US stock futures remained calm on Tuesday ahead of key consumer prices data in March. Stock and bond investors seek to assess whether the projected US economic recovery will trigger a sharp rise in inflation.

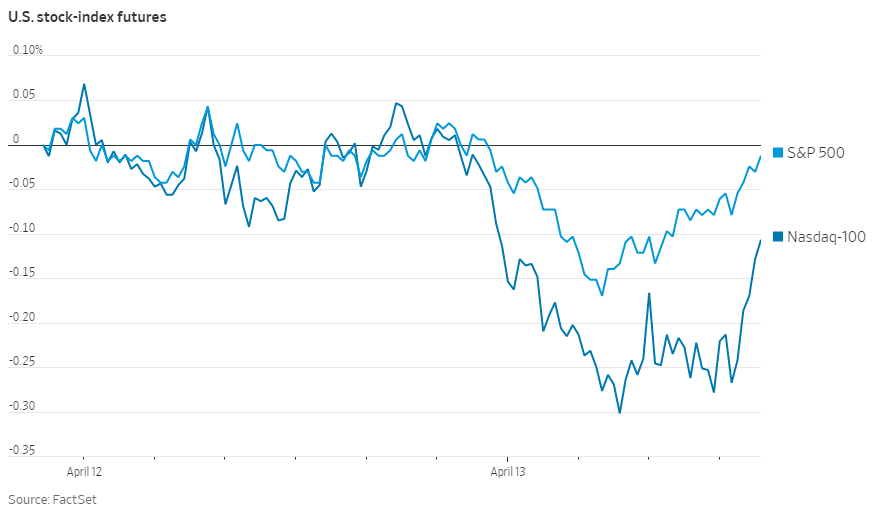

Futures tied to the S&P 500 wavered between gains and losses, with the broad-market index hovering near its recent record closing high.

Futures on the technology-heavy Nasdaq-100 remained relatively flat.

Pan-continental Stoxx Euro 600 rose 3%.

Japan’s Nikkei 225 gained 0.7%, while Hong Kong’s Hang Seng Index jumped 0.2%.

The yield on the 10-year Treasury note ticked up to 1.693%, from 1.674% on Monday.

Earlier this year, a sharp uptick in inflation expectations led to a rise in bond yields and a lessened appetite for richly valued technology stocks last month.

Higher yields at the back of stronger inflation could lead to the rotation of portfolios out of very risky equities to less risky bonds.

Stocks are, nonetheless, expected to continue to climb as long as the economy grows, even if inflation moves higher.

Global stocks are currently mixed. S&P 500 is down 0.020%, NASDAQ 100 is down 0.19%, Euro Stoxx is up 0.21%, NI225 is up 0.72%, Hang Seng Index is up 0.15%