Cryptocurrency prices have had a rough start to the year. According to CoinGecko, they had a market capitalization of about $2 trillion in the first week of March. At their peak in 2021, they were all valued at over $3 trillion. And a closer look at most coins shows that most of them have fallen by over 50% from their all-time high. In this article, we will look at some of the top cryptocurrencies to buy and hold.

Chainlink

The blockchain industry is seeing strong growth and adoption. Think of key areas like decentralized finance, non-fungible tokens (NFT), and the metaverse. While their growth has stalled a bit, most analysts believe that they have a bright future ahead.

Many experts also believe that the future of the industry will have to marry on-chain and off-chain data. This is where Chainlink comes in. It is a leading blockchain platform that offers products that help developers across the sectors integrate off-chain data to their platforms.

For example, a developer who wants to incorporate weather and traffic data can use these oracles to do it easily. Similarly, decentralized exchanges use Chainlink to provide accurate price feeds in their platforms.

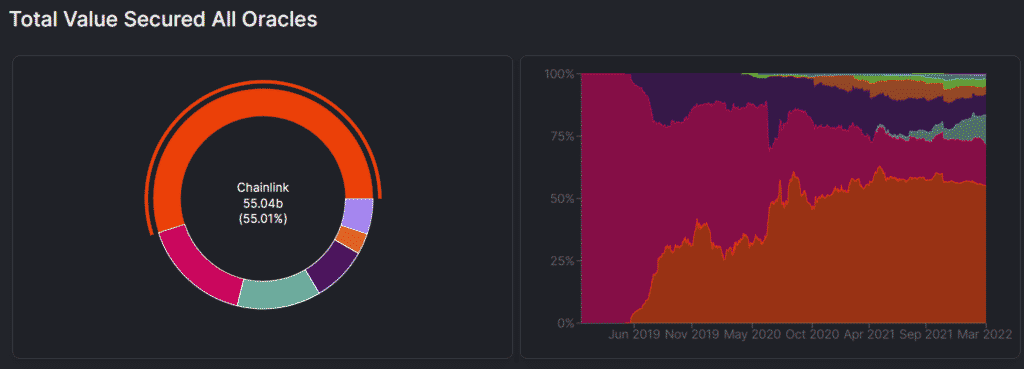

Chainlink also offers multiple solutions like keepers, verifiable random number generators, and proof-of-reserves. According to DeFi Llama, the network has a total value reserved of over $54 billion, making it the biggest oracle network in the world.

The Chainlink price will likely bounce back in the coming months because of the value it provides other developers and the fact that it has minimal competition.

Polygon

Ethereum is the biggest smart contract network in the world, and its technology dominates all industries like the metaverse and DeFi. But Ethereum has its own challenges. For example, since it is a second-generation platform, it is energy inefficient, slow, and highly expensive.

This is where Polygon comes in. The network, which was previously known as MATIC, provides a solution that helps Ethereum developers to optimize their Ethereum apps. As a result, their Polygon apps have lower costs and better performance.

Polygon has grown to become the biggest layer-2 network in the world, with over 2,000 projects in its ecosystem or in development. Aave, the leading lending protocol, was among the first dAPP to be integrated into the network. Other popular ones are Uniswap and Curve Finance. According to DeFi Llama, it has a total value locked (TVL) of over $4.1 billion.

Therefore, Polygon will keep doing well because of its traction among Ethereum developers and the fact that it has expanded its solutions to include zero-knowledge (k) rollups and Polygon Avail.

Fantom

Fantom is another Ethereum-killer that has seen great traction among developers. It was launched in 2018 and has become one of the top cryptocurrencies in the world. According to CoinGecko, it has a total market cap of over $4.8 billion and is the 30th biggest cryptocurrency in the world.

Fantom solves the challenges that Ethereum has in multiple ways. For example, its platform is significantly faster and has lower costs than Ethereum. It is also highly scalable and secure because it uses the asynchronous Byzantine Fault-Tolerant (aBFT) technology that supports one-third of faulty nodes.

Fantom has been embraced in all industries in the Blockchain sector. For example, there are over 184 DeFi applications built using the network that have a TVL of over $11.9 billion. This makes it the fourth-biggest smart contract platform in the world after Ethereum, Terra, and BNB Chain.

Therefore, while the FTM price has dropped recently, there is a likelihood that it will remain at elevated levels in the future. For one, it is highly undervalued considering that its market cap is smaller than that of Avalanche, Cronos, and NEAR.

Terra

Terra is a South Korean blockchain platform that has had a spectacular performance in the past few months. It has literally come from nowhere and become one of the biggest platforms in the world, valued at over $34 billion.

Terra has become extremely popular in South Korea, where it powers an app called Chai. It is a simple-to-use app that allows people to pay for products in retail and e-commerce stores. Most importantly, Terra is known for its algorithmically-adjusted stablecoins. Terra USD has become the fourth-biggest stablecoin in the world, with a total market cap of over $13 billion.

Many developers are also embracing Terra’s platform to build decentralized applications. They love the fact that its network is cheap and that it integrates with Terra’s stablecoins. Its DeFi ecosystem has a market cap of over $23 billion, making it second only to Ethereum. Its top platforms are Anchor Protocol, Lido, and Astroport.

Cosmos

The blockchain industry is extremely wide. For example, there are multiple smart contract platforms like Ethereum, Solana, and Polkadot. These protocols work differently and use diverse technologies. Ideally, it would be good if all these protocols worked together.

A few ideas have been suggested, with the most popular one being bridges, which link multiple chains. Another option is known as Cosmos, which is a platform that uses the Inter Blockchain Communication (IBC) protocol. It helps multiple cryptocurrencies communicate and work with one another. Today, it has over 150 coins like LUNA, BNB, and Cronos.

Cosmos also has an SDK that has become popular among developers. Indeed, it is the same technology used to build Terra. And there is a likelihood that more apps are being built using the technology. Unlike other chains, Cosmos builds cryptocurrencies that have a relationship with each other.

Therefore, there is a likelihood that the Cosmos price will continue doing well in the future. Cosmos has a market cap of more than $9.6 billion.

Summary

There are thousands of cryptocurrencies today. Some of them are not viable, and there is a likelihood that they will struggle to gain traction in the future. In this article, we have looked at some of the top coins that we believe will keep doing well in the long term.