The 20th century is characterized by significant changes in the global financial system. As countries started to print their own money, inflationary pressures began piling up, forcing people to look elsewhere to protect their wealth and affirm their purchasing power.

Amid the widespread printing of money that came into play, some siblings felt that the value of most fiat currencies had been eroded. Likewise, they embarked on an ambitious plan to bet against fiat currencies.

The Hunt brothers

Nelson Bunker Hunt, William Herbert Hunt, and Lamar Hunt were the three brothers who sought to protect their purchasing power in a unique way. The three had initially inherited a huge fortune from their father, a billionaire, who had made significant wealth in the oil business.

With so much wealth at their disposal, the siblings sought to protect their purchasing power by essentially betting on silver. Likewise, they embarked on an aggressive buying spree in the early 1980s in ways that shocked the markets as well as governments.

The Hunt brothers invested in the metal on fears that inflation would result in the precious metal becoming a safe haven like Gold. They also ramped up their purchase on fears that inflationary pressure will end up destroying the value of any investment tied to paper money.

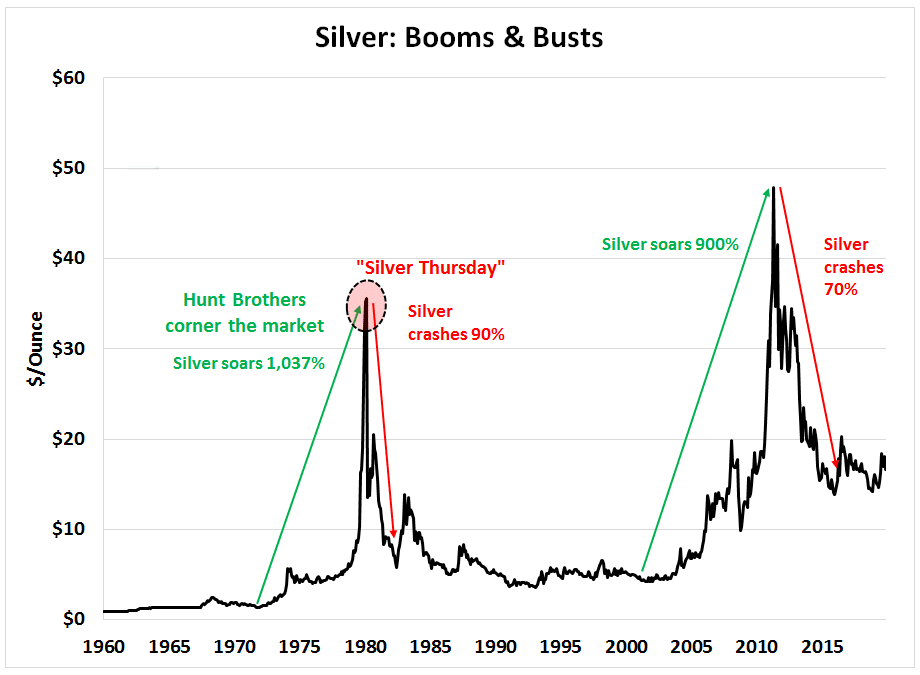

Amid the buying spree, the XAG price moved from $6 to over $40 an ounce, and with it came a huge fortune for the trio.

Silver Thursday

While the siblings were extremely wealthy at the time of ramping up purchases, they had relied on margin loans to make the purchases. While the siblings took in physical silver and future contracts, they did not close out the contracts with a cash settlement. Instead, they took delivery and opted to stockpile using the live cash reserves at their disposal. They borrowed heavily to finance their buying spree.

At the height of the buying spree, they had accumulated $4.5 billion worth of precious metal. In addition, they had reduced the amount of the commodity in the market available to other traders. The act of ramping up their purchasing power using margin would later catch up with them in one of the most bizarre incidents discussed for decades.

By buying huge chunks on margin, they were able to push the price to record highs of $49.95 per troy in January of 1980. The situation was so dire that it triggered condemnation from jeweler Tiffany. At the time, there were concerns that the rate had been overinflated.

The government steps in

Faced with outrage over the artificially high prices, the government stepped in and introduced new exchange rules over leverage trading. ‘Silver Rule 7’ was adopted by COMEX, all but placing stringent restrictions on commodities margin trading.

The legislation came into place to prevent more long positions contacts on the metal’s futures. At the time, the US government feared that their action would hurt the nation’s XAG reserves.

The placing of restrictions on speculative margin trading as part of the rule would, later on, catch up with the trio in ways they could never imagine. Additionally, restrictions on margin trading triggered an event that has only come to be known as ‘Silver Thursday.’

As the new rule stopped the siblings and other traders from going long on silver futures contracts, prices started to drop. Sensing a window of opportunity, other traders started ramping up short positions that continued to pile pressure on the highly inflated XAG.

The brothers faced significant losses in their positions. Reports that the siblings were facing margin calls as XAG tanked sent shockwaves in the market. As fear gripped the market, a financial crisis erupted as investor sentiment on the commodity tanked.

As silver imploded by over 50% in four days, the siblings paid a high price for financing their purchases through margin. As the XAG positions dropped below the minimum margin requirement, the siblings were hit with a margin call for $100 million.

As reports hit the market that they could not cover their margin calls, the metal’s prices tumbled to under $11 from highs of $49.95 a troy on March 27, 1980, resulting in Silver Thursday.

The brothers could not cover the margin call as they were facing losses running into $1.7 billion. Additionally, fears started gripping the markets as governments that held huge portfolios of the precious metal feared Hunt’s fallout could result in several banks going under as well.

Fearing the ripple effect of the siblings failing to cover their margin trades, a consortium of banks came together and provided the siblings with a $1.1 billion line of credit. The amount was to be used to pay Bache Halsey Stuart Shields, one of the brokerage firms used to place the margin trades on the commodity.

In the aftermath of the fallout, the US Securities Exchange lodged an investigation as it emerged the siblings had a 6.5% stake in brokerage firm Bache.

The aftermath

As XAGUSD dropped from record highs of $49.95 a troy to below $10, the siblings lost billions of dollars. They were forced to pledge most of their remaining assets, including stakes in oil companies, to repay the $1.1 billion bailout package.

The bailout did little to rescue the situation as their fortunes continued to decline. Their net worth fell from highs of $5 billion to $1 billion in a matter of eight years. Civil charges lodged vary their role in manipulating the market only to complicate the situation.

The trio was later hit with a $134 million fine as compensation over their margin trading action, resulting in the Peruvian mineral company losing money. As the 1990s beckoned, the Hunt Brothers were forced to file for bankruptcy.

Silver collapse

As the brothers filed for bankruptcy, silver had imploded, trading in a tight range of between $4 and $6 for most of the 1990s. Price did rally to highs of $40 a troy in 2011 before once again plunging and currently oscillating in the mid $20 levels.