The Swissquote Group Holding Ltd, as listed on the Six Swiss Exchange since 2000, is a financial conglomerate headquartered in Gland, Switzerland, specializing in online banking and trading services. The company expanded to Switzerland’s most significant financial portal and runs subsidiary offices in several other countries offering STP broker trading services. It serves more than 340,000 customers and employs around 805 staff, and its trading bracket consists of stocks, warrants & derivatives, options & futures, funds, EFTs, indices, FX, commodities, bonds, and cryptocurrencies.

Pros

- It offers trading of 130+ currencies and CFD instruments.

- It is an actual STP broker.

- No account fees for ordinary accounts

- It offers diverse trading platforms integrated with robo-advisory and APIs. For example, Autochartist and MT Master editions.

- It is well established with offices in 9 countries and more than 340,000 clients.

- Every Swissquote subsidiary falls under an agency where it is located.

- It offers four types of client accounts depending on your level of trading skills.

- Forex trading leverage is 100:1

- Withdrawal of as low as $10

- Account opening is fast.

- Deposit and withdrawal are free.

Cons

- High trading fees.

- It targeted more severe and experienced newbies.

- The initial deposit is relatively high compared with other brokers.

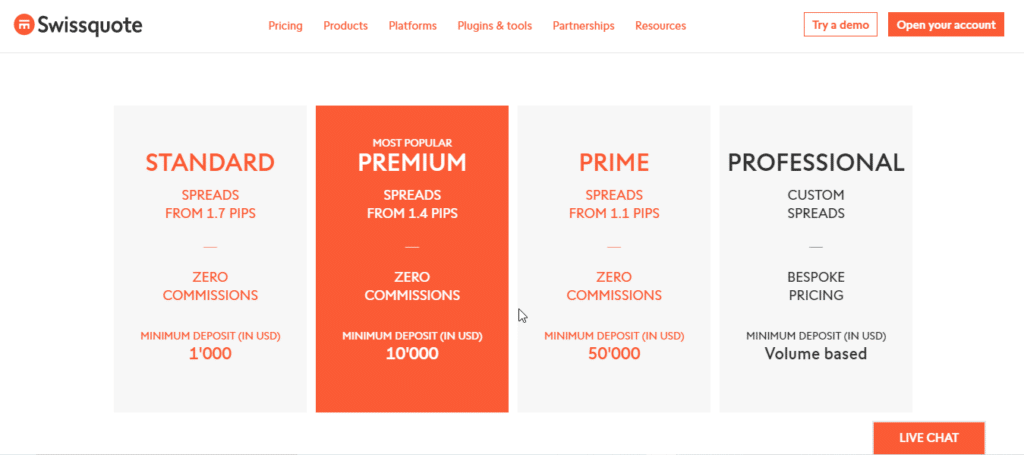

- Minimum deposit and trading conditions vary between its accounts. A standard account requires $1000 to set up, while a prime account costs up to $50000.

- Spreads differ depending on the type of account. The minimum spread for a standard account on major crypto pairs is 1.7, while a prime account is 1.1.

- Trading leverage for CFDs is low 50:1 while forex is 100:1.

- An inactivity fee imposes in 6 months.

The Swissquote Group Holding Limited is a financial giant based in Switzerland operating an umbrella of offices in London, Zurich, Bern, Dubai, Malta, Hongkong, Luxembourg, and Singapore. It started in 1990 as a business firm targeting the financial software and web application niche co-led by Mark Burki and Paolo Buzzi. It offers e-banking and trading services in Switzerland and across the world. It has 20+ years in this marketplace and serves over 340,000 clients.

Its trading class includes a range of tradable assets that clients can access. Swissquote allows customers to trade more than 130 currencies, commodities, crypto-assets, stocks & shares, indices, precious metals, among other indulging instruments. Traders access these assets across the company’s multiple trading platforms at a maximum leverage of 100:1 for forex and 50:1 for CFDs. In addition, it offers competitive spreads starting from 1.7 pips for standard account users.

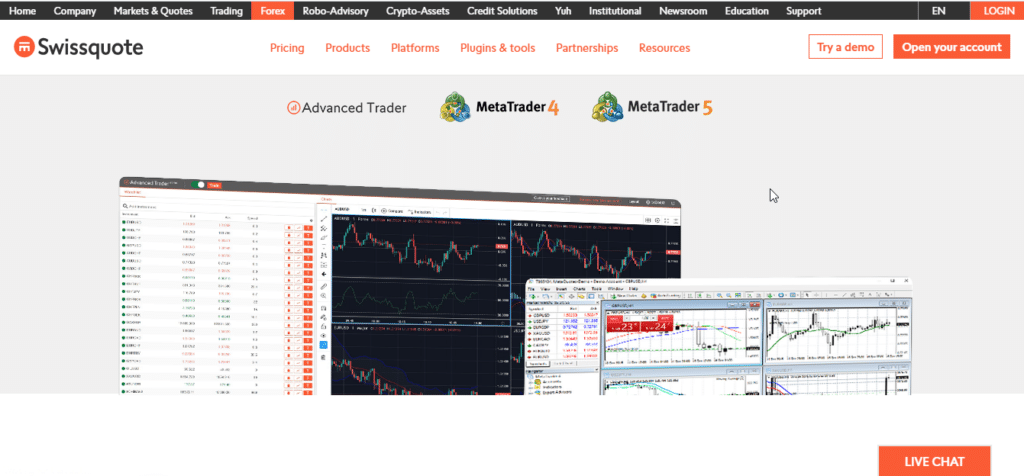

Swissquote provides liquidity through the following platforms; Advanced trader, MetaTrader 4, 5, and the new MetaTrader master edition. They integrate with smart plugins that aid in market analysis like APIs, autochartist, among others. The platforms exist as web applications, desktop applications for Windows and Mac OS, and mobile apps on both Android and IOS.

Trading through Swissquote bank limited and its subsidiaries means you are dealing with a legitimate and reputable finance company. Its regulation extends from Switzerland to every region habiting its offices. In Switzerland, it’s regulated by the Swiss Federal Financial Market Authority (FINMA) and affiliates with the Swiss Federal Banking Commission (SFBC). The other nine offices located in different regions are regulated by agencies based on that country.

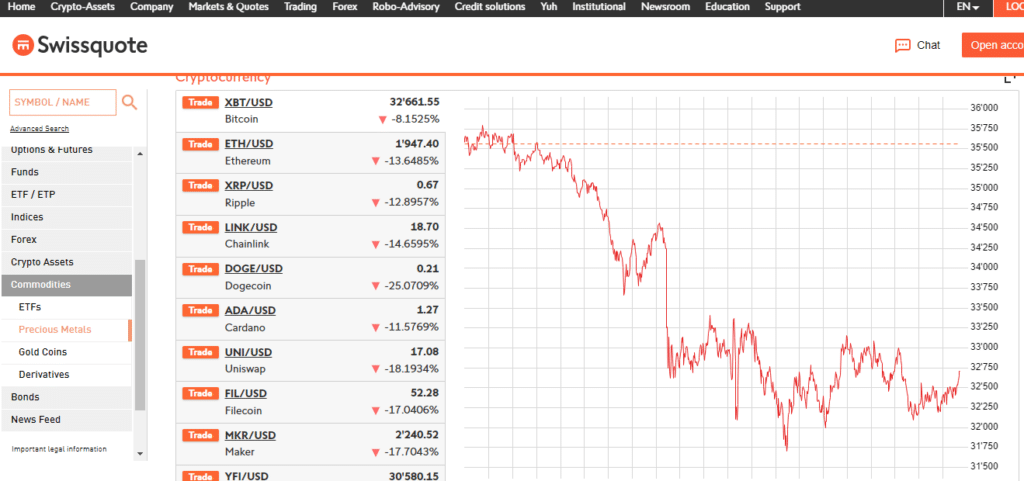

Besides, it is diving deep into the crypto market, offering the exchange of crypto-assets like Dogecoin, Bitcoin Cash, Ethereum, and Defi tokens like MarkDAO, Link, and Uni against the US dollar. Nonetheless, it announced enrolling into Initial Coin Offerings (ICOs) in 2019 to help fund the launching of new digital assets.

Regulation

As slightly introduced in this review, Swissquote Group Holding limited is extensively regulated across its branches. FINMA and members survey the main office in Gland Switzerland with the SFBC in the country. However, the other subsidiaries’ regulations depend on the land of location. The Swissquote arm dubbed Swissquote Ltd is authorized and regulated by the UK’s Financial Conduct Authority (FCA).

Swissquote MEA, based in the United Arab Emirates Dubai, is licensed with a category four license by the Dubai Financial Services Authority (DFSA). In addition, the firm’s main office operates at the Dubai International Financial Center (DIFC). The following office is in Asia, Hongkong and abides by the Securities and Futures Commission (SFC). SFC credits Swissquote Asia Ltd with a category three license.

The branch in Malta is under the supervision of the Malta Financial Services Authority (MFSA). The company holds a category four license issued by the MFSA and serves clients in Malta and other world regions.

Every office is extremely regulated according to its regional location. However, as much as the Swissquote Group Ltd operates in various regions globally, its services are off in some countries. The company services are absent in the US, Turkey, Japan, Nigeria, among other nations.

Pros

- Each branch regulation varies according to location.

- All subsidiaries conduct transparent operations to clients.

- It is well established.

Cons

- Only regulated by one top-tier agency, the FCA.

- It’s unavailable in some nations.

- Trading policies may differ depending on the regulatory body.

Account Types

Swissquote bank limited targets to work with more experienced traders or serious newbies ready to invest in Forex or CFDs. The company operates four different accounts that clients choose depending on their pocket size and level of trading skills. These accounts include the standard version, the premium account, the prime account, and a professional account.

| Standard account | Premium account | Prime account | Professional account |

| Minimum deposit — 1000 USD or its equivalent Spreads start from 1.7 pips Instruments include 75+ FX pairs, and 130+ CFDs and commodities Maximum leverage is 100:1 (for forex trading), and 50:1 (for CFDs) STP exécution Zero commissions | Minimum deposit — 10000 USD or its equivalent Spreads start from 1.4 pips Instruments include 75+ FX pairs, and 130+ CFDs and commodities Maximum leverage is 100:1 (for forex trading), and 50:1 (for CFDs) STP exécution Zero commissions | Minimum deposit — 50000 USD or its equivalent Spreads start from 1.1 pips Instruments include 75+ FX pairs, and 130+ CFDs and commodities. Maximum leverage is 100:1 (for forex trading), and 50:1 (for CFDs) STP execution Zero commissions | The minimum deposit (in USD) is volume-based Spreads are custom Instruments include 75+ FX pairs, and 130+ CFDs and commodities Maximum leverage is 100:1 (for forex trading), and 50:1 (for CFDs) STP execution Bespoke pricing |

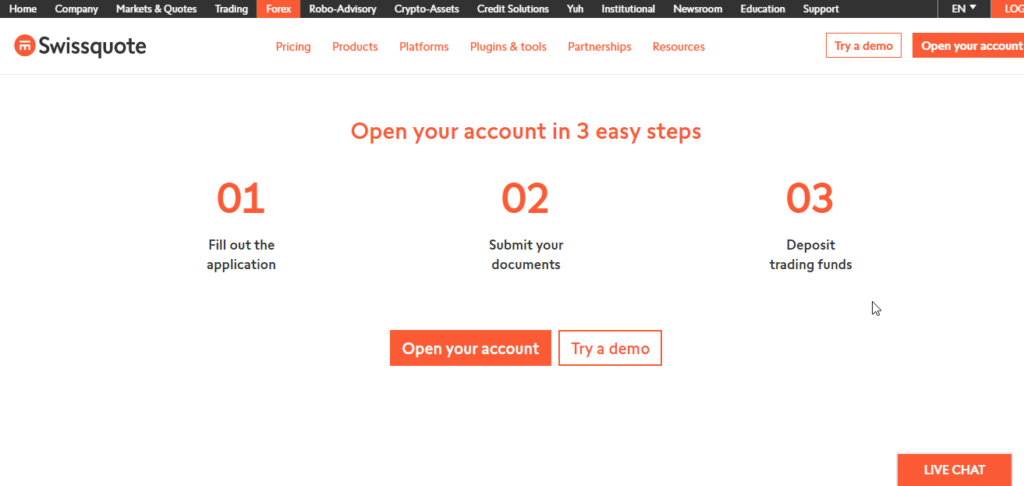

How to open a Swissquote account?

The account opening process and verification are efficient and take only 24 hours. It involves three main steps.

Step 1. Fill an online form that requires your name, email, address, among other details.

It entails four other sub-steps that ask for personal information, create a client profile, provide financial information, and review the account.

Step 2. Provide KYC documents like national ID, proof of address, among others.

Step 3. Depositing trading funds.

Fees and Commissions

They effectively depend on the account type. The spreads are much tighter in some accounts, starting from 1.1 pip and hiking the commission imposed on the volume of trades. Also, the company charges a quarterly range of 50 Swiss Franc as custody fees. For flat rates on Swiss DOTS, ETF leader, and themes trading, a fee of 9 CHF incurs. On the contrary, options & futures face a fee of CHF 1.50.

Payment options

There are plenty of payment options. Swissquote offers transactions through an e-banking portal where the client can directly get paid to a Swiss bank account. Other methods include; bank cards like Visa, MasterCard, Unionpay, and bank wire transfers. However, wire transfers are unavailable for withdrawals.

Pros

- Multiple payment options

- Deposit and withdrawal is free

- Real-time e-banking transactions for clients using the Swiss bank account

Cons

- No withdrawals for wire transfers like Skrill.

- There are imposed trading fees

- Withdrawals require filling a form and emailing it to the bank

Deposit

Swissquote accepts deposits from these methods:

- Bank Cards like Visa, Mastercard, among others

- Wire transfer through Skrill

- E-banking wire transactions

Withdrawals

They occur through the following:

- Credit cards

- Bank wire transfer

N/B: the client must fill a form and email it to the bank.

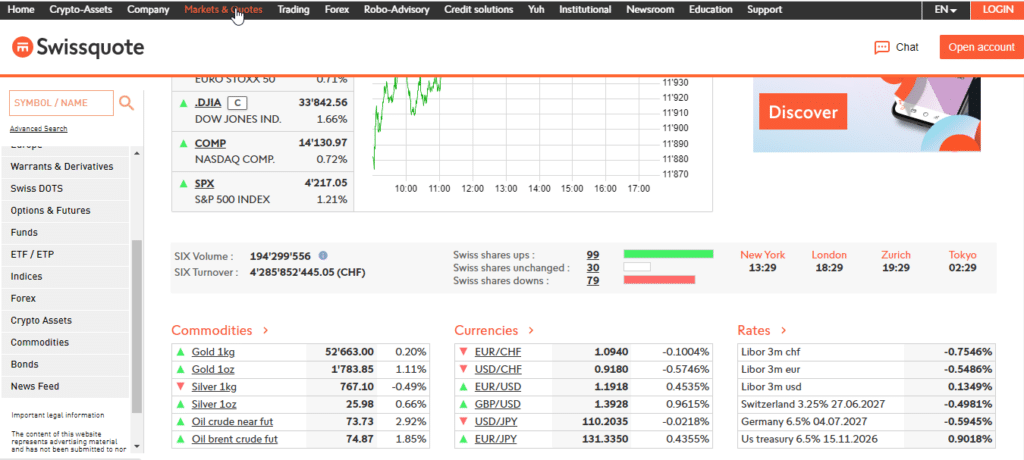

Available Markets

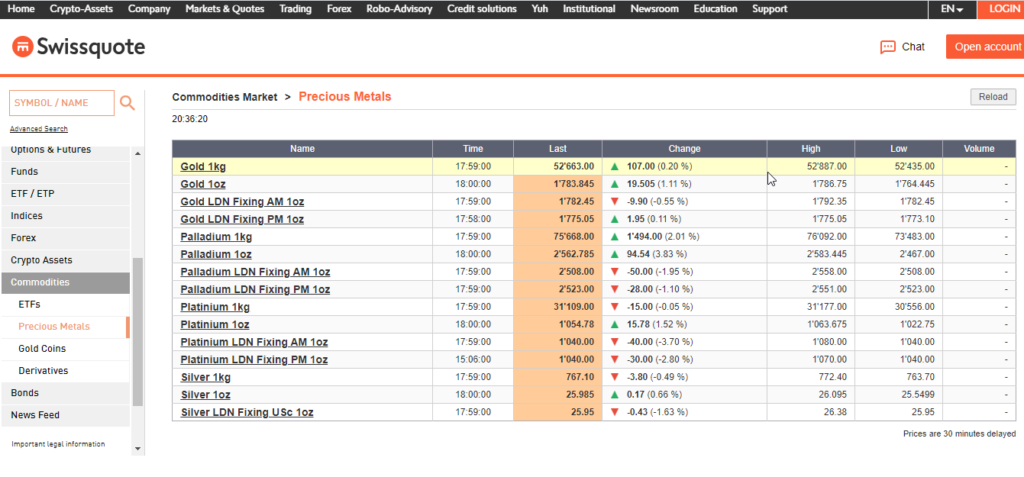

Swissquote operates as a versatile financial enterprise. Besides offering online banking services, it provides diversified trading markets for clients. Its instruments extend from FX pairs, stocks, bonds, commodities, indices, and crypto assets to precious metals like palladium.

- Forex

Swissquotes’s FX runs for 24 hours from Monday to Friday. It provides clients with 75+ currency pairs for competitive spreads and low margin rates. Clients are directly linked to the interbank and enjoy fast STP executions. The institution also guarantees flexible transaction sizes providing micro, mini, and standard lots.

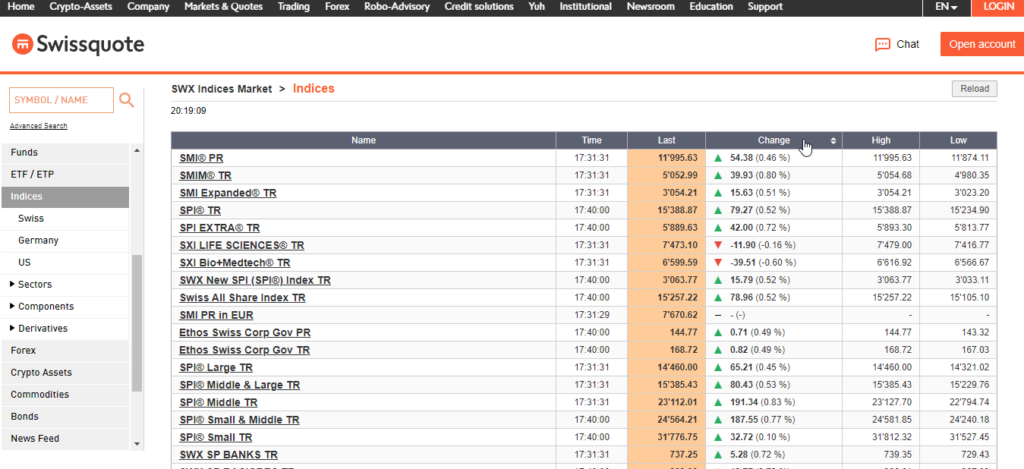

- Indices

Swissquote helps clients participate in the SWX Indices Market. It allows clients access to trade indices through Index CFDs across its platforms.

- Commodities

Commodities also trade on this company’s platforms. Customers trade commodity products like energy, metals like gold, platinum, silver, and palladium through EFTs.

- Precious metals

AS alluded, metals make up the commodities market. Popular metals on Swissquote are gold, silver, platinum, and palladium. They trade against major fiat currencies like the US dollar.

- Crypto-assets

Swissquote is investing big in cryptocurrencies. It offers 20+ digital assets traded against the US dollar. Recently, it boarded the debated stable coin Dogecoin in its crypto portfolio. Besides, it allows customers to buy major cryptocurrencies like Ethereum, Litecoin, and ripple. In addition, it provides trading of decentralized finance tokens like Link, Uni, and MKR against the USD.

Trading Platforms

The broker has three trading platforms integrated with smart plugin tools. Clients choose the platform to use depending on the device and the plugin tools fused with the platform. They select from either Advanced Trader, MetaTrader 4, or MetaTrader 5.

| MT4 | MT5 | Advanced trader |

| The MT4 platform is available on the web, mobile in Android and IOS, and desktop versions for easy accessibility in Windows and Mac OS. It offers automated trading. Other features include: A built-in editor to develop and backtest your strategies. A plethora of expert advisors. Easy to view hundreds of successful traders’ profiles and copy their deals automatically. Detects trends and forecast price direction with technical analysis tools. Plugins like Autochartist and MetaTrader Master Edition. | The MT5 platform is a predecessor of the MT4 and allows clients to experience next-generation trading because of its advanced tools and top-notch trading capabilities. It is also available in Windows and Mac OS, Android and IOS, and on the Web. Other features include: The indicator’s creating.44 analytical objects. Highly customizable charts with 21-time frames. Plugins like autochartist, MT master edition. Trading central. Most features relate to MT4’s features. | A web-based trading platform for FX and CFD trading. User-friendly and powerful tools. 50+ intelligent charting tools. 80+ technical indicators for the analytically minded. Synchronized layout for multiple charts. |

Features

Generally, Swissquote’s features include:

- Plugins like autochartist and MetaTrader master edition

- The robo-advisory tool manages client accounts digitally

- Analysis tools

- e-Trading platform

- Mobile apps

- Tesla app

- Fix API

Education

Swissquote’s fundamental goal is dealing with highly skilled traders. It provides clients with tutorial materials through its education platform to scale their trading skills. However, the tutorial offers are done distinctively as the level of mastery in clients differs.

There are basic tutorials, while long-term trading lesson administration happens via webinars, seminars, and trading glossaries. In contrast, the company offers short trading courses.

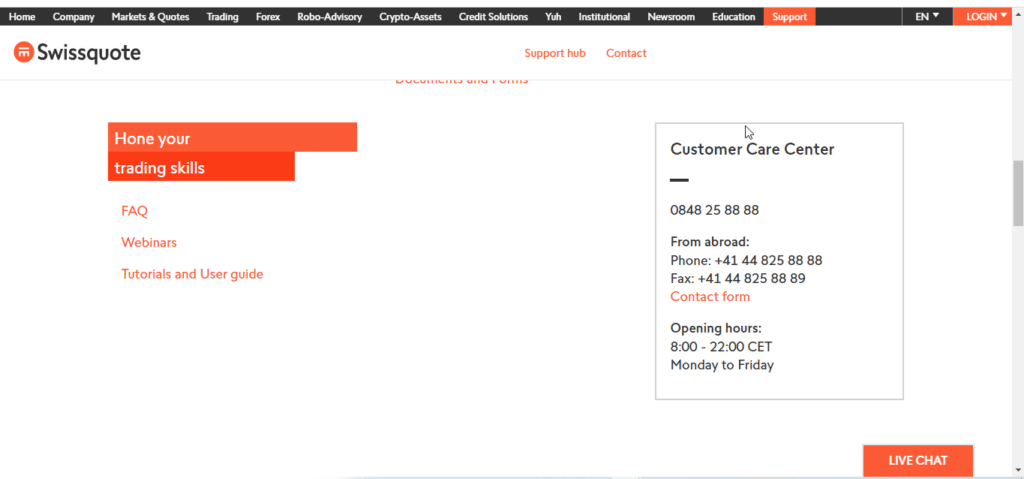

Customer Support

The customer support at the Swissquote Group Holding Limited is efficient. Each branch has its customer care numbers that clients use to contact a specific office. The institution’s website allows clients to access customer care sections made up of FAQs, videos, and webinars with most burning client issues.

Besides, the robo-advisory operates the section solving and answering most customers’ problems and issues before contacting customer care. In addition, phone numbers link to a reliable customer display on the section for clients to dial for questions or any case.

Review Summary

The Swissquote Group Holding Limited is a well-established financial institution. Its services surge in several regions of the globe. This is through the company’s subsidiaries located and regulated in different places of the world. Its financial services are versatile as it provides online banking and instruments’ trading. The trading niche entails multiple assets that clients trade 24/5. However, due to its high deposit stake, the broker is suitable for severe beginners and experienced traders.