Stenvall Mark III is the 3rd generation of the EA Stenvall, the first version, which was created back in 2016. As per vendor claims, the system is better than other EAs simply because it has been tested for several years and proved to work. The strategy used is also stable and will never lose its significance due to the peculiarities of the EURUSD pair. The EA needs to be analyzed to gauge if the developer’s assertions have any truth in them. Let’s get down to business.

Stenvall Mark III is very costly. To get a lifetime copy, get ready to pay $980. Though the annual renting option seems cheap ($399), it can be expensive in the long run. A refund policy is missing. So, don’t expect the vendor to return your money if the product doesn’t meet your trading needs.

Stenvall Mark III trading strategy

According to the vendor, this EA uses two main trading styles: trend and counter trend. The first approach tries to capture profits when the price of a currency pair is moving in a sustained direction. The second one entails making gains by trading against the current, wider trend. The grid strategy is included in the algorithm, but this info is not in the public domain.

Stenvall Mark III features

This system has several features:

- Performance monitoring is open and available for viewing 24/5.

- The robot does not utilize ticks, only technologies.

- It is not sensitive to the broker, spreads, and requotes.

- The system does not engage in rollover trading during 00:00 hours when spreads expand.

- It protects every position by a stop loss.

- About 76 functions are on board.

- It is designed to trade the EURUSD currency pair on the M5 timeframe.

- The EA runs on the MT4 or MT5 platform.

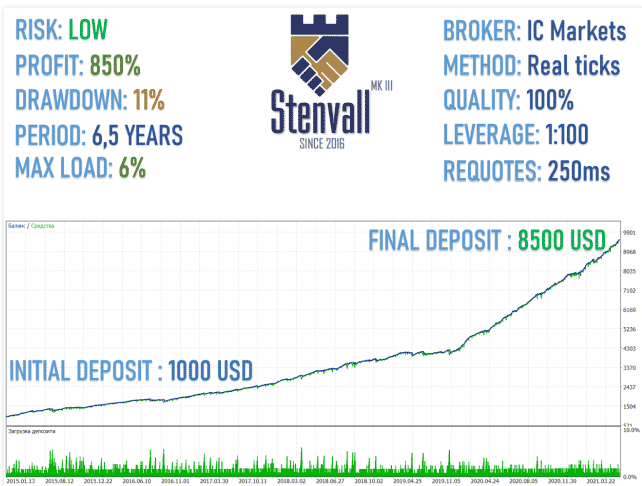

Stenvall Mark III backtesting results

This is not your ordinary backtest data report as it is lacking in detail. It is not clear what timeframe was used, the exact trading period, or the percentage of the modeling quality. Info on win rates, trading rate, profit factor, etc., is also absent. Anyway, the EA was tested for 6.5 years using a deposit of $1000. In the end, a total profit of $8500 was generated, which represented an 850% growth rate. A drawdown of 11% meant that the strategy used didn’t take many risks while trading.

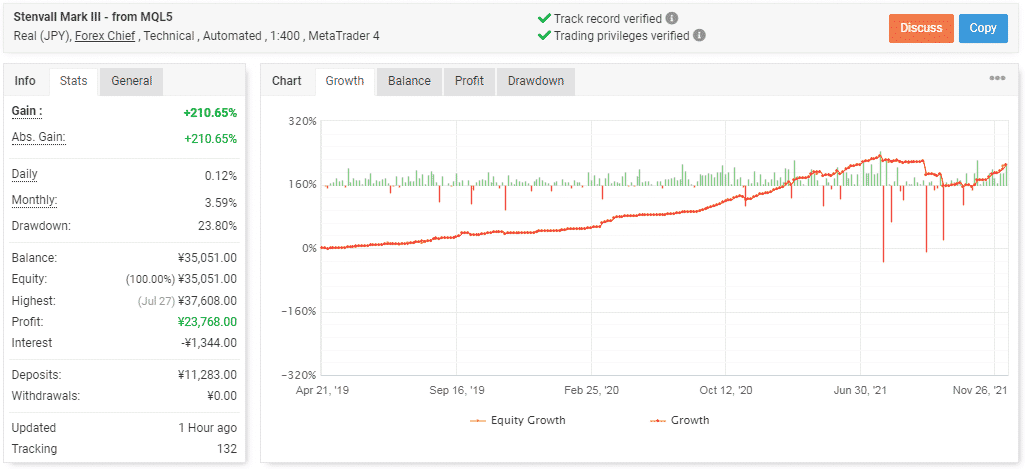

Stenvall Mark III live trading results

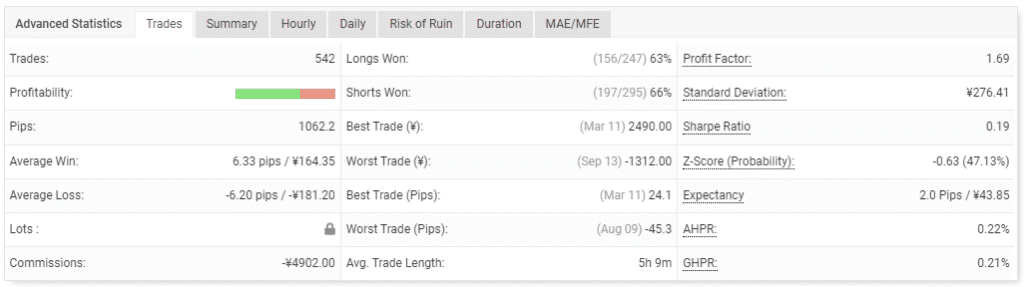

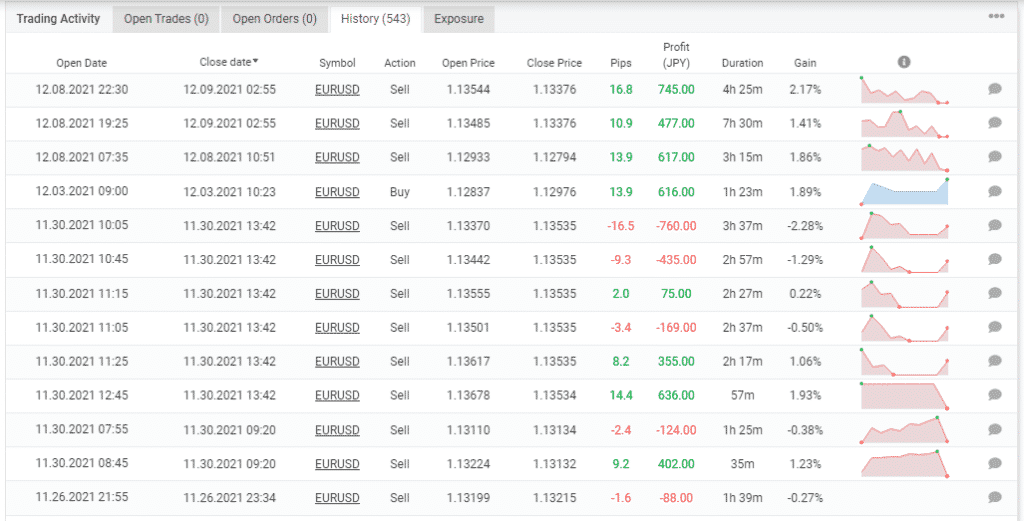

At a glance, these results look astounding. Till now, the robot has managed to make a profit of ¥23,768 after completing 542 trades. So, the EA has doubled the investment. Overall, the gain made is 210.65%. The current drawdown is 23.80%. This is an acceptable value, given that the account was activated in April 2019. It means that the strategy on board does not cause many losses.

There are 1062.2 pips, with an average win of 6.33 pips and an average loss of -6.20 pips. The outcomes for long (63%) and short positions (66%) are unpleasant. The system holds a trade for 5 hours and 9 minutes on average. To date, the best trade managed to earn the account $2490, while the worst one caused it to lose -$1312.

The robot mainly worked with a grid of orders and held each order for some minutes or hours. As a result, substantial profits were generated. The account also suffered big losses on several occasions.

Stenvall Mark III reputation

A Russian called Gennady Sergienko is responsible for developing this expert advisor. However, we don’t know much about him, only that he is also the creator of Alexis Stenvall, Ruxzo, Franc Pacific, North Star, CounterTrend Indicators Systems. There’s zero info about his other qualifications or trading experience.

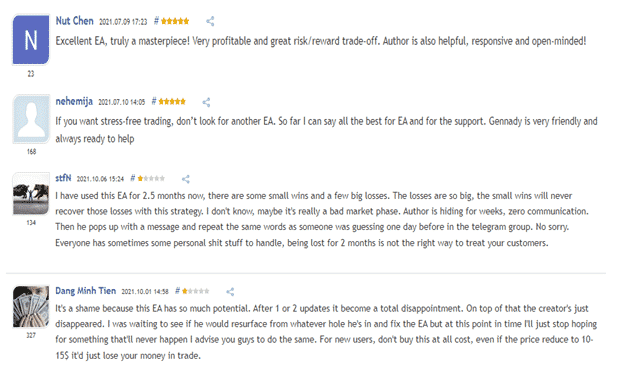

This robot has an average rating of 2.5 on mql5. This indicates that some traders like it while others don’t. The claim among the satisfied clients is that Stenvall is very profitable, has a great risk/reward ratio, and best customer support. However, a section of traders disagree. They say the EA makes small wins, and the big losses made are irrecoverable. Furthermore, the vendor can disappear for months.

Stenvall Mark III review summary

- Strategy – 4/10

- Functionality & features – 5/10

- Trading results – 4/10

- Reliability – 5/10

- Pricing – 3/10

We have seen from the live trading stats that the EA can generate considerable returns for the user. Some traders have also confirmed that the system is profitable. You have to keep in mind that Stenvall works with a dangerous approach. Therefore, it can cause huge losses, and some customers had to find this out the hard way. Furthermore, we are informed that the vendor may disappear when you need him most.