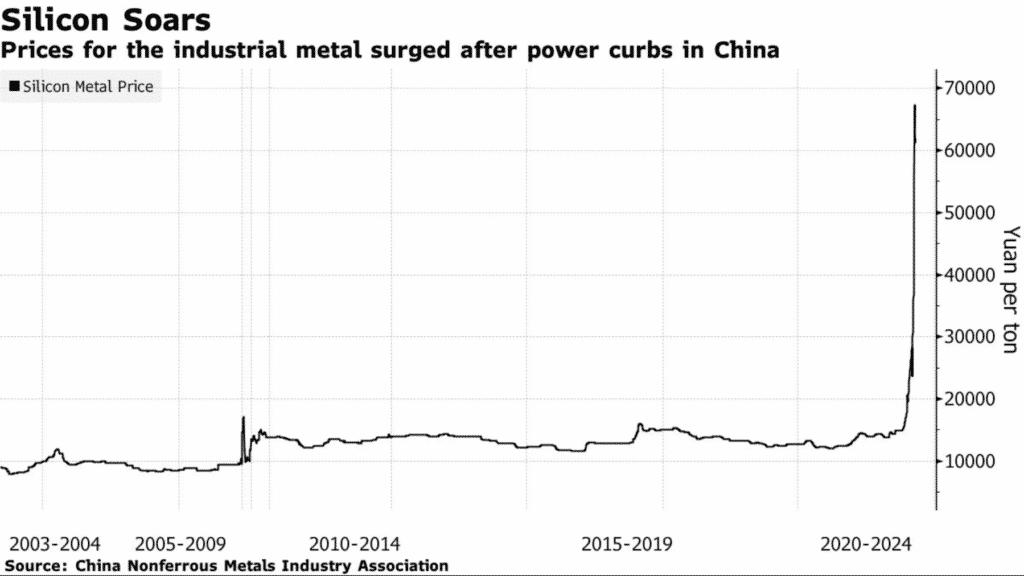

(Bloomberg) Analysts are warning that persistent silicon metal shortage could keep prices elevated through summer, with the prices now up 300% in under two months.

Fig: Silicon Metal Prices

China is blamed for the silicon shortage after it ordered manufacturers in Yunnan provinces to slash production by 90% due to power disruptions caused by low hydropower resources and a push for energy efficiency.

The disruption has led to supply chain snarl-ups across industries, fueling inflation.

Prices of silicon metal had been ranging between 8,000-17,000 yuan or $1,200 to $2,600 per ton before shooting up to 67,300 per ton recently.

Solar-grade polysilicon prices jumped 13% to $32.62 per kilogram on Wednesday, the highest in a decade. The prices are now four times higher since the beginning of June 2020.

Silicon is a key component in the manufacture of computer chips, car parts, and solar panels.

RS6Q2021 is up +1.94%.