The stock market is a labyrinth of diverse stocks. When someone merely mentions the word, stock, we could think of just one kind. However, nuances for each type of stock exist, which are critical for acquiring adequate knowledge about the stock in question.

At its core, we class stocks either as common and preferred. Further diving into these two distinctions, we divide this instrument by market capitalization and its major types. We must also bear in mind a company can cross over in various stock categories. For example, Microsoft can be considered a blue-chip and growth stock. Besides being one of the most valuable brands worldwide (making it blue-chip), even with its already massive growth, predictors expect the company to grow even further.

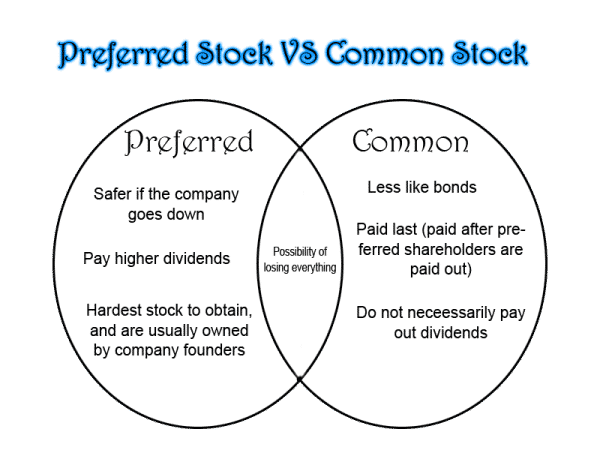

Preferred vs. common stock

Any stock for investors represents some portion of ownership in the listed company. The glaring difference between the two forms is that preferred stocks provide no voting rights to the shareholders and board of the listed company, while the latter does. Common stocks are actually those we’re most familiar with generally when we think of this instrument. Common stocks may earn dividends from the company they invested in, though these are not a must, nor do they have any guarantee in frequency.

Preferred stocks are not traded on a stock exchange, unlike their counterpart, and are very identical to bonds. They also offer higher and guaranteed dividends. Essentially, common stocks are more for the average retail trader or investor aiming for quicker and greater growth, while preferred stocks are for institutional investors, looking for predictable income.

Market capitalization

As with some financial markets, analysts class stocks into different market capitalization categories, namely:

- Large-cap (at least $10 billion, e.g., Tesla)

- Mid-cap (ranging between $2-10 billion, e.g., Vanguard S&P Mid-Cap 400 ETF)

- Small-cap (ranging between $300 million and $2 billion, e.g., Tupperware)

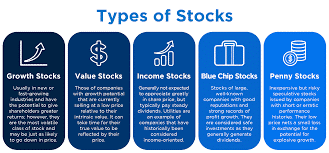

Analysts make auxiliary distinctions with stocks according to their nature. One must consider this list isn’t definitive, and what makes one stock unalike another is subjective. Generally, the best way to know which category a stock falls in is by looking at its market capitalization since that’ll give you a general idea. For example, blue-chip stocks are the most lucrative and appealing, effortlessly passing the $10 billion market cap, qualifying as large-cap. As mentioned previously, many of these companies cross paths for the different categories below.

- Growth stocks: Growth stocks are companies forecasted to have significantly higher earnings than what the markets suggest. These could be relatively old and newer corporations. In most cases, they either pay low or no dividends for several years as the general idea is for these companies to reinvest their earnings to grow even further. Examples of such stocks include the likes of Netflix, Facebook, Amazon, to name a few.

- Value stocks: Analysts consider these stocks undervalued yet provide potential unseen by the markets. This concept of value is most synonymous with Warren Buffett and his philosophies of value investing. The general perception of the listed company is they possess more assets than what the stock price suggests. Value stock brands are very mature businesses with steady revenues, which can increase spectacularly over time. Examples of value stocks are Walmart, Cisco, etc.

- Income stocks: As the name suggests, income stocks pay dividends on a predetermined basis. While some may assume income stocks to have limited future expansion, many high-performing stocks continue to pay dividends every year. An example of an income stock is Verizon. Income stocks are also commonly found in REITs (real estate investment trusts) and less popular sectors like energy and utilities. Investors prefer such stocks as their design was to produce income and have less engagement trading-wise than other stocks.

- Blue-chip stocks: These corporations are massive in size, well-known, and have proven profitability consistently over the years or even decades. We generally consider them market leaders in their respective industries as they possess much of the market share. Blue-chip stocks are plentiful and include household names such as Apple, Coca-Cola, etc. Risk-wise, blue chips are more stable because of their impressive track record and longevity. Due to their prestige, blue-chip stocks also tend to be pricier than the rest, but many of them pay dividends.

- Penny stocks: Penny stocks are low-priced stocks that cost less than $5 a share. They are considered the most speculative of all stocks. Penny stocks tend to be issued by small, obscure start-up companies. There are several glaring disadvantages with penny stocks like the lack of liquidity, lack of company fundamental information, and susceptibility to fraud. Of course, the biggest attraction with penny stocks is their low prices compared to other more established businesses. Surprisingly, there are many prominent corporations that we could consider penny stocks even now, such as Ford and Xerox. While many of these brands aren’t necessarily less than $5 a share, they have been somewhere in their history and are still significantly cheaper than other large companies.

Conclusion

As we can see, there are so many different forms of stocks that each have unique attributes. In this sense, the stock market has a broader range of instruments than most financial markets. Knowing the categories of stocks should align with the sort of investor one is. For example, investors willing to withstand more risk might bet on penny stocks, while more long-term investors may prefer income stocks. Picking the best stocks ultimately all boils down to an investor’s risk appetite and goals in the end.