The Financial Times Stock Exchange (FTSE), also known as FTSE Russell Group, is a British financial organization that specializes in providing index offerings for several market participants. The index service provider launched its indices more than 30 years ago. These indices are known as the FTSE FTSE Global Equity Index Series (FTSE GEIS). The majority of these indices are market-cap weighted so that they reflect proportional representation.

The primary intention of the launch of these indices was to allow investors across the globe to track the performance of different countries, regions, and sectors. When FTSE launched its products to the investing community, it was still warming up to the idea of passive investing. Fund managers were charging high fees while promising to offer returns higher than the market. However, in reality, they were failing to provide any additional returns.

Even for investors inclined towards passive investing, there was a lack of a globally acceptable benchmark. This problem was acute, especially when it came to investing globally. Countries have restrictions on investment from overseas investors for certain stocks. Additionally, some stocks may have low free float leaving little space for additional investors.

FTSE standardized review process

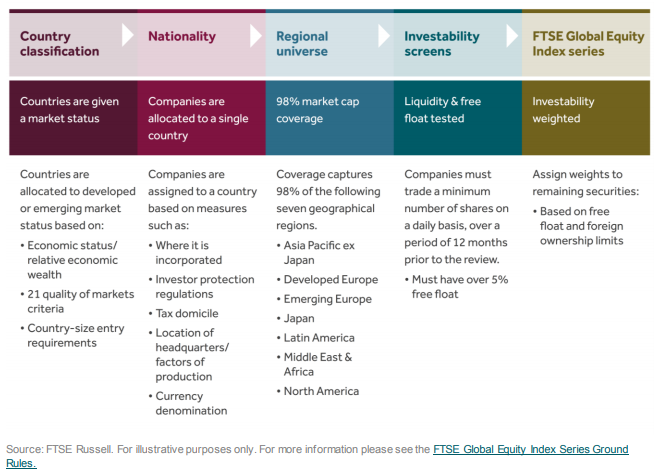

FTSE came up with a review process so that it can form indices that adequately represent a market performance feasible for global investors.

The process essentially consists of 5 main steps, as seen in the below figure. The very first step involves identifying whether a country is emerging or developed. Emerging countries are further split down into advanced emerging, secondary emerging, or frontier. The second step involves identifying the country for each company. Now, this is not as straightforward as it might seem. There are various ways of identifying a country, such as country of incorporation, country of domicile, or location of headquarters. FTSE takes a call based on which factor seems appropriate.

Post this country assignment, companies are then segmented into geographical regions. There are seven primary geographical regions – Asia Pacific ex-Japan, Developed Europe, Emerging Europe, Japan, Latin America, Middle East & Africa, and North America. The companies covered by FTSE indices are expected to capture 98% of these geographies.

The next step is important as it tests whether a company is suitable for global investment. Two major parameters are tested here – liquidity and free float. Liquidity represents what amount a particular company trades on a daily basis. The higher the traded value, the lower will be the impact of flows to the stock, thus making it more suitable for investment. Free float, on the other hand, represents what proportion of the total shares of a company is actually available for trading.

Shares held by promoters are not traded and hence are not available for investors. Similarly, strategic investors like governments and pension funds hold shares for a prolonged period of time, and so shares held by these are also unavailable for investors. So, the free float proportion represents the shares freely available for investors.

The final step involves assigning weights to the companies in the indices. The weights are typically in proportion to the free-float market cap. However, if there is a foreign ownership limit for the stock, the lower of the two is chosen as the weight.

Impact and significance of FTSE indices

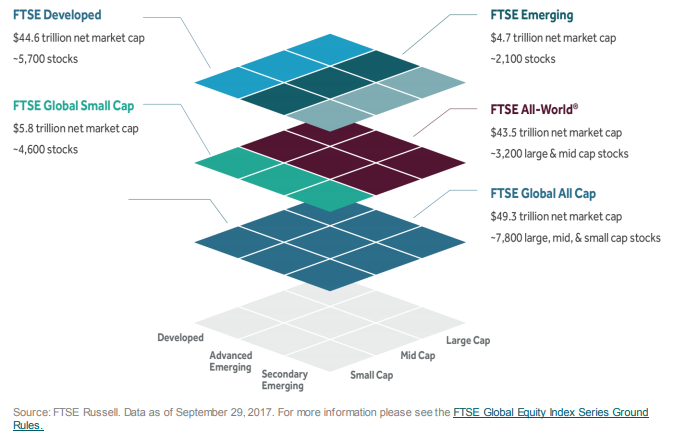

FTSE GEIS extends to roughly 7,700 large, mid and small-cap stocks across 47 developed and emerging markets via the FTSE Global All Cap Index, reaching over 98% of the world’s market capitalization.

The series is divisible into modular subcomponents, including the FTSE All-World Index, which includes large and mid-cap stocks from all covered markets, and the FTSE Global Small Cap Index. A wide range of sub-indexes is available to further segment the markets into sectors, regions, and individual countries.

Vanguard, which is among the largest investment management firms in the world, has funds that track several FTSE indices. The assets under management with these funds run into trillions of dollars. As can be seen in the below figure, the FTSE developed market index has a whopping $44.6 trillion tracking it.

As discussed above, FTSE runs a multi-step stringent process to screen for stocks. This implies that when a stock is included in the indices, it has passed multiple tests for inevitability and size. Inclusion also serves as a certificate for the stock’s significance on a global level.

Thus, the inclusion of stock creates a wave of positive sentiment in the investor community, which also provides a tailwind to the stock price. So, just the mere announcement of inclusion often leads to stock outperformance vs domestic markets.

Additionally, as seen above, just by virtue of inclusion, several funds will have to buy the stock in order to track its returns. So, on the date of implementation, these stocks see massive inflows in a very short period of time. For example, let us assume that a stock A enters the FTSE index with a very small weight of 0.5%. But let us understand the number of flows that could potentially take place in the stock. With $50 billion tracking the index, even a 0.5% weight results in a $250 million inflow.

From backtests on several FTSE reviews, it has been observed the stocks that are included in the index tend to outperform the indices a few weeks before and after the inclusion. Similarly, stocks expected to be excluded underperform over the same period.

These reviews also involve changes in country weights in these indices. For example, China A-shares have seen inclusion and weight increases in the FTSE indices over the past few years. This has brought in a significant amount of inflows in the country and also supported the China equity market levels.