicly traded semiconductor businesses in the United States.

This comprises manufacturers of semiconductor-based materials used in electronic applications or LED and OLED technology and providers of semiconductor-related services or equipment. Companies must meet investment and liquidity requirements and have a minimum market capitalization of $100 million to be eligible for the index.

The index uses market-cap weighting with a capping approach, in which the top five stocks’ weights are capped at 8%, and the other shares’ weights are capped at 4%. ADRs, whose cumulative weight in the index is capped at 10%, may also be held by SOXX. The fund tracks its index using a sampling approach, which is recreated annually and rebalanced weekly.

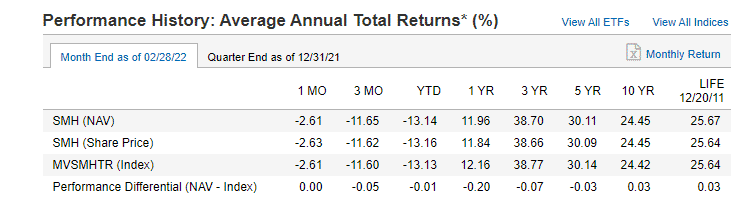

VanEck Vectors Semiconductor ETF (SMH)

SMH is a highly concentrated fund that invests in common stocks and depositary receipts of US-listed semiconductor companies. Companies with a market capitalization of less than $1 billion and foreign companies listed in the United States can be included. A company’s revenues must be predominantly derived from the manufacture of semiconductors and semiconductor equipment to be eligible.

The top 50 qualified companies by market capitalization are then ranked in two categories: free-float market capitalization and three-month average daily trading volume in descending order. These two rankings are added together, and the top 25 companies are chosen. A capping method is used to ensure diversification, with larger enterprises receiving greater weight.

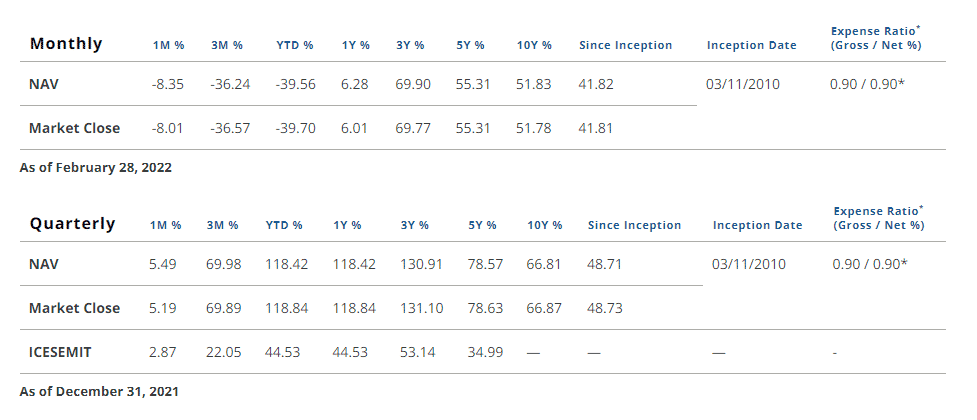

Direxion Daily Semiconductor Bull 3X Shares (SOXL)

SOXL is a one-day aggressive and bullish bet on a concentrated portfolio of the 30 top US-listed semiconductor companies, including semiconductor producers and providers of services or equipment. The fund’s index uses market-cap weighting, with the top five stocks’ weights capped at 8% and the other shares’ weights at 4%. ADRs may be included in the index, but their cumulative weight is limited to 10%.

The fund invests in swap agreements, index securities, and index-tracking ETFs to get exposure to the index. SOXL rebalances its 3x leverage on a daily basis, which means that over time, due to compounding impacts of this daily rebalance, targeted returns may look drastically different.

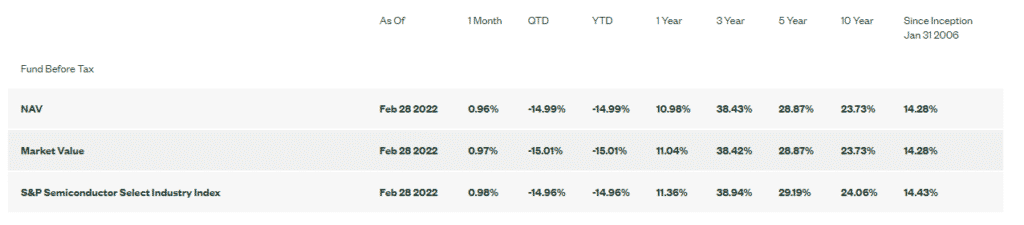

SPDR S&P Semiconductor ETF (XSD)

XSD tracks an equal-weighted index of semiconductor stocks. In its segment, it has a high number of pure-play semiconductor companies. It aims to produce investment outcomes that, before fees and expenses, are roughly equivalent to the S&P 500’s total return performance. It follows a modified equal-weighted index that offers unconcentrated industry exposure across large, mid, and small-cap equities. It allows investors to adopt more specific strategic or tactical positions than typical sector-based investment.

The select industry indices, each of which is designed to measure the performance of a certain sub-industry or group of sub-industries as defined by the Global Industry Classification Standard (“GICS”). Its top 3 holdings are SiTime Corporation, Alpha and Omega Semiconductor Limited, and Navitas Semiconductor Corporation. The index is rebalanced every three months.

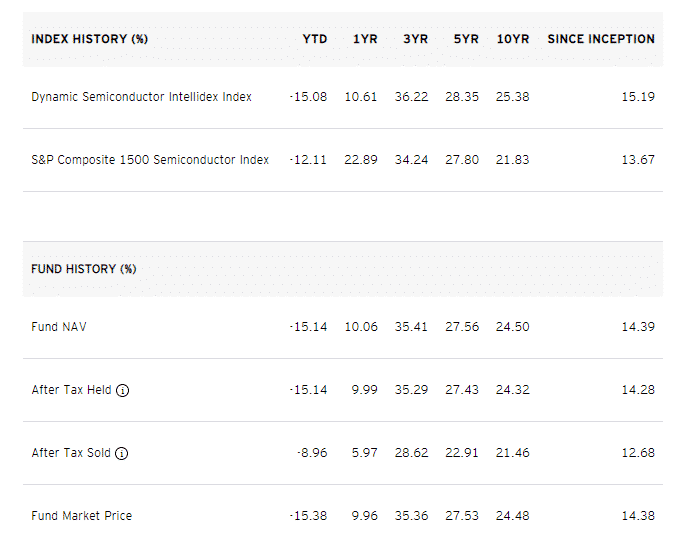

Invesco Dynamic Semiconductors ETF(PSI)

PSI is an index that selects and weights US semiconductor businesses based on a quantitative algorithm. It’s a passively managed fund that aims to outperform the market by picking and weighting 30 semiconductor companies based on a proprietary quantitative process that considers risk considerations, style classification, and company price. Stocks are evaluated based on five factors: price momentum, earnings momentum, quality, management action, and value.

Because of its tier-weighting scheme, PSI favors smaller growth enterprises in a highly concentrated industry. As a result, mega-cap concentrations are reduced, and the group of enterprises is evenly weighted across sizes. The fund and the index are rebalanced and reconstituted quarterly in February, May, August, and November.

Summary

The semiconductor market has continued to draw investors’ attention as demand from a variety of industries grows. The pandemic times spurred demand within the space, as the stay-at-home culture boosted demand for laptops, PCs, and cellphones, as evidenced by the performance lists. In addition, as the automotive industry evolves to include more electronic components in vehicles that rely on chips, the demand is increasing.