Retirement planning is an important concept that many people are embracing. More than 60 million Americans have an Individual Retirement Account (IRA). Among taxpayers, the average amount of money in their IRAs is about $160,000. In this article, we will look at how you can invest in stocks as part of your retirement planning exercise.

Why retirement planning is important

Retirement planning is important for several reasons. For one, most Americans retire at 66 years. At the same time, the expectancy rate in the United States is about 78 years. As such, after you retire, you can expect to live for at least 12 years. This means that you will need a substantial amount of money to live comfortably.

Worse, in most cases, people in retirement have more needs than younger people. For example, they spend more money on healthcare. Some of the top benefits of retirement planning are:

- It helps ensure that you invest enough cash that will last for many years after you retire.

- A good retirement plan helps to ensure that you generate substantial returns in your portfolio.

- Retirement planning is an excellent way to save money on taxes.

- It also helps you have a good life both in your professional life and in retirement.

- Retirement planning helps to maximize returns while minimizing risks.

How stocks work

Stocks are small parts of a company that investors own. For example, if you invest $10,000 in a company like Etsy that has a market capitalization of more than $21 billion, you own a small part of the company. As such, your shareholdings will depend on how the stock performs.

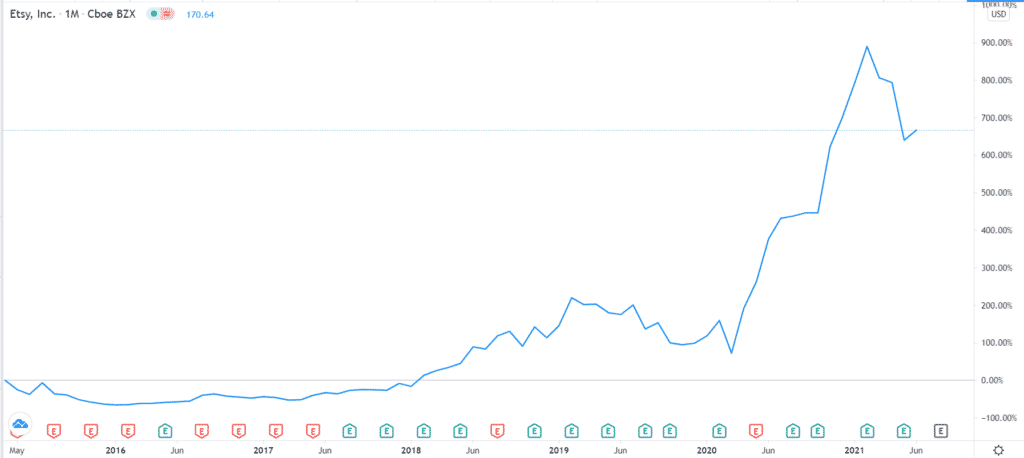

For example, as shown below, Etsy’s shares have risen over 900% from the time it went public. If you invested $10,000 in the stock, the shares would be worth more than $90,000.

Etsy stock price

In addition to share appreciation, investors make money through the dividends that the company pays. A dividend is simply the profits that the company distributes to shareholders.

Types of stocks

Stocks are not all the same. For one, there are more than 4,000 companies that are publicly traded in the United States. These firms are all in different sectors.

Below are some of the most popular sectors.

- Financials – These are firms like banks, investment companies, insurance, and financial services. Examples are Goldman Sachs, Blackrock, and Blackstone.

- Technology – These are companies like Apple, Microsoft, and Netflix that use modern technology to provide solutions.

- Consumer staples – These are firms like Unilever, P&G, and Coca-Cola that provide products that people need for their day-to-day needs.

- Consumer discretionary – These are companies that sell items that people want or those that are not considered essential. Some of these are Louis Vuitton, Hermes, and Starbucks.

- Energy – These are firms like those in the oil and gas sectors like Chevron and ExxonMobil.

Other sectors in the market are retail, materials, communication, and utilities.

Stocks can also be classified by the stage of their life cycles they are in. For example, an old company like ExxonMobil is valued differently than new-tech companies like Palantir Technologies, Roku, and Docusign.

Below are the popular types of companies by their life cycles.

- Growth stocks – These are companies that are experiencing substantial growth in their businesses. These firms record strong growth but low profitability. Some of them are Okta, CrowdStrike, and Upwork.

- Emerging stocks – These are publicly traded companies that are relatively new and those that are still developing their products. Examples are companies like QuantumScape, Nikola, and Lucid Motors.

- Value stocks – These are stocks of relatively stable companies but those whose valuation is relatively depressed. These firms have relatively stable revenues and often pay dividends.

- Income stocks – These are relatively boring companies that people buy solely for the dividends they provide. Dividend kings are firms that have paid and increased dividend dividends for more than 50 years, while aristocrats are those that have done that for 25 years.

How to create a sound retirement portfolio

Having a good and well-diversified portfolio is an essential concept in retirement planning. We recommend that you create a portfolio that combines companies in different sectors and those in different life stages.

The lion’s share of your portfolio should go to companies that pay a dividend. These firms will guarantee you a regular income for your retirement. You can also reinvest some of these dividends in other companies.

As you select dividend stocks, consider the following points.

- Credit rating – Knowing how independent rating agencies like Moody’s and S&P Global have rated the company will help you know how stable it is.

- Dividend yield – Look for a company with a good yield. You can diversify your portfolio with high-yield companies and those that have a lower yield. The former are usually relatively safer.

- Historical performance – While past performance is not an indication of future results, look for companies that have done well before.

- The sector of the company – Look for companies that are in a good sector that is growing. For example, a dividend company like Apple operates in sectors that have substantial growth.

After creating a good dividend portfolio, you should allocate some of your retirement funds to growth companies. This is important since growth stocks tend to outperform value companies in the long term. Look for momentum companies that have a strong market share, good product, and excellent management. Alternatively, invest in an ETF that tracks growth stocks.

Summary

In this article, we have looked at what retirement planning is and its benefits. We have also looked at how stocks work and some of the benefits of investing in stocks. Further, we looked at the types of stocks and how to create a balanced portfolio. Doing all these will help you have a good-performing retirement portfolio.