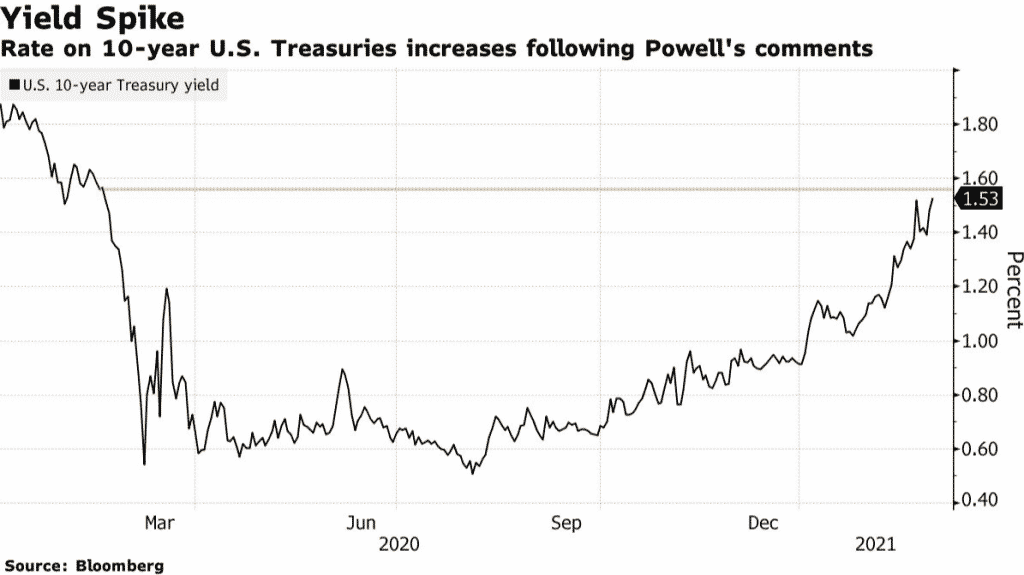

Fed Chair Jerome Powell prompted caution in the bond market on Thursday when he hinted at watching the recent run-up in yields, according to Bloomberg. Powell is concerned about disorderly conditions in markets and tightening in financial conditions that threaten the achievement of Fed goals.

In recent weeks, bond yields have risen on expectations of stronger economic growth and faster inflation after the pandemic ends.

Higher bond yields have unsettled the stock market, especially the high technology companies.

Powell reassured investors that the Fed is nowhere close to pulling back economic support, even as he hopes for better economic times ahead.

The Fed chair also stressed that he is not focused on bond yields per se, but rather, the financial conditions broadly.

Although Powell sounded dovish in his statement, analysts point that his message was not dovish enough to prevent further rises in yields.

The Fed will keep short-term interest rates near zero until the labor market reaches maximum employment and inflation rises to 2%.

Analysts project Fed to hike rates in early 2023 when the economic outlook has improved.

Powell downplayed the surge in inflation on ultra-easy monetary policy and stepped-up government spending.U.S stocks are currently declining as the dollar gains. SPY is down 1.24%, QQQ is down 1.07% on premarket, EUR/USD is down 0.38%.