It was a strong week for the risk assets: S&P 500 and Nasdaq made new all-time highs, and risk currencies closed the week positive against the dollar.

The US dollar was falling for the whole week as the market was responding to the negative US economic data, anticipating the Fed stalling the tapering.

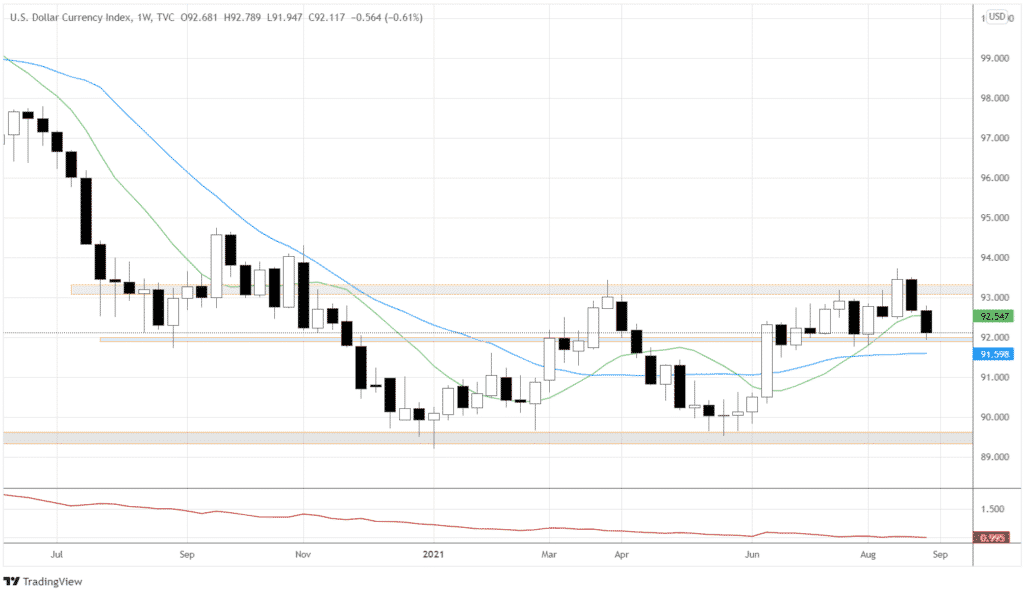

DXY and the uncertainty over Fed’s stance

Let’s consider that according to Fed, the timing of the tapering will depend on the labor market. It becomes clear why investors favored stocks and risk currencies last week – ADP Nonfarm Employment Change (Aug) missed expectations, posting an actual 374K versus forecasted 613K.

The sentiment has already been uncertain over the Fed being “not in a hurry” to taper, so the weak labor market data gave another reason for investors to perceive that the rates will stay low for considerably longer. Thus, people aren’t excited to hold the greenback.

Let’s see where the dollar index (DXY) stands amid current sentiments.

At this point, we can confidently say that the latest DXY breakout above the critical support 93.0 has failed. Last week closed decisively bearish, finishing the week below 50-day Moving Average (green) and testing the local support 92.0.

Look out for momentum trades to the downside if the price manages to hold below 92.0 during the next week. 100-day Moving Average (blue) can provide another support for DXY, so you should heed to the price action around 91.5 to avoid selling into support. If you see various rejection signals on 4-hour and daily timeframes around 91.5-92.0, consider sitting on your hands or even going long the USD.

Notably, the volatility has been declining for a significant time, as you can see in the ATR indicator’s window under the main chart. It may tell us that wild swings in the USD are ahead. The volatility tends to change in cycles, from high to low and vice versa, so expect the new ATR wave to start rising at any moment.

Nikkei 225 shots up as BOJ may inject more liquidity

Japan doesn’t seem to be in a hurry to taper either – quite the opposite. BOJ’s Kataoka has been consistently dovish, viewing that BOJ should aggressively drive the yields down to boost the investment climate. The inflation is still far from reaching the BOJ’s 2% target, so there is no reason not to pump in more liquidity to stimulate the economy.

After Kataoka’s remarks on September 2nd, Japanese 10-year bond yields rose last week, closing at 0.04%. As the yields grew, we may see it as the confirmation of the risk-off sentiment in Japanese equities, as Investors wouldn’t struggle to imagine further stimulus from the BOJ.

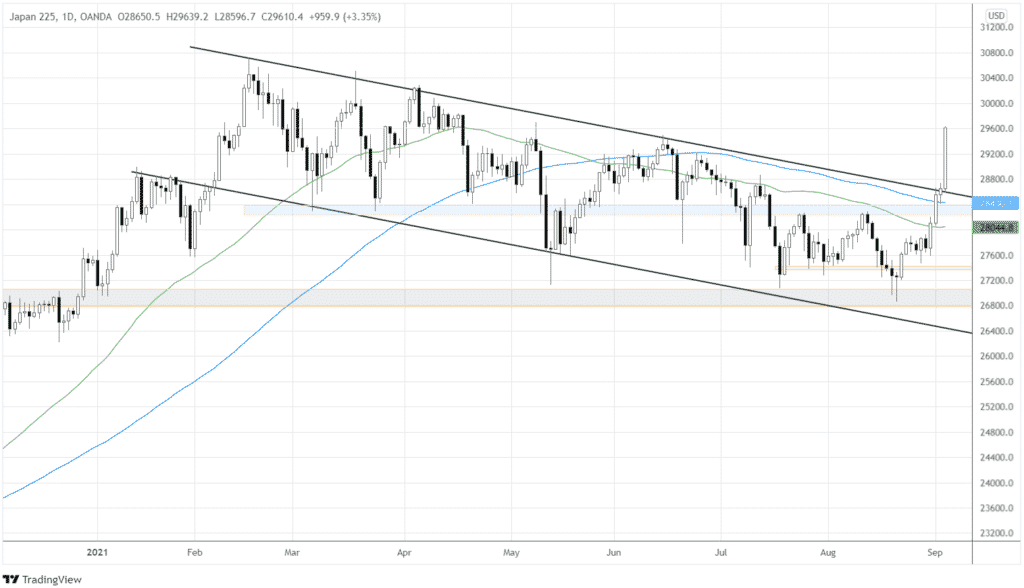

The reaction of the Japanese equities benchmark, Nikkei 225, is also coherent with the sentiment. Look at this massive breakout from the half-year-long descending channel.

For momentum traders, this is the market to be in. If you were not catching that breakout last week, the market would likely offer more short-term entry setups next week. However, expect some correction on Monday, as early buyers may be taking profits after the initial impulse.

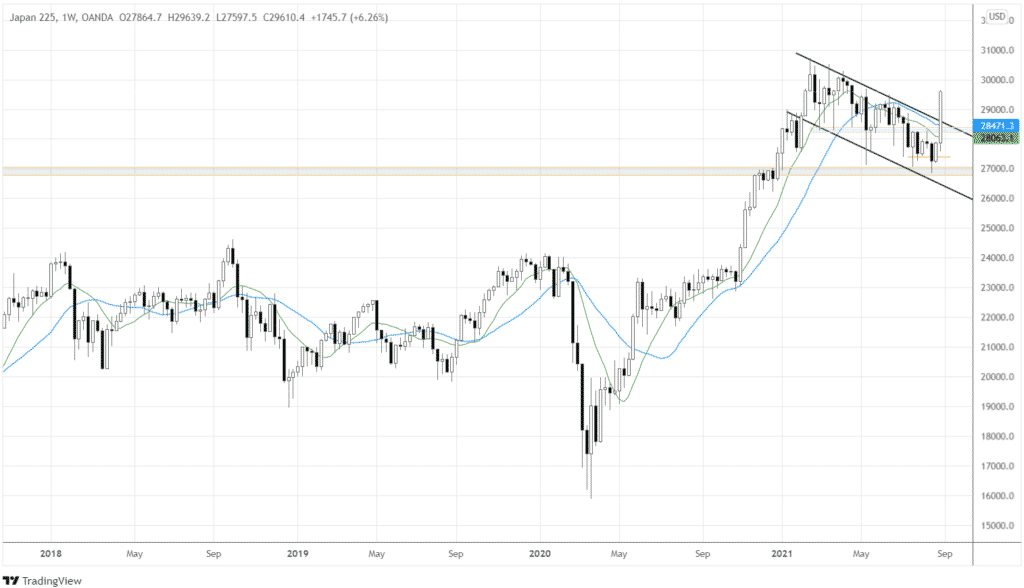

Long-term investors might also be interested in buying the index, considering the technical structure on a bigger scale. Look at the weekly chart below. The descending channel breakout is happening in the context of the rebound from the long-term resistance-turned-support 27000.

In the case of buying at this timeframe, the logical spots for the protective stop would be under the possible local support around 28400 and 100-day Moving Average, last week’s low, or even all the way below 27000, if you’re really for the long haul here.

Conclusion

The uncertainty around the Fed’s decisions sends the risk assets higher, putting pressure on the dollar. The BOJ’s dovishness spurs the risk-on sentiment in Japanese equities. Traders can take advantage of the current setup in Nikkei 225.