Trading indicators have long since aided traders in managing positions, determining correct entry/exit points, and opening new trades. With the advancement in software engineering and the development of new infrastructure that shifted trading from NYSE floors to your home desk, there have been tons of newly coded algorithms at hand each day. Market participants utilize different ideas and strategies by combining indicators that result in a profitable outcome.

We can categorize all the indicators that predict prices as follows:

- Leading. They predict the future of market prices.

- Lagging. As the name indicates, these indicators act as a rearview mirror that shows you the prices’ past movement.

Benefits and demerits of indicators

Indicators have the following benefits for traders:

- Emotions. Using a tool that works on the set of coded inputs makes it completely free of all the psychological barriers that most humans are exposed to.

- Managing trades. Indicators help you out in making trading decisions and managing current positions with ease.

- Profitability. You can increase your consistency by a considerable margin.

- Ease of use. Using indicators is extremely easy and will only require a little understanding from your side.

Whereas the demerits are:

- Numbers. As there are a huge number of trading indicators, choosing the right one can be tricky. Beginners usually give in to the holy grail indicators spending thousands of dollars on tools that don’t work.

- Lagging. Lagging indicators are utterly useless as they do not depict the future; instead, they focus on the past.

What is the relative strength index?

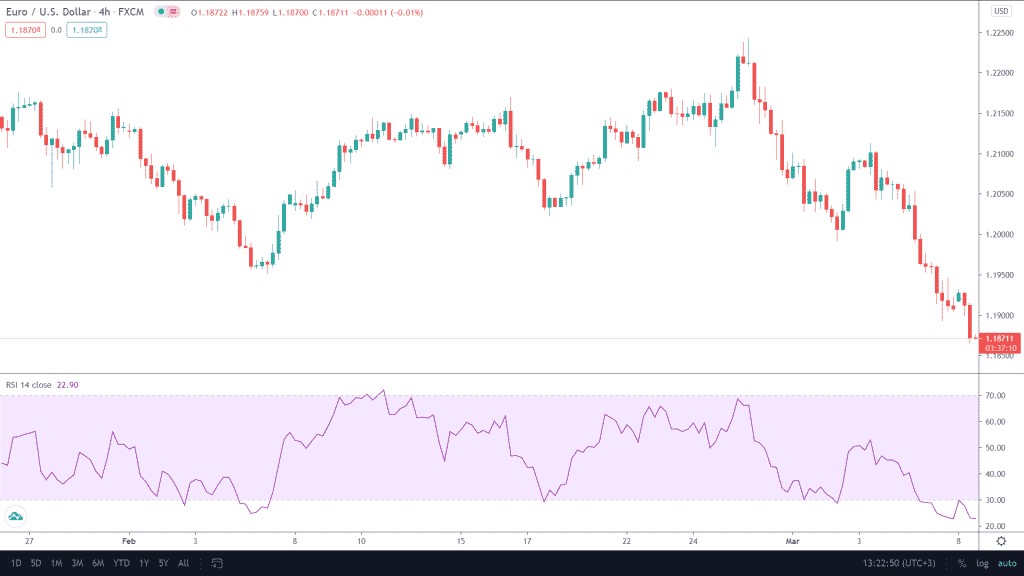

J Welles Wilder developed the Relative Strength Index or RSI to measure momentum and overbought or oversold market conditions. Any RSI value above 80 indicates that the price is at the end of its uptrend and is due for a pullback, while a number below 20 states otherwise. These figures can change depending on your personal preference.

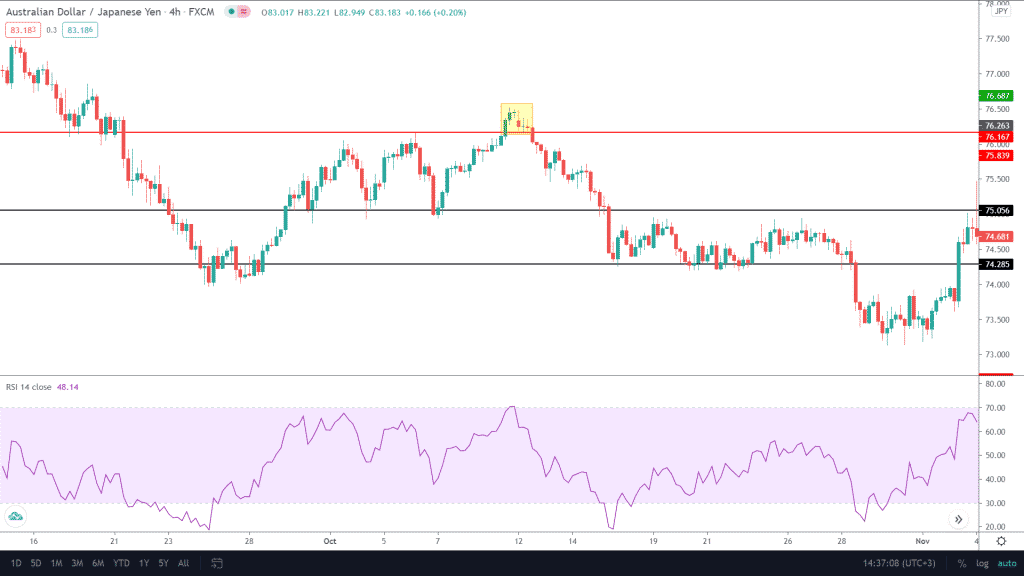

Image 1. An RSI indicator highlights overbought and oversold conditions. For our reference, we have used values of 30 and 70.

Over the years Relative Strength Index has become a popular choice among investors and technical traders. It readily indicates accurate market conditions, trends, and divergences. Traders combine RSI with other indicators frequently for high probability setups.

Using the Relative Strength Index

You can use the Relative Strength Index for the following purposes in your trading.

Trend indication

We can identify the potential momentum of an instrument in a specific direction by looking at our RSI values. When the indicator is hovering above the mark of 50, we call out for long trades, and the opposite goes for values below 50. Keep on the lookout for overbought and oversold conditions as well.

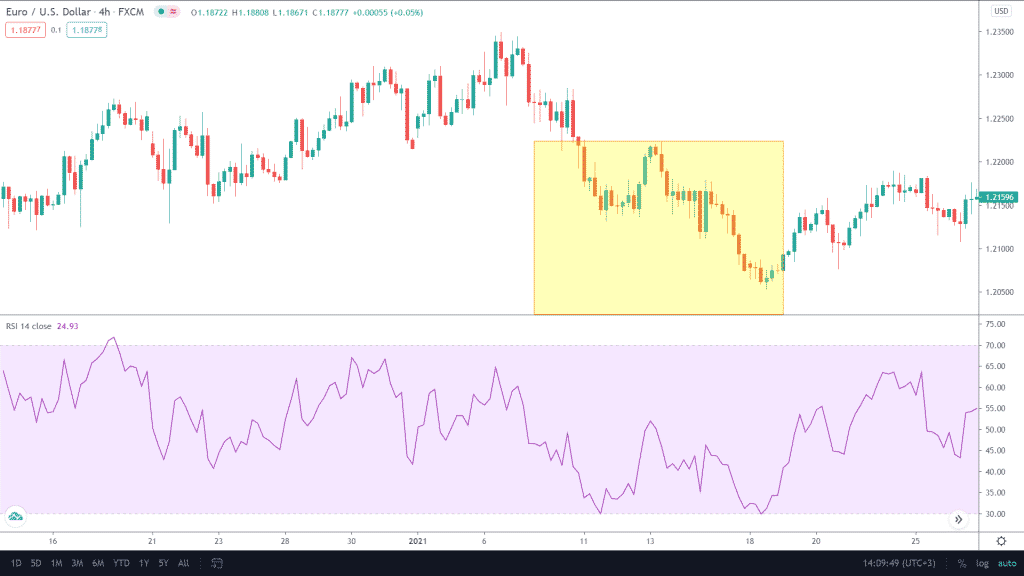

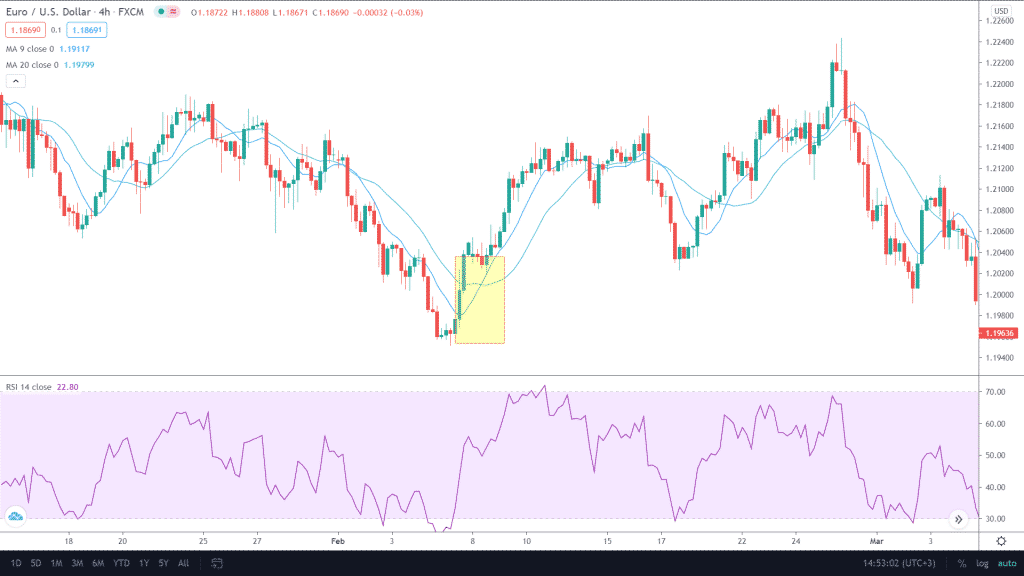

Image 2. The yellow portion in our chart indicates the portion where the RSI values are below 50. We look out for sell opportunities during this period.

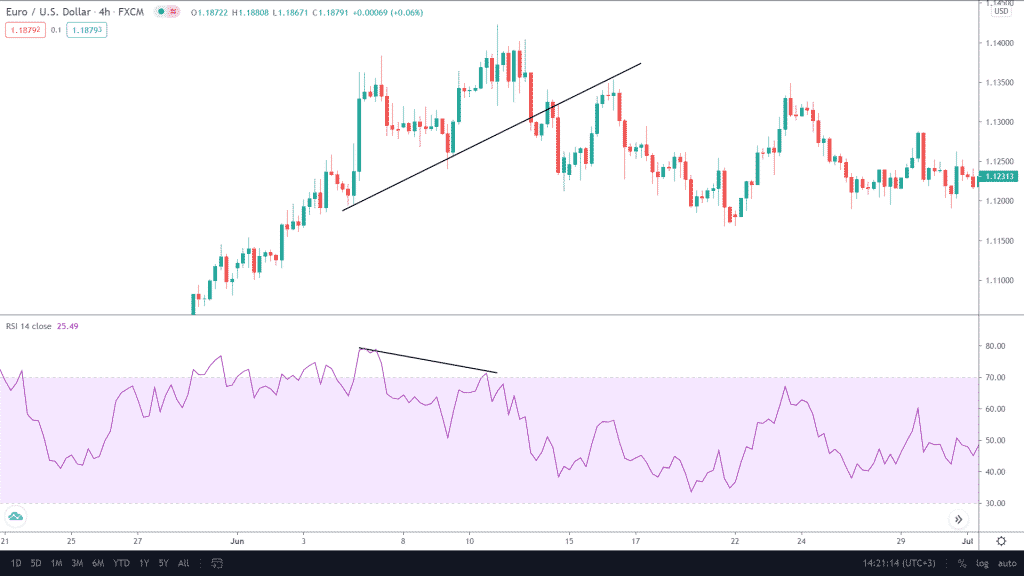

Noticing divergences

The concept of divergences is often confused by novices who find it hard to understand this simple term’s basic concept. Divergence is when your charts speak another language, i.e., indicate higher highs and lows while the indicator is continuously making lower lows and highs. This type of movement suggests that a possible reversal is incoming.

Image 3: A perfect example of divergence is indicated by the black lines on the chart and the indicator.

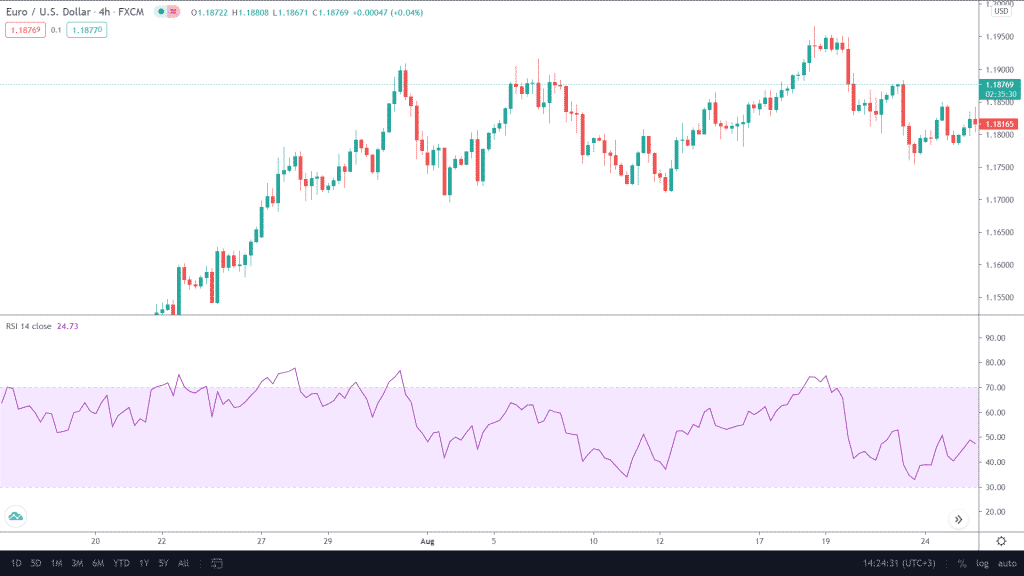

Overbought and oversold conditions alert

As stated before, RSI is a perfect indicator for pointing out overbought and oversold conditions.

Image 4. Notice how the price swings back and forth as the indicator reaches critical levels.

RSI strategies

There are tons of strategies that institutions and retail traders have tested over a long period. You do not have to spend hours on scanning and backtesting as we share a few of the top game plans that RSI offers for best outcomes.

- Price action. Price action and technical traders readily use RSI indicators alongside their supply and demand zones, trend lines, Fibonacci, and key levels.

Image 5. As soon as the price reaches the daily key level line shown in the red, your RSI screams about oversold conditions. A price action trader realizes this and uses bearish candles for additional confirmation before entering the trade.

- RSI and moving averages. This strategy is pretty simple as a trader can spot reversal by using the cross over between 8 and 20 SMA and adds further confluence using the Relative Strength Index.

Image 6: Traders capitalize the moving average crossover and oversold conditions by the RSI for a buying opportunity. Be careful as the moving average is a lagging indicator, and the signals presented by it may take some time to accumulate.

- RSI and bollinger bands. Look out for short trades when the price touches the upper portion of Bollinger Bands and becomes oversold on the RSI and vice versa.

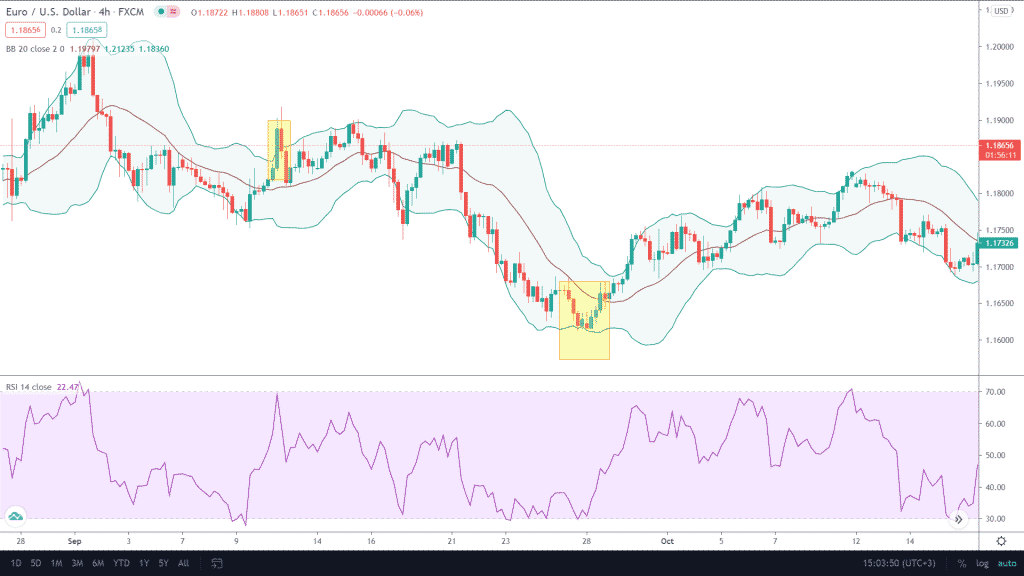

Image 7: The yellow market highlights two conditions. One in which the price is at the oversold and the other on the overbought mark. You can place your stop losses just above the band or at a certain distance from the candle.

End of the line

Learning all the best indicator strategies can give an edge in the financial industry. However, keep in mind that trading is a combination of the game plan, risk management, and proper mindset. If anyone fails to understand the concept behind any of these, then even the market’s top tools will not result in good outcomes. RSI indicator is the right choice for beginners, amateurs, and professionals looking to be inside the profitable 5%.

A: RSI is a momentum oscillator measuring the speed and change of price movements, ranging from 0 to 100.

A: Generally, an RSI above 70 indicates an overbought condition, while an RSI below 30 suggests an oversold condition.

A: Yes, many traders combine RSI with other indicators to refine their trading signals.