London and Melbourne-headquartered company, ThinkMarkets, operates as a No Dealing Desk (NDD) broker in the online trading marketplace serving thousands of clients from 180 countries worldwide. It offers forex trading and CFDs on various instruments that trade with ultra-fast executions, tight spreads, and low commissions. The established 2010 broker also holds licenses from trusted regulatory bodies such as the FCA, FSCA, and ASIC.

Pros

- Fast order executions

- Tight spreads starting from 0.1 pips

- No minimum deposit

- No inactivity or subscription fees

- Offers social trading through ZuluTrade

- 24/7 multilingual customer support

- Well furnished trading platforms

- Chance to diversify your portfolio using CFDs

- Offers negative balance protection

- Variety of assets to trade

Cons

- Zero spread clients incur higher trading commissions

- Fewer FX pairs compared to other brokers

- Not accepted in the USA, Canada, Japan, among other nations

ThinkMarkets made its debut in the financial trading space in 2010, aiming to offer forex and CFDs trading on a spectrum of assets to retail and corporate traders. The broker’s main goal entailed rolling out a platform that served newbies and veteran traders with ultra-fast executions, tight spreads, and meager commissions when exploring forex and CFDs on diverse assets.

Over the past decade, the broker expanded to achieve its primary goal and now serves thousands of traders worldwide, as it operates in 180+ nations. It offers various assets such as FX, indices, energies, metals, shares & ETFs, futures, and crypto that clients speculate on using CFDs.

Nonetheless, the broker provides transparent trading services. It claims to offer tight security of client’s funds through top tier-1 banks and holds trading licenses from regulatory bodies like the FCA, ASIC, and the FSCA. ThinkMarkets also confirms being an official partner of Liverpool FC, an imprint that adds more weight to it as a legit broker.

As it offers ECN execution to its criteria of traders, the broker provides furnished trading platforms integrated with smart tools to meet the trader’s needs. Its array of trading platforms consists of the MT4, MT5, and its proprietary trading platform, ThinkTrader. Some of the tools prompting good trading experience at ThinkMarkets include; Autochartist and VPS Hosting.

Regulation

ThinkMarkets operates under the eyes of trusted regulatory bodies that make sure the broker conducts transparent activities to clients.

Agencies surveying the broker include:

- The Financial Conduct Authority (FCA) under the license number 629628

- The Australian Securities and Investment Commission (ASIC) under license number 424700

- Registered with the Financial Sector Conduct Authority (FSCA) of South Africa under the registration number 2017/098181/07

Pros

- A top tier regulated broker

Cons

- It’s unavailable in some nations

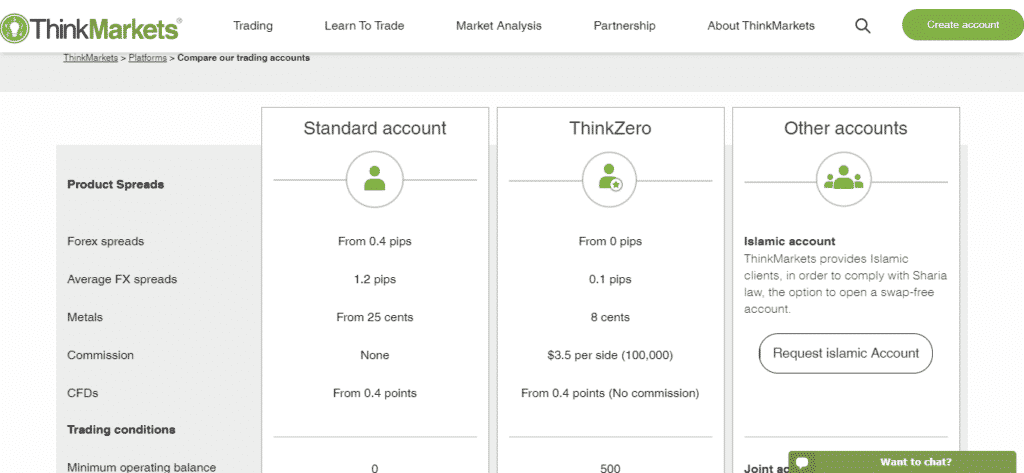

Account Types

ThinkMarkets offers clients a spectrum of live accounts and a demo account for those that intend to grow their skills in a bid to start trading. The live accounts come with different trading conditions that favor diverse clients.

Think zero account traders experience ultra-low spreads, and as a result, the broker charges commissions on trades. However, ThinkMarkets levels the playing field for its clients by shaving down the minimum deposit to zero. Moreso, clients can request special accounts such as joint accounts and Islamic accounts. They include the standard account and the ThinkZero account.

Analysis of the accounts

Standard account

- Forex spreads — from 0.4 pips

- Average FX spreads — 1.2 pips

- Metals — from 25 cents

- Commission — none

- CFDs — from 0.4 points

- Minimum operating balance — 0

- Lot size — 1.0 (100k)

- Max. leverage — 500:1

- Max. tradable size — 50 Lots

- Min. stop-loss/ take profit levels — none

- Server locations — LD5 HK4

- Platforms — ThinkTrader, MT4 & MT5

- 24/7 live support — yes

- Free VPS service — yes

- Autochartist — MT4 & MT5 only

- Account manager — no

Think Zero account

- Forex spreads — from 0 pips

- Average FX spreads — 0.1 pips

- Metals — from 8 cents

- Commission — $3.5 per side (100,000)

- CFDs — from 0.4 points (no commission)

- Minimum operating balance — $500

- Lot size — 1.0 (100k)

- Max. leverage — 500:1

- Max. tradable size — 100 lots (on some commodities, it remains at ten)

- Min. stop-loss/ take profit levels — none

- Server locations — LD5 HK4

- Platforms — ThinkTrader, MT4 & MT5

- 24/7 live support — yes

- Free VPS service — yes

- Autochartist — MT4 and MT5

- Account manager — yes

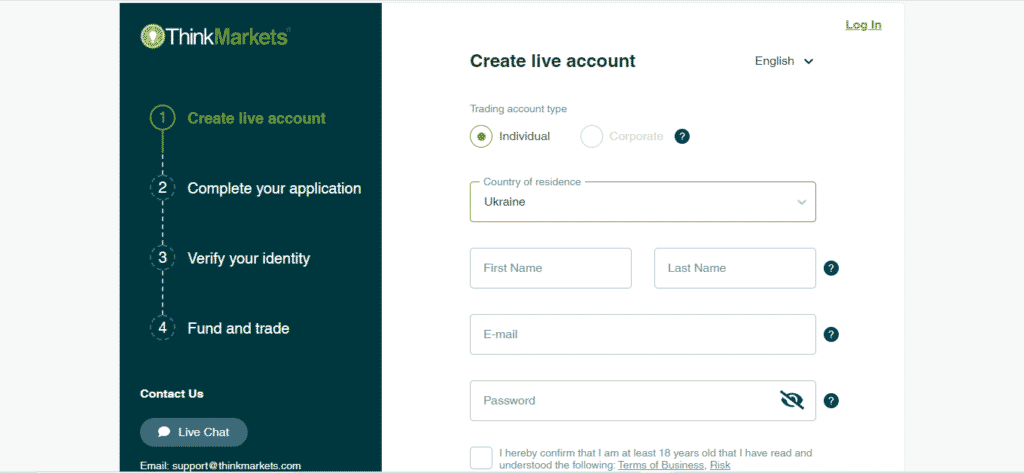

How to open a ThinkMarkets account?

ThinkMarkets allows clients to follow a few swift steps amid opening a live account. The process is fast as it’s aided by expert client support. Traders go through the following steps ahead of creating an account at this broker.

Step 1. Log into the broker’s official website and click the “create account” button.

Step 2. Select the live account option.

Step 3. Fill the form that pops up.

Step 4. Verify your identity.

Step 5. Select your account type and trading platform.

Step 6. Fund the account and start trading.

Fees and Commissions

ThinkMarkets claims to shave down most fee charges to its traders. The broker notes to mitigate fees such as account fees, inactivity fees, and subscription fees. It also says to have obliterated fees on deposits. However, as it offers NDD services, ThinkMarkets charges fees on the spread markup and commissions trades.

But commissions depend on the assets traded and the account type the trader chooses. For example, the ThinkZero account traders incur $3.5 commissions on 100,000 volumes of trades.

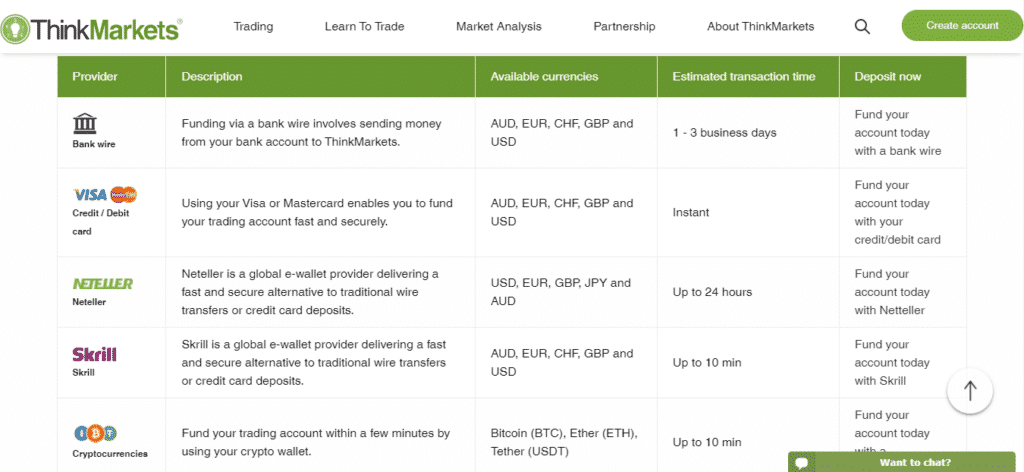

Payment options

It offers diverse payment options to meet the demands of its clients from around the world. Clients choose the options that serve them conveniently. This depends on their preferred deposit currency, duration of the transaction, among other factors. Some options transactions take only ten minutes while others stretch up to three business days.

The payment options offered by ThinkMarkets include:

- Bank wire transfers

- Credit/debit cards such as Visa and MasterCard

- E-wallets such as Neteller and Skrill

- Crypto-wallets like BTC, Ethereum, and USDT

Pros

- Multiple payment options

- Deposit and withdrawal is free

- Accepts deposits in cryptocurrency

Cons

- Some transactions take up to 3 business days, like bank wire transfers

Deposit

ThinkMarkets accepts deposits from these methods:

- Bank Cards like Visa, Mastercard

- E-Wallet transfers like Skrill and Neteller

- Cryptocurrencies such as Bitcoin, Ethereum and USDT

Withdrawals

The same deposit methods apply to withdrawals.

Available Markets

ThinkMarkets allows clients to access a wide range of markets, granting them the opportunity to diversify their portfolios. Clients experience FX trading on a pool of FX pairs and trade CFDs through the broker’s assets.

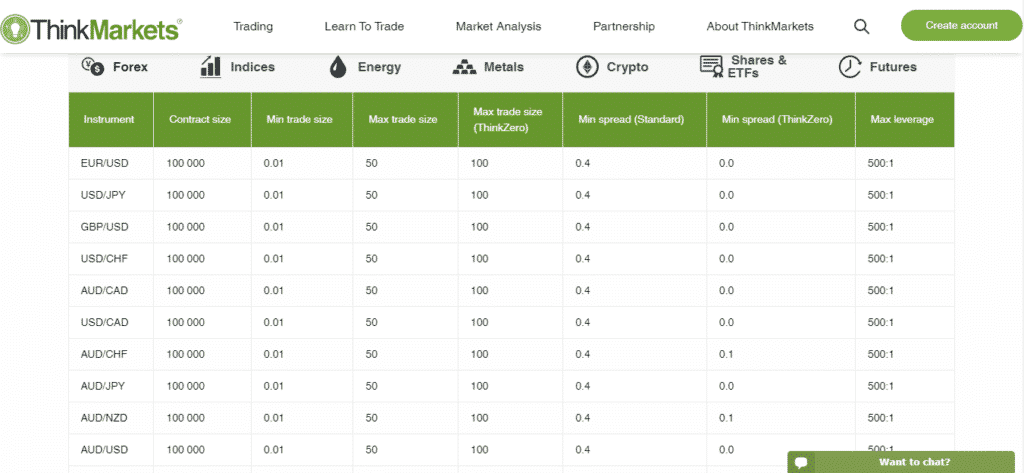

Forex

The FX market trades 24/5 with real-time client support and encompasses more than 40 pairs of significant currency, minor, and exotic currencies. These instruments trade with low spreads starting from 0.0 pips to average around 1.2 pips and leverages of up to 500:1.

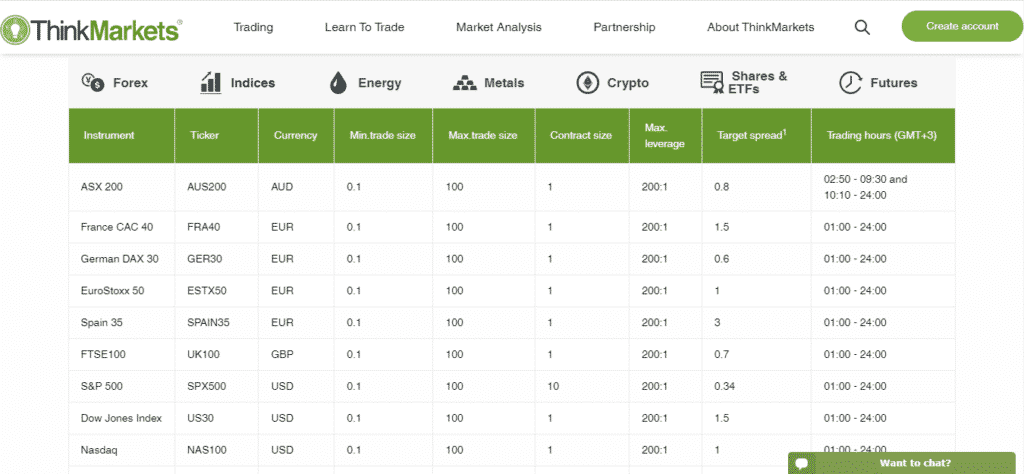

Indices

ThinkMarkets links clients to the global indices market to trade instruments such as the UK100, GER30, SPX500, among others with flexible pricing. The asset’s variable spreads start from 0.4 points and fluctuate to average around 1.5 points. However, the maximum leverage is capped at 200:1.

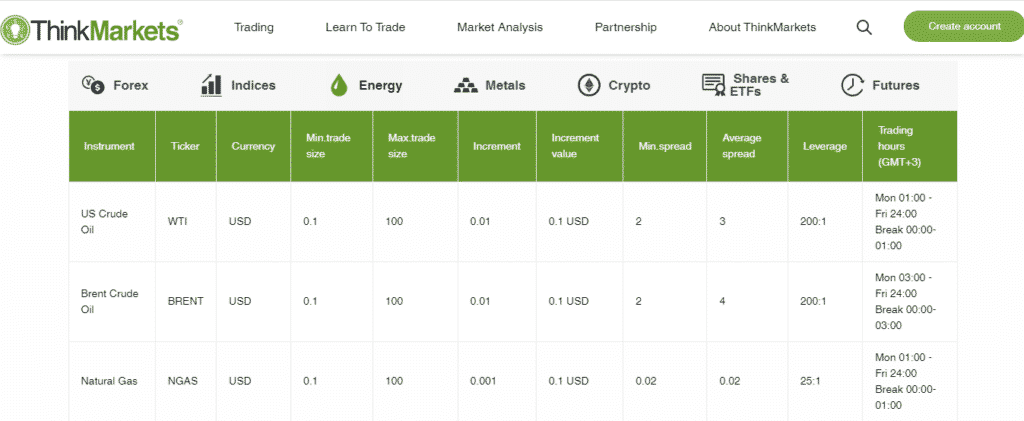

Commodities

ThinkMarkets allows clients to trade CFDs on an array of commodities with no commissions. Traders speculate the instrument’s market volatility by going long or short. The selection consists of instruments like oil, gas, coffee, among others.

The energies bracket holds instruments such as the US crude oil, Brent crude oil, and natural gas. The minimum spread is capped at 0.2 pips. However, it stretches to average at four pips with a leverage of up to 200:1. However, the natural gas’ leverage only climbs up to 25:1.

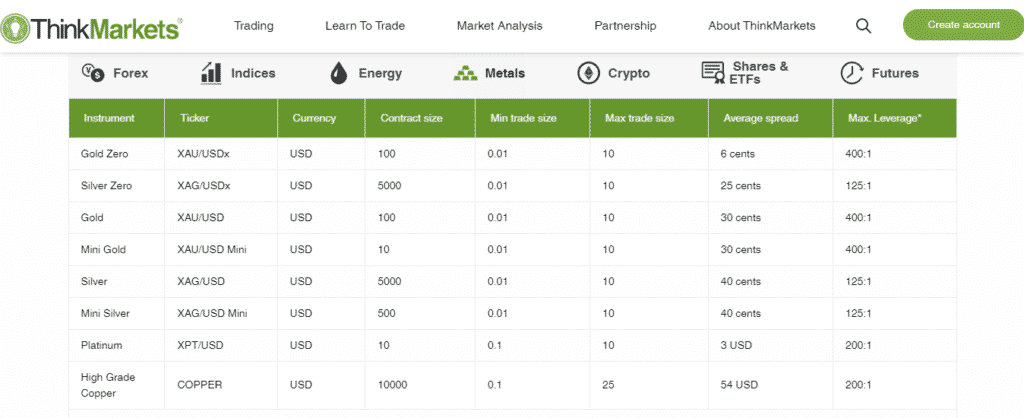

Precious metals

Clients also trade CFDs on some of the most valuable metals. This market operates under the commodities page and holds gold, silver, platinum, and high-grade copper instruments. At ThinkMarkets, these assets trade 24/5 with a max. leverage of up to 400:1 against the USD.

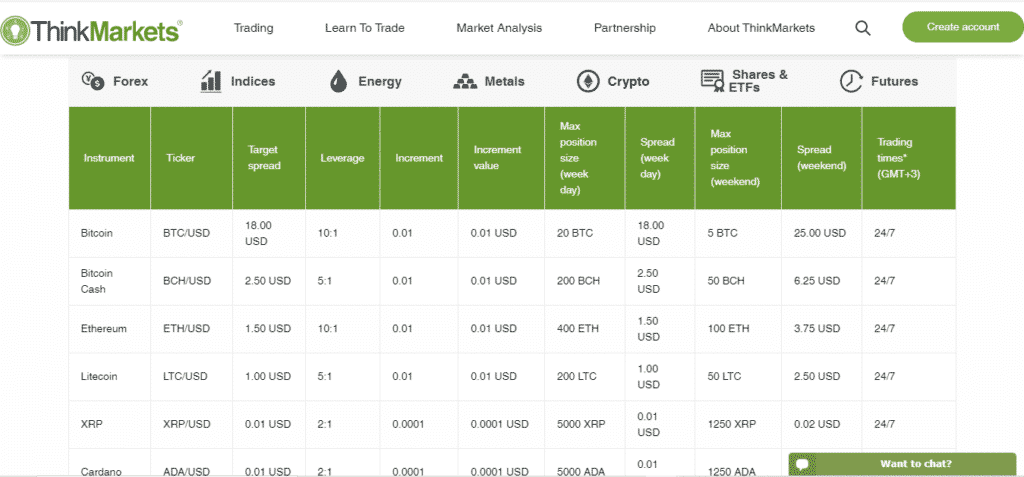

Cryptocurrencies

Clients are looking to spread, bet and trade CFDs on one of the world’s most volatile markets hosting instruments like Bitcoin, BTC Cash, Ethereum, Litecoin, XRP, a few DeFi tokens, among others crypto-assets. At ThinkMarkets, the crypto market trades 24/7 with a leverage of up to 10:1 and fluctuating spreads.

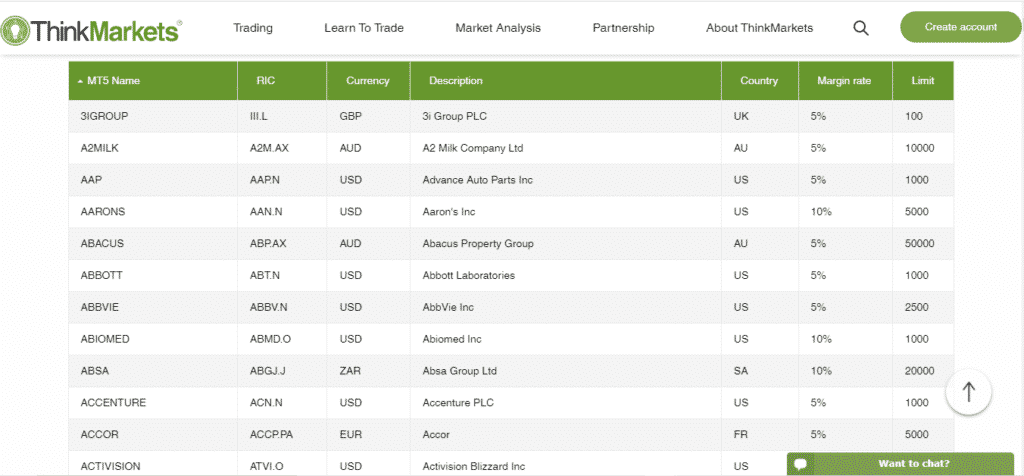

Shares & ETFs

ThinkMarkets also offers a portfolio of instruments on shares and ETFs that trade with an average margin rate of 5%. The instruments were compiled from global companies worldwide and changed through the broker’s ThinkTrader or the MT5.

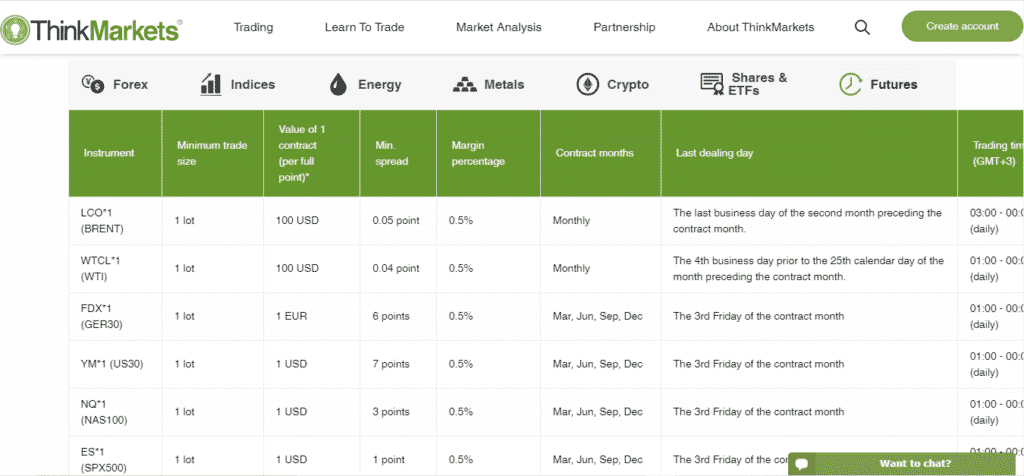

Futures

Traders also explore futures on commodities and indices with a minimum trade size of 0.1 lot or one lot.

Trading Platforms

ThinkMarkets offers cutting-edge trading platforms available on different interfaces to clients. Clients select either its proprietary trading platform ThinkTrader or the world’s popular trading platforms, i.e., the MT4 and the MT5. The broker’s platforms integrate with EA tools to provide a conducive trading environment.

Analysis of the platforms

ThinkTrader

- Over 80 intelligent indicators

- 50 drawing tools

- 14 chart types

- Get up to 200 cloud-based notifications

- Access to the TrendRisk scanner tool

- Best mobile trading app in the world

MetaTrader 4

- Held on servers in high-end colocation centers for ultra-fast trade execution

- Top-notch indicators and tools

- Integrated with Autochartist and 100+ indicators

MetaTrader 5

- Enhanced order management, including two more pending order types

- First-class charting and 21 time frames to select from

- Integrated economic calendar with advanced features

Features

ThinkMarkets features generally include:

Trading tools

- Autochartist

- Expert advisors

- Risk scanner tool

- charting tools

Analytical tools

- Market watch information tools

- Economic calendar

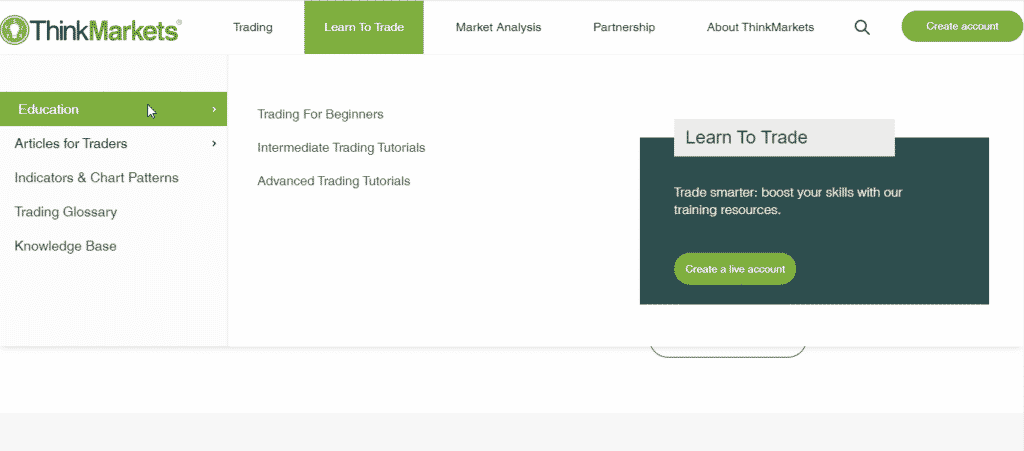

Education

ThinkMarkets cares about the well-being of its clients by providing rich educational materials that face traders towards success. Due to the volatility of the financial markets, FX and CFDs trading is risky. However, the broker offers materials such as trading articles feeding traders the best tips and strategies to apply to unwind losses. The tutorials serve all sorts of traders.

Customer Support

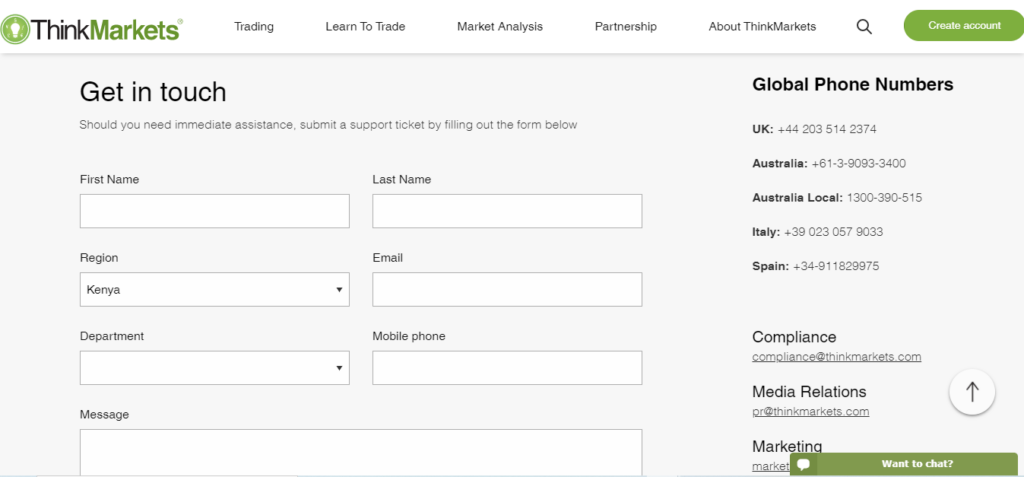

ThinkMarkets’ offers real-time customer support services to its clients. It claims to provide a multilingual customer support team 24/7 through its website. Clients and customers contact the live support team via the chat section, phone call, or filling out the form for any queries.

Review Summary

ThinkMarkets brags on over ten years of experience in the trading space, offering forex and CFDs trading services to both retail and institutional traders. It provides multiple assets hosting a portfolio of instruments that traders speculate on through CFDs with ultra-fast executions, tight spreads, and low commissions.

Its tamperproof security of clients’ funds and recognition from legitimate regulatory bodies such as the FCA marks it as a safe and good trading broker for newbies and expert traders.