Saudi Arabia is seeking to sell 1% stake in Aramco to a ‘leading global energy company’ for close to $19 billion, according to Bloomberg. The deal aims to generate customer demand for Aramco’s crude and could occur in two years time

The deal is expected to broaden Aramco’s sales in the acquiring company’s country of residence.

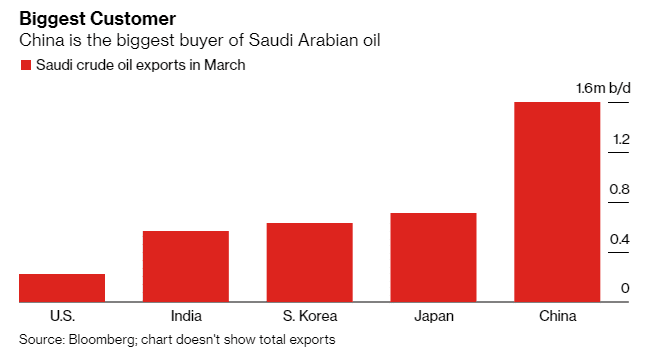

Currently, China remains as the largest customer to Saudi Arabia oil and bought as much as 30% of its oil last month.

Aramco is also interested in India’s expansion, the most expanding oil market before the coronavirus.

Saudi’s crown prince seeks to use Aramco to fund his project of diversifying and growing the economy through ‘Vision 2030.’

Aramco generated close to $30 billion in the 2019 IPO after disposing about 2% of its stock and has since been selling non-core assets and accumulating debt to pay dividend.

Despite Aramco holding a record IPO sale, most financiers are local investors and wealthy Saudi families as foreign investors stayed away on valuation concerns.

Aramco stock is currently gaining, 2222 is up 1.13%