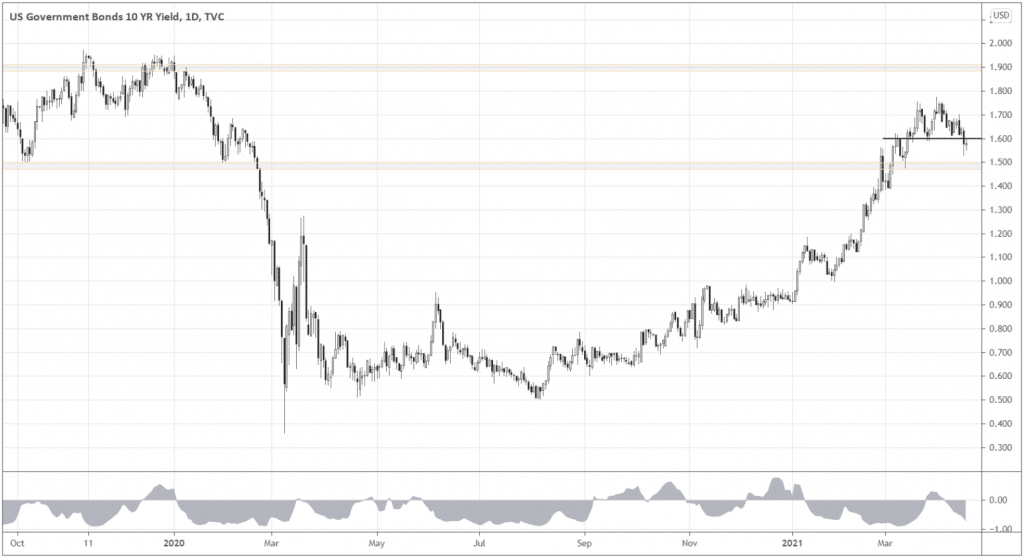

Are we really recovering from the pandemic? Bond traders seemed to believe that, as they have been dumping debt, propelling yields higher since the beginning of the year. Although the new surge in weekly covid death cases hit the US, the economy is reopening despite warnings.

We are now talking about the market being aligned with reality.

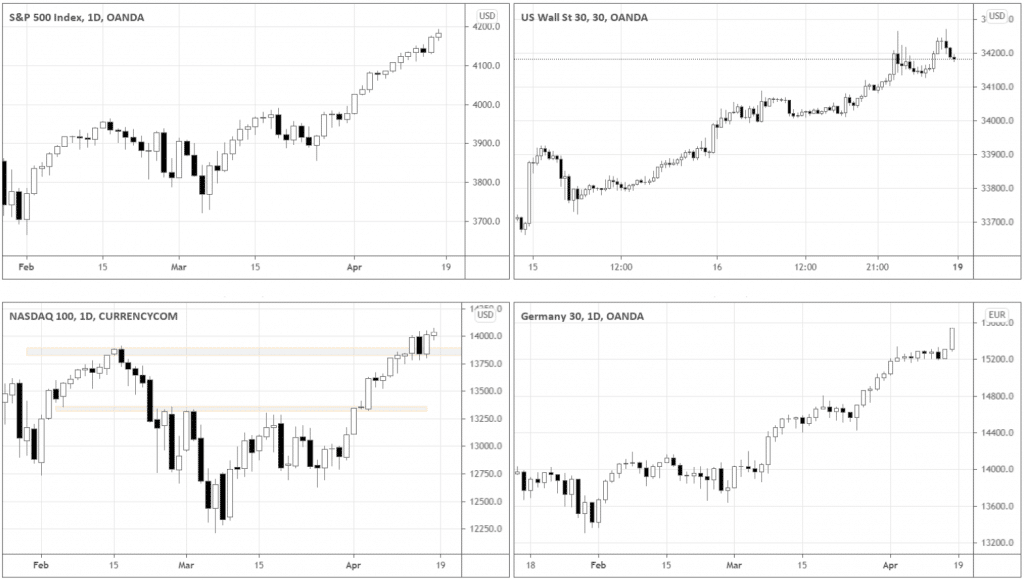

The US President’s ambitions to support the economy add to the bullish sentiment in risk assets. Joe Biden plans to inject $50 billion into the semiconductor manufacturing industry to address the current trend of chip shortage. Tech bulls and the dollar bears should be happy about it.

The recent US economic data seems positive, and the market sees it so, as western indices kept climbing and the dollar got crashed last week.

DXY and the US outlook

According to the latest data release, the US economy is progressing towards the Fed’s monetary targets. The annual inflation rate is speeding up, amounting to 2.6% as of March 2021, exceeding the Fed’s target of 2%.

The latest CPI release, which was higher than forecasted, set a tone for the whole week for the USD. DXY sharply declined right after the release and kept being under pressure for the rest of the week.

DXY moved below the significant level of 92.0, breaking the short-term uptrend structure (see the black trendline). The odds have decreased drastically that the DXY would continue a steady surge in the short term as the index closed the week below 92.0.

We may expect DXY at least to consolidate, if not keep crashing into somewhere near 90.0.

If the market doesn’t like the dollar when the data is good, it makes sense to expect DXY’s long-term downtrend continuation as the economy progresses towards Fed’s targets.

Speaking of which, the second primary indicator, the unemployment rate, is also steadily declining (11 months straight!), posting 6% in March.

Fed’s perspective on rates hike

Fed should consider rates hike after the Inflation and Unemployment stay consistently at the target levels according to Chair Jerome Powell speech on Wednesday, April 14, “We will reach the time at which we will taper asset purchases when we’ve made substantial further progress toward our goals.”

The policymaker expects it to take a while, “That would in all likelihood be before — well before — the time we consider raising interest rates.”

How long did he mean, saying “well before”? According to Dallas Fed CEO Kaplan, it should happen around 2022.

If we cannot expect rate hikes in the near term, there shouldn’t be many reasons for risk seekers to restrain bullish bets.

What are the implications of the expectations mismatch?

Expecting the rate hike, maybe bond bears got on the train too early? After Powell’s speech, 10-year yields slumped below 1.6% the following day.

So, what do we have here? We have a time window to follow the economic expansion until 2022, when the Fed aims to raise rates. In the interim, it makes sense for the risk assets to keep climbing. However, the market might have already priced in the future expansion, growing faster than the actual economic recovery.

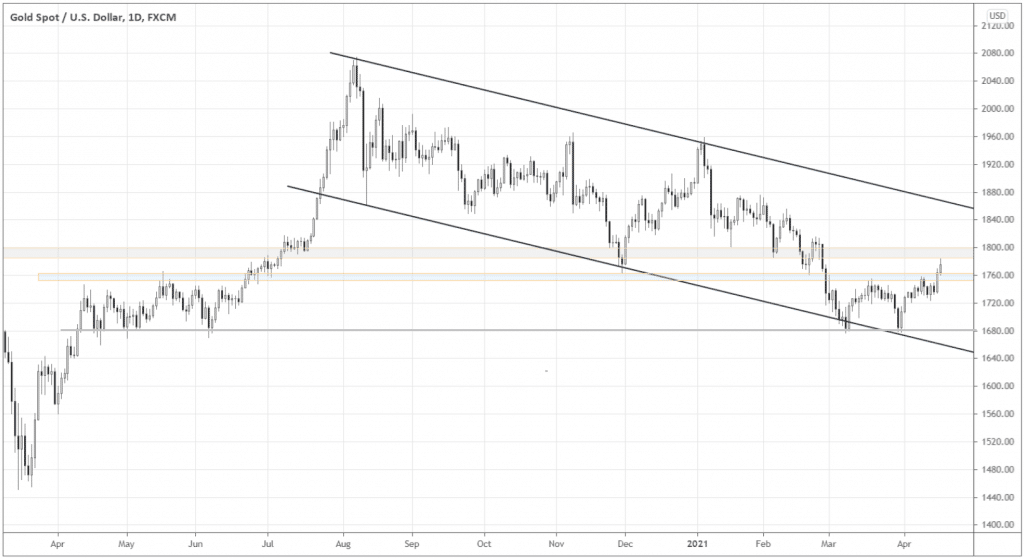

On the other hand, people buy bonds, and by the way, gold, as yields entered the new cycle of the negative correlation with gold (aka bonds in positive correlation with gold).

Look at that perseverance of the lately despised yellow metal!

Do you see how gold rebounded from a critical support 1680 and the down border of the descending channel? Technically we can expect strength in gold in the near term, especially considering it broke above the 1760 resistance level.

Meanwhile, the stock markets continue climbing, although on the decreased volume and volatility. To me, it smells like the growth is choking overall.

Can the mismatch between the views of the rate hike timing between the market and the Fed cause disappointment among investors? How will the asset prices react?

Conversely, I wonder how Fed will act if it achieves its policy objectives well before the expected time. Will we see some sort of “policy surprise”?