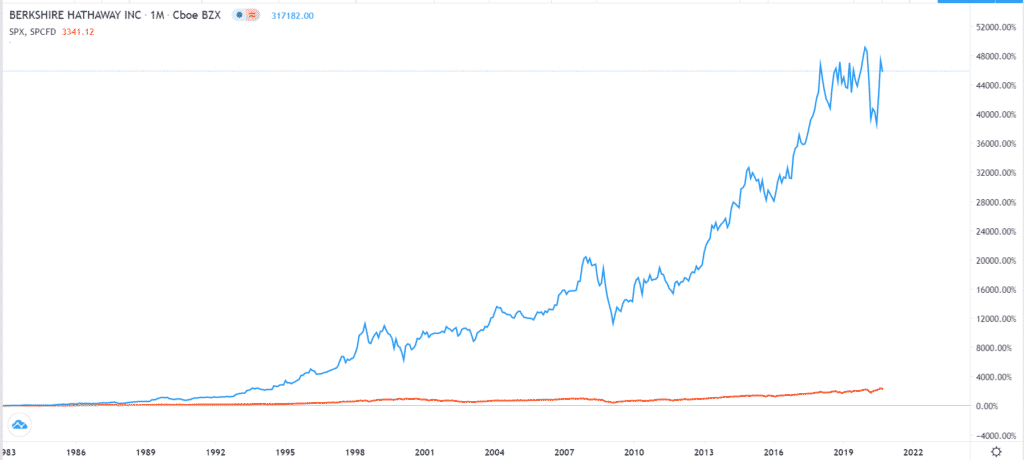

Warren Buffett is one of the best-investors in our generation. Only James Simons of Renaissance Technologies comes close. Indeed, since 1983, Berkshire Hathaway’s stock has grown by more than 38,080% while the S&P 500 index has jumped by just 2,500%. In this report, we will look at the best Warren Buffett stocks to invest in today.

Amazon (AMZN)

While Warren Buffett has done well over the past decades, his recent performance has been relatively sluggish. Indeed, in the past five years, Berkshire Hathaway stock has returned about 63% while the S&P 500 and Nasdaq 100 have returned more than 70% and 160%, respectively.

The reason for his relatively poor performance is that he has largely avoided investing in technology companies that have helped the Nasdaq and S&P do well. He has ignored the industry mostly because he does not understand it well. For example, he has not invested in Facebook and Twitter because he doesn’t understand or use the tools.

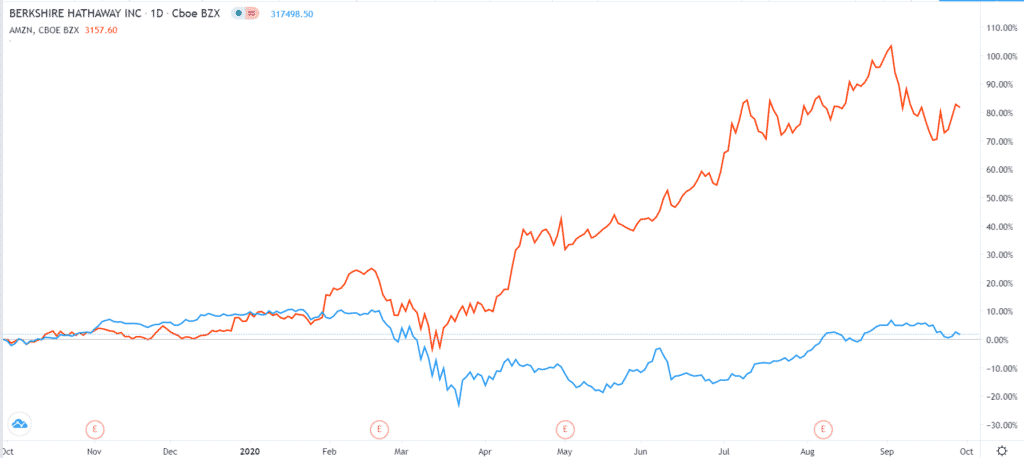

One of his first major tech investments was Amazon, which he started accumulating in 2019. Today, he owns more than 533k Amazon shares, which are worth more $1.8 billion.

At $3,161, Amazon is not a cheap company. However, there are still several reasons why it makes a good investment. First, Amazon has more than 150 million Amazon Prime members who pay about $120 per year. That service in itself brings more than $13 billion in revenue per year.

Second, Amazon has a large moat that very few companies can compete with it. Third, Amazon is the market leader in cloud computing, an industry that is expected to grow rapidly in the future. Fourth, Amazon is a good investment because of the diversity of its business. For example, it is now a leading player in e-commerce in India, a leading firm in artificial intelligence, and grocery.

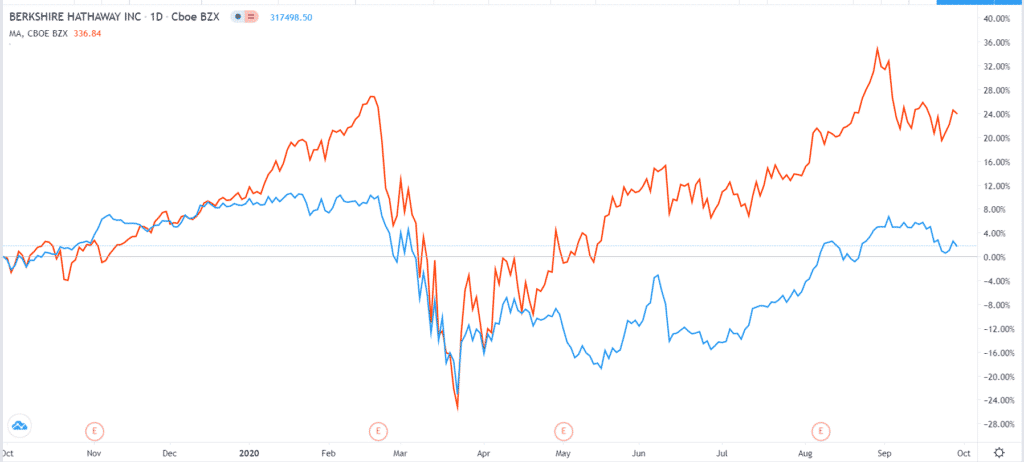

Berkshire Hathaway vs Amazon

Apple (AAPL)

Apple is one of the best Warren Buffett stock you can invest in today. Buffett first invested in Apple in 2016 and increased its stake over the years. In total, he owns more than 982 million Apple shares that are now worth close to $90 billion. This makes Apple his biggest holding, representing about 44% of his total portfolio. Most importantly, Apple has made him more than $60 billion in the past few years. This year alone Apple shares have jumped by more than 52%.

While Apple is not a cheap stock anymore, there are several reasons why it still makes sense to invest in the firm.

First, like Amazon, Apple has built a large subscription business. In the last earnings call, the company revealed that it had more than 565 million subscribers to its digital services industry. These include App Store, Apple Music, Apple News, Apple Arcade, and Apple TV+ among others. And it is aiming to reach 600 million members by the end of the year. Therefore, even if the average revenue per service is about $5 per month, it means that the firm is generating more than $36 billion every year.

Second, Apple’s accessories and wearable business is growing fast. For example, the coming iPhones will not ship with a charger. This presents an opportunity for the firm to save money and also make a lot of it in charger sales. Third, Apple has an incredible balance sheet, with more than $100 billion in cash. Finally, it has a long history of paying dividends, which are supported by its low payout ratio.

Mastercard (MA)

Warren Buffett invested in Mastercard in 2011. Today, he owns more than 4.56 million shares in the company that are worth more than $1.3 billion. This means that the company represents below 1% of his portfolio. Still, Mastercard has been a good investment for Buffett.

Like Apple and Amazon, Mastercard is not a cheap stock especially now that it is trading at a 50x earnings multiple. However, the company makes a good investment for a number of reasons. First, the company operates in a high-margin industry where it only provides the technology. It spends minimally on marketing since banks/issuers do that work for it. Also, since it does not lend to people, it has low credit risk.

Second, due to Covid-19, the role of digital transactions is expected to increase. As it happens, Mastercard will benefit from that. Third, Mastercard operates in a duopoly, where its major competitor is Visa. That means that it is very difficult for startups to compete with it.

Mastercard vs Berkshire Hathaway

RH (RH)

RH Holdings, formerly known as Restoration Hardware, is a fast-growing luxury home furnishing store with a market cap of more than $7 billion. The firm has annual revenue of more than $2.67 billion and a profit of more than 220 million. It has 83 retail locations.

There are several reasons why RH makes a good investment. First, the firm targets upscale buyers who tend to be less affected in downturns. Indeed, in 2020, the firm’s stock has jumped by more than 70%. Second, the firm offers unique products that it is almost impossible to find anywhere else. This makes it an ideal investment when most Americans are looking to upgrade their furnishings.

Third, and most importantly, RH has minimal presence abroad. This opens a vast opportunity for it to expand its business especially in Europe and China.

Still, a major risk for RH is that its balance sheet is not all that strong. The firm has only $17 million in cash and short-term investments. On the other hand, it has more than $53 million in short-term debt and more than $685 million in long-term debt.

Snowflake (SNOW)

Snowflake is the latest technology investment by Warren Buffett. He invested 6.1 million class A shares in the firm, which are now valued at more than $1.5 million. That is an excellent short-term return considering that he invested about $250 million. For starters, Snowflake is a technology company in the cloud computing sector.

It provides data warehousing to some of the biggest firms around the world. According to IDC, Snowflake’s industry is growing rapidly and is expected to reach more than $84 billion by 2023. This growth is evidenced by the company’s revenue growth. In 2019, it made more than $264 million. On the other hand, in the first six months of the year, the firm’s revenue was already more than $241 million.

While Snowflake is clearly overvalued, the reality is that traditional valuation metrics don’t seem to work in the SAAS industry. Indeed, some firms like Salesforce, Okta, and Shopify have done extremely well over the years even with stretched valuation multiples.

Final thoughts

Warren Buffett is an exemplary investor who has a long track record of success. However, not all the companies he invests in ends up being successful. For example, his recent investments in Occidental and Kraft have not been successful. Still, we believe that your portfolio will do well if you invest in the five companies we have mentioned in this report.