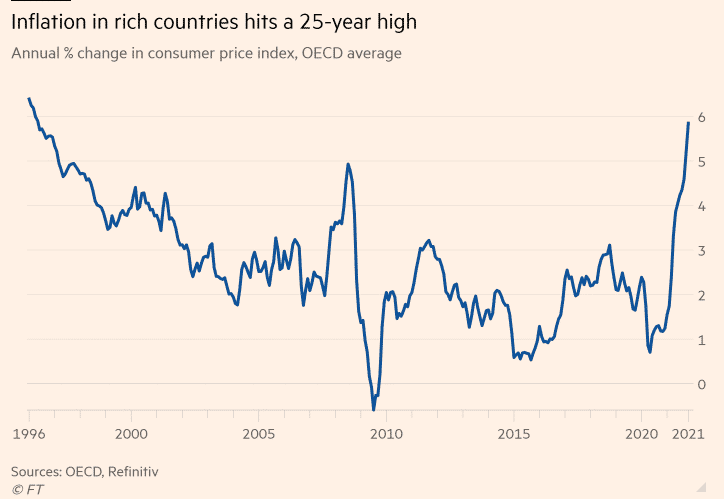

(FT) Central banks of the world’s richest economies comprising the OECD group face pressure to raise rates as consumer prices of 5.8% in November rank the highest since May 1996.

At the rate of 5.8%, consumer prices have risen by 1.2% from the prior year, adding concerns to the overall cost of living in the world’s richest economies.

The surge in consumer prices have mainly been driven by energy prices, which rose by 28% to their highest since June 1980. The energy prices are up by about three percentage points from October.

Food prices have also been a catalyst of inflation, reaching 5.5% in November, from 4.6% the previous month.

Germany’s central bank president Joachim Nagel is now warning that the high inflation could persist longer than economists predict. He warns of rising concerns over the purchasing power by individuals.

Barclay’s economist Silvia Ardagna warns that inflation in the Eurozone could have topped out at the end of last year. She says inflation pressures may prompt companies to pass costs to the consumers.

The high inflation has caught the attention of other global world banks, with the Bank of England initiating a rate hike in December, the first in three years. The US Federal Reserve has also said it would hike rates sooner than expected.

SPY is down -0.032% on premarket, DAX is up +0.28%, CSI 300 is up +1.00%.