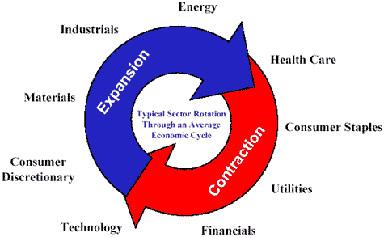

Market is in sector rotation mode, but what is it? Sector rotation entails investors moving their investments from one or multiple sectors to another or other sectors based on the present business cycle.

Overview

The stock market is a constant battle of ‘out with the old, in with the new.’ Sectors that were once relevant are soon less in-demand due to the economic climate and are replaced by those the market deems pertinent then. This concept is the core of sector rotation.

Sector rotation is a theory related to stocks that refers to investors moving their investments from one sector of the markets to another depending on the current business cycle.

We can also think of sector rotation as a method used by those with a diversified stock portfolio who rotate their investments strategically over designated sectors to spread out risk in anticipation of the next business cycle.

Since this practice is typically a long-term one, investors in this regard will always be conscious of any significant changes to the sectors they’ve purchased stocks in. They would look for opportunities to shift their focus by selling existing stocks and use the proceeds to diversify portfolios with other booming sectors.

How does sector rotation work?

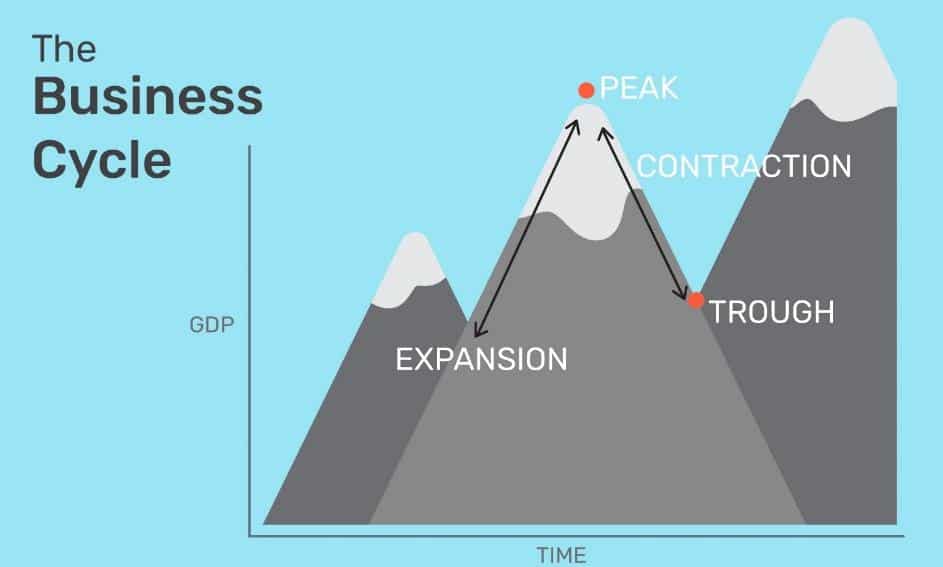

To understand sector rotation, we need to learn about the general business cycle. Typically, a business cycle will feature periods of a recovering to the booming economy, followed by signs of a waning economy, and then ultimately a recession. The cycle would then repeat itself in this manner.

More technically, analysts best describe the business cycle by four phases:

- Early recovery (expansion)

- Late recovery (peak)

- Early recession (contraction)

- Full recession (trough)

Sector rotation works primarily according to the stages of a business cycle. When buying stocks, investors note the consumer trends and the services that are the most attractive and in-demand. If some particular sectors perform poorly while others are not due to a prescribed business cycle, these are some signs for them to sell ‘bad stocks’ in favor of buying ‘good ones.’

List of main sectors in the stock market

Using the S&P (Standard & Poors) 500’s method of categorizing sectors, according to business activities, publically-traded companies generally fall into 11 sectors:

- Information technology (e.g., Microsoft)

- Healthcare (e.g., Johnson & Johnson)

- Financials (e.g., Goldman Sachs)

- Consumer discretionary (e.g., Starbucks)

- Communication services (e.g., Facebook)

- Industrials (e.g., Boeing)

- Consumer Staples (e.g. Procter & Gamble)

- Energy (e.g., Chevron)

- Utilities (e.g., E.ON)

- Real Estate (e.g., Boston Properties)

- Materials (e.g., Eagle Materials)

What’s also beneficial to note is that some sectors are cyclical or non-cyclical. As an essential consideration in sector rotation, cyclicality refers to the priority level of products and services depending on the economic state.

Particular companies that sell products and services like food, for example, which are essential regardless of the economic state, are non-cyclical. Cyclical are companies selling consumer discretionary items that customers buy more when times are good but spend less during an economic downturn, e.g., hotels, airlines, luxury retail, etc.

Current sector rotation

We have technically been in a global recession for well over six months, resulting in a few notable trends and shifts. Millions lost their jobs through retrenchments, tremendously reducing consumer spending in specific sectors.

Investors will plow money into non-cyclical stocks during an economic slump since these tend to maintain relatively outstanding performance. Some of the stocks that benefited from the pandemic were healthcare (biotech, pharmaceutical, etc.) and information technology (streaming, e-commerce, internet communication, etc.).

Presently, many companies in the health space are frantically researching and testing for possible suitable vaccines to combat the virus. Such activity will naturally boost the stocks of those companies.

People who lost their jobs and those who worked from home had to rely heavily on streaming companies for entertainment, e-commerce brands for shopping, and internet communication providers to communicate effectively.

Again, as with health, any corporation in this sector greatly benefited. Most companies in the hospitality, entertainment, and airline space, among others, performed terribly since fewer people could use their services due to the restrictions.

How to use sector rotation

The above scenario shows us how investors will move money from badly-performing sectors to prosperous ones according to the economic climate.

It’s essential to note that, as with anything, accurately predicting which sectors will be more in demand than others is not always possible. Also, sector rotation works best for long-term, buy-and-hold investors who should naturally be more concerned about stock fundamentals.

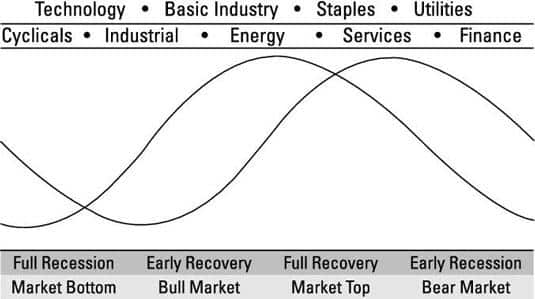

One of the best methods of using sector rotation theory is first identifying the current business cycle and which sectors tend to thrive at each stage.

- Full recession. A full recession is the worst stage in any economy, characterized by consecutive declines in the GDP, falling interest rates, and falling consumer expectations, among other things.

Also, a full recession can be the result of a catastrophic world event, as we have seen in 2020. Regardless, stocks that do well during these periods are healthcare, consumer staples, real estate, finance, and utilities. We could argue a few other sectors also thrive during a recession, which will be more prominent at a later stage.

- Early recovery. This stage exemplifies growing optimism on all aspects of the economy, ranging from rising consumer expectations to growing industrial production. Stocks based on the finance and technology sectors, to name a few, start to show signs of bullishness as a result.

- Full recovery. Here, the economy has fully recovered. Everything in early recovery magnifies itself at this stage. Stocks based on consumer discretionary, technology, and numerous other cyclical industries enjoy the most growth during this cycle as consumers have more money to spend.

- Early recession. The aspects of a full recession show up in glimpses during an early recession. Stocks that performed well during early and late recovery will soon fall out of favor and make way for more non-cyclical stocks like utilities and consumer staples.

Another aspect of using sector rotation analysis is aligning the technical analysis with specific stages in the business cycle. The image below demonstrates this idea.

Conclusion

Sector rotation is just one aspect that encompasses the often complex fundamental analysis of stocks employed by long-term investors. Ultimately, sector rotation and related concepts are merely theories and are not foolproof predictors, meaning that stocks don’t always necessarily follow these patterns.

In most cases, though, investors should be aware of how the economy is doing by using sector rotation to forecast any possible trends and knowing when it may be time to sell specific stocks to buy other ones.