The Tesla stock price has gone nowhere in the past few weeks. The stock ended last week at $643, bringing its total market capitalization to more than $620 billion. This consolidation could change this week as the firm publishes its quarterly results.

Tesla earnings ahead

Tesla will publish its second-quarter results on Monday after the regular session. These results are highly anticipated because of the challenges the firm faced during the quarter.

To a large extent, the company had a strong quarter. For one, its monthly deliveries report showed that the firm sold more than 201,000 vehicles in the second quarter. This was the best quarterly delivery on record. It followed the first-quarter deliveries of more than 184,000 vehicles.

Using these numbers, analysts expect that the company’s total revenue increased to more than $11 billion in the second quarter from $10.39 billion in the previous quarter. At the same time, the earnings-per-share is expected to have increased from $0.93 to $0.98.

Still, investors will be focusing on several things from the company’s earnings. First, they will look at the impact of parts shortage in the quarter. Many automakers are currently going through the biggest semiconductor shortage ever, and there is speculation that the situation will last until 2023. The shortage happened after automakers canceled most of their orders last year as they priced in weaker demand due to the pandemic.

Second, the Tesla stock price will react to the overall cost structure, considering that many parts saw price increases. For example, in the second quarter, the prices of aluminum, nickel, and lithium surged, helped by strong demand from China.

Third, investors will also focus on the company’s Bitcoin investment. In the first quarter, the firm recorded a $200 million profit from its investment in Bitcoin. However, the price crashed in the second quarter as China intensified its crackdown. Therefore, there is a possibility that the firm’s total income will be dragged by Bitcoin.

Is Tesla stock a buy?

Tesla is the biggest and most profitable electric automaker in the world. It has a strong presence in the United States, China, and Europe.

However, the country is facing significant competitive challenges from established vehicle companies and startups. Most companies like Volkswagen, BMW, and Volvo have all invested billions of dollars in EV production. In fact, some of their products like Polestar and Porsche Taycan have received positive reviews.

Meanwhile, startups like Faraday, Lucid Motors, and Rivian have all accelerated their development. Just last week, Rivian raised $2.5 billion from investors, bringing its total capital to more than $10 billion. The firm will now start production soon. In China, Tesla is also facing strong competition from the likes of XPeng, Nio, and Li Auto.

Still, analysts expect that the Tesla stock price will keep doing well because of its developed charging infrastructure and its strong brand presence.

Tesla stock price forecast

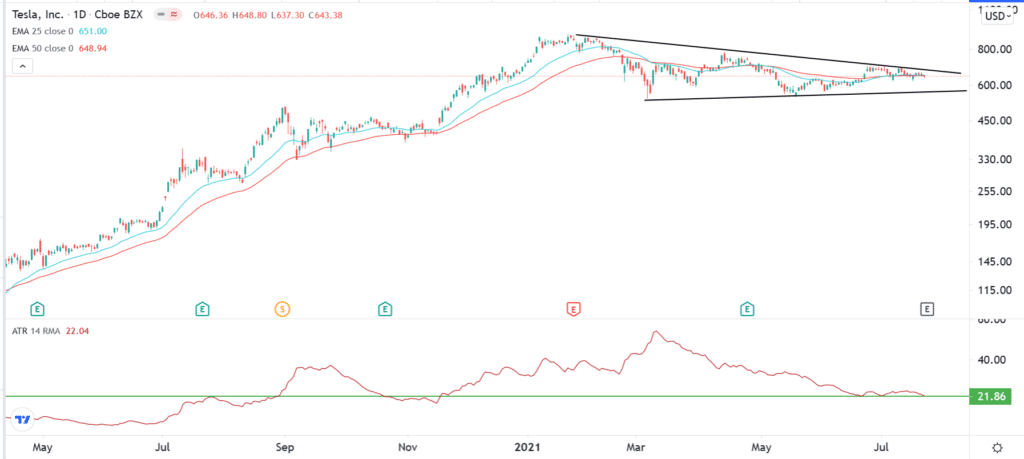

The daily chart shows that the TSLA stock has been ranging recently. As a result, it is trading at the same level as the 50-day and 25-day Moving Averages. It has also formed a symmetrical triangle pattern while the Average True Range (ATR) has declined to the lowest level since November 19.

Therefore, there is a possibility that the stock will surge after the upcoming quarterly results. If this happens, the stock will likely move above $700 as investors target the all-time high of around $900.